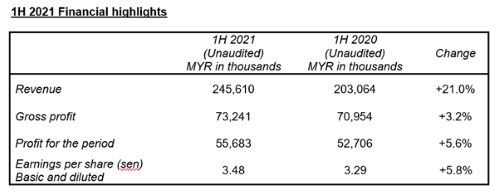

HONG KONG, Aug 16, 2021 – (ACN Newswire) – Pentamaster International Limited (1665.HK) ("PIL" or "the Group") which is listed on the Main Board of The Stock Exchange of Hong Kong Limited announced its interim financial results for the six months period ended 30 June 2021 ("1H2021") today. The Group recorded a revenue of MYR245.6 million, while its net profit stood at MYR55.7 million, showing an improvement of approximately 21.0% and 5.6% respectively from the corresponding period last year.

|

|

|

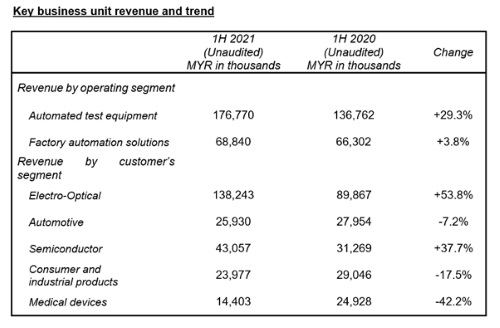

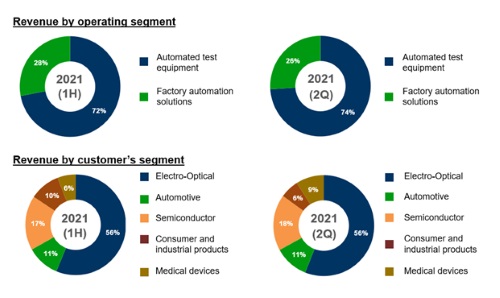

In 1H2021, the Group's revenue was contributed by both the ATE and FAS segments, with each constituting approximately 72.0% and 28.0% respectively of the Group's total revenue in the current period.

The ATE segment continued to contribute the larger portion of revenue and profit to the Group's results for the first half of 2021 at a revenue contribution rate of 72.0%. This segment recorded an increase in revenue of MYR39.2 million, representing a growth of 28.3%, to MYR177.6 million in 1H2021 as compared to the corresponding period in 2020. Given the continued recovery in the smartphone market with 5G capability and other incremental features, the electro-optical segment of the Group's business segment contributed MYR138.2 million in revenue for the 1H2021, representing a 53.8% growth as compared to 1H2020. The ATE segment also benefitted from the semiconductor industry where revenue from this business segment shown a growth of 37.7% as compared to 1H2020. Given the global automotive industry's production is wilting under pressure from the supply chain challenges since beginning of the year, the Group's revenue from the automotive segment witnessed an overall drop of 7.2% in 1H2021 as compared to 1H2020. However, the Group expects the revenue contribution from the automotive segment to rebound in the second half of the year given the momentum of the Group's current order book and as the production of the global automotive industry normalise. Overall, barring any major deterioration of the COVID-19 pandemic situation, the Group continues to witness structural growth within its electro-optical and automotive segments.

In 1H2021, revenue from the FAS segment increased by approximately 5.4% to MYR70.8 million as compared to MYR67.1 million recorded in the corresponding period last year. The FAS segment has continued to chalk growth in 1H2021 with the increasing demand for the Group's i-ARMS (intelligent Automated Robotic Manufacturing System) albeit at a lower growth tangent as project's complexity undertaken by FAS segment requires a longer project lead time for revenue recognition. The FAS segment was predominantly contributed by the consumer and industrial products segment as well as the medical devices segment, where deployment of the Group's proprietary i-ARMS was more prevalent within these segments. Meanwhile, the COVID-19 pandemic may increase the adoption and transition towards automation as concerns regarding social distancing and spread of the virus has forced manufacturing companies and businesses worldwide towards digital technologies. Against the backdrop of this automation trends, the Group will leverage on its competitive advantages to further broaden the capability of its automation manufacturing solutions and continue to grow its FAS segment.

Outlook

As 2021 remains an observance year with the ongoing threat of the pandemic, the Group has been confronting all sorts of uncertainties and volatilities in the form of supply chain constraint and disruptive logistics arrangement. Amid the challenges, the Group continuously put in place the necessary safety measures, operating procedures and system infrastructure to embrace the volatilities and uncertainties in an orderly sustainable manner to minimise disruption to its business operation. As the roll-out of vaccination is gathering pace globally and in Malaysia, the Group anticipates a more stable and favourable operating environment for its timely delivery commitment of projects on hand.

Despite having to endure the severe social and economic challenges presented by the pandemic, the situation is not all doom and gloom. Through the pandemic, the Group witnessed the emergence of new ways of working in a business environment where there is an accelerated pace towards the greater adoption of digital transformation in our daily lives. Within this context and in an encouraging development, the Group saw the order intake momentum gathering pace since the beginning of the year and such momentum continues to prevail as it enters the second half of the year on the back of several catalysts driving both its ATE and FAS segment. At present, with the growing adoption of digital technologies, which encompasses AI, cloud computing, big data and the Internet of Things ("IoT") which further compounded by the deepening application of 5G, optical sensing and electrification in the automotive industry, the Group is exposed to the rapid development of technological revolution and industrial transformation which enable the Group to seize the opportunities.

In general, the Group expects the demand level in its major markets in particular the electrooptical and automotive industry to improve. With the prevalence of optoelectronics and 3D sensing technology, further compounded by the pandemic situation, the Group's core products and solutions that cater for a wide range of smart sensors will become increasingly important to its customers. Additionally, demand from the automotive market is expected to continue to be strong for the Group following the increasing wave of development of automotive electrification and various technology advancements changing the automotive landscape. Given the Group's current exposure and product portfolio in the automotive industry encompassing a diverse area of the automotive test solution from front-end to back-end, the Group will be able to play a dominant role in this ecosystem. In respect of the Group's exposure in the medical segment, the Group is making progress in the prototyping stage of single-use medical devices which involves the intravenous catheters and pen needle and the timeline for ISO13485 certification by 2021 remains on track.

In view of the perceptible momentum from local companies in China to localise their production amid the rising geopolitical tensions, coupled with China's ambition to leapfrog to the upper echelons of technology and its initiative to funnel investment into integrated power module market, the Group's recent establishment of a wholly foreign-owned enterprise in China, namely Pentamaster Technology (Jiangsu) Limited ("PT Jiangsu") serves part of the Group's Greater China expansion plans. The Group will leverage on its core competency and competitive advantage specifically in the electro-optical, automotive and medical segment to further capitalise on the demand for its customised test equipment in the region. Consequently, through PT Jiangsu, the Group hopes to reinforce its position in China and paves its way for more strategic opportunity.

While macroeconomic uncertainties may linger, the Group will continue to focus on its business fundamentals and capitalise on its financial wherewithal to strengthen its product portfolio and position in the industry. Barring any drastic deterioration of the current market conditions, the Group anticipates a better performance in 2021 and specifically, the Group expects its revenue to set another new record for the year. On top of the Group's focus on growing revenue, the Group strongly believes in attaining a sustainable business operation in terms of its profitability and prospect and such policy remains a top priority of the Group. On a longer term basis, the Group looks forward to deepening and diversifying its presence in high-growth industry such as automotive, IoT, industrial electronics, optoelectronics and medical where the Group stands to benefit with its breadth of equipment and solution offerings.

About Pentamaster International Limited

PIL (HKEX stock code: 1665) is a leading global supplier in providing automation technology and solutions to multinational manufacturers mainly in the semiconductor, automotive, electrical & electronics, medical devices and consumer industrial products sectors spanning APAC, North America and Europe. The Group's broad range of integrated automation products and solutions entails innovating, designing, manufacturing and installing automated equipment and/or automated manufacturing solutions. To learn more about PIL, please visit us at www.pentamaster.com.my

For media enquiries, please contact:

Pentamaster International Limited

Email: investor.relation@pentamaster.com.my

ICA Investor Relations (Asia) Limited

E-mail: pentamaster@icaasia.com

Copyright 2021 ACN Newswire. All rights reserved. http://www.acnnewswire.com