SINGAPORE, Feb 20, 2023 – (ACN Newswire) – Singapore Exchange Catalist-listed Mooreast Holdings Ltd. ("Mooreast" or the "Group") signed a Collaboration Agreement (the "Agreement") to explore establishing a manufacturing facility in Aberdeen, Scotland for the production of subsea foundations, as well as consolidation and assembly of mooring components for the floating offshore renewable energy sector.

|

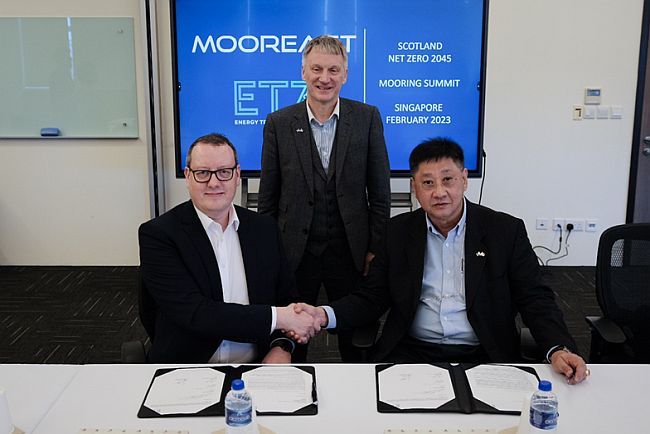

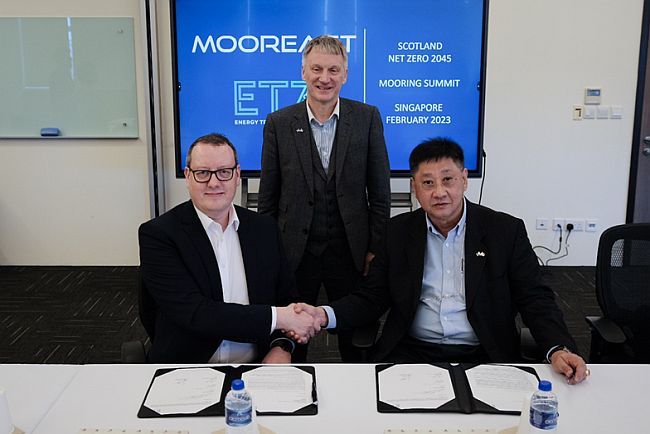

| Mr Sim Koon Lam, CEO of Mooreast (right), alongside Mr Andy Rodden (left), Director, Offshore Renewables of ETZ Ltd, signed a Collaboration Agreement in the presence of Mr Ivan McKee (centre), Minister for Business, Trade, Tourism and Enterprise to explore establishing a manufacturing facility in Aberdeen, Scotland |

Pursuant to this Agreement, the mooring and rigging solutions leader will work with ETZ Ltd ("ETZ"), a private sector-led not-for-profit company spearheading the energy transition ambitions of Northeast Scotland by supporting the creation of a hub to protect the Scottish renewable sector whilst facilitating job creation.

Signed in Singapore together with ETZ Offshore Renewables Director, Mr Andy Rodden, and witnessed by Mr Ivan McKee, Scotland's Minister for Business, Trade, Tourism and Enterprise, the facility is projected to be more than double the floor space and output of the Group's Singapore facility at 51 Shipyard Road.

It will support Mooreast's efforts to target an increasing number of offshore wind projects emerging in Europe. High-profile projects include the ScotWind auction, The Celtic Sea Cluster and the Innovation and Targeted Oil and Gas (INTOG) project, which are expected to deliver over 20GW, 5 GW and 4.5GW of floating wind energy, respectively. As part of its strategy to capture such opportunities, the Group incorporated Mooreast UK Co Limited ("Mooreast UK") in July 2022.

Based on the Agreement, Mooreast and ETZ will work closely on the following areas, amongst others, to help secure a positive outcome in terms of:

– Developing a preferred site plan to meet the requirements of Mooreast that is compatible with local planning regulations, development requirements and site limitations.

– Delivering a jobs and skills plan to secure a workforce ready to support the effective operation of a facility whilst creating employment opportunities for local communities aligned with just transition principles.

– Facilitating introductions to key local supply chain companies required to support the start-up and future operation of the preferred site.

Mr Sim Koon Lam, CEO of Mooreast, said: "We are honoured to have Mr Ivan McKee grace this event. Upon completion, the facility will serve as a cornerstone of Mooreast's expansion into Europe, and will enable us to produce high-quality products and services for our renewable energy customers in the region."

Scottish Government Minister for Business, Trade, Tourism and Enterprise, Ivan McKee, said: "It is great to witness the signing of this Collaboration Agreement. As the world's largest floating offshore wind leasing round, ScotWind puts us at the forefront of the global development of offshore wind and represents a massive step forward in our transition to net zero.

As set out in our National Strategy for Economic Transformation and our Inward Investment Plan, it is critically important that we work closely with inward investors by offering our unique 'Team Scotland' approach to support their growth and expansion into Scotland, enabling us to deliver inclusive economic prosperity."

ETZ Ltd Offshore Renewables Director, Andy Rodden, said: "Mooreast's intention to explore establishing significant operations in Aberdeen is warmly welcomed and a testament to the critical mass this region has in the skills and expertise required to support such an exciting development.

"Owing to a world-class oil and gas sector, our region is home to 75% of the world's subsea engineering capability and the highest concentration of energy supply chain companies anywhere in the UK. ETZ Ltd's role is to harness these competitive strengths and accelerate diversification in order to retain that global status as a sustainable and long-term-industry cluster for new and green energies.

We are at the very early stages of this particular process but this potential development reflects the type of investment that will help us realise this ambition. I'm therefore delighted that ETZ Ltd, which has a key role as a catalyst to attract investment to the region, will be working closely with Mooreast on a range of areas as we seek to secure a positive outcome."

Mooreast has appointed Mr Barry Silver as Managing Director of Mooreast UK. He brings over 24 years of business, technical and operational experience in offshore energy markets, and will be responsible for establishing and managing the Group's facility, as well as business development to support Mooreast's international growth.

Mr Sim added: "We welcome Mr Barry Silver to the Mooreast team. His deep domain knowledge, extensive experience, and strong leadership skills will be a valuable asset in bringing the Group to the next level, as we continue to capture opportunities in the offshore renewable energy industry."

About Mooreast Holdings Ltd.

Mooreast is a total mooring solutions specialist, serving mainly the offshore oil & gas ("O&G"), marine and offshore renewable energy industries, with operations primarily in Singapore, and through its wholly-owned subsidiary, Mooreast Europe, a European sales office in Rotterdam, the Netherlands.

Mooreast's solutions include the design, engineering, fabrication, supply and logistics, installation and commissioning of mooring systems. Mooreast is applying its experience and expertise in mooring solutions to floating renewable energy projects, in particular floating offshore wind farms. It has successfully participated in developmental and prototype projects for floating offshore wind turbines in Japan and Europe. For more information, please visit https://mooreast.com/

About ETZ Ltd

ETZ Ltd ("ETZ") is a not-for-profit organisation operating on the basis of no commercial gain and with one over-riding goal – to protect and create as many jobs as possible ensuring a sustainable and vibrant future for the North East of Scotland and the people who live and work here. ETZ Ltd will is supporting the creation of a world-leading hub for renewable energies – offshore wind, hydrogen, carbon capture and storage – establishing a sustainable cluster of activity, jobs and skills. For more information, please visit www.etzltd.com

Media & Investors:

WeR1 Consultants Pte Ltd

Isaac Tang, e: mooreast@wer1.net, m: +65 9748 0688

This press release has been prepared by the Company and its contents have been reviewed by the Company's sponsor, W Capital Markets Pte. Ltd. (the "Sponsor"). This press release has not been examined or approved by the Singapore Exchange Securities Trading Limited (the "SGX-ST") and the SGX-ST assumes no responsibility for the contents of this press release, including the correctness of any of the statements or opinions made or reports contained in this press release.

The contact person for the Sponsor is Ms Sheila Ong, Registered Professional, W Capital Markets Pte. Ltd., at 65 Chulia Street, #43-01 OCBC Centre, Singapore 049513, Telephone (65) 6513 3541.

Issued for and on behalf of Mooreast Holdings Ltd. by WeR1 Consultants Pte Ltd.

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com