HONG KONG, Mar 6, 2024 – (ACN Newswire) – Blockpass is excited to announce a partnership with AYA, a regulated UAE-based fundraising platform focused on the intersection of blockchain and sustainability. Concerned with facilitating innovative solutions which encourage a greener future, AYA mentors and cultivates projects which combine the borderless, transparent nature of blockchain to further the goal of sustainablility and achieving the SDGs.

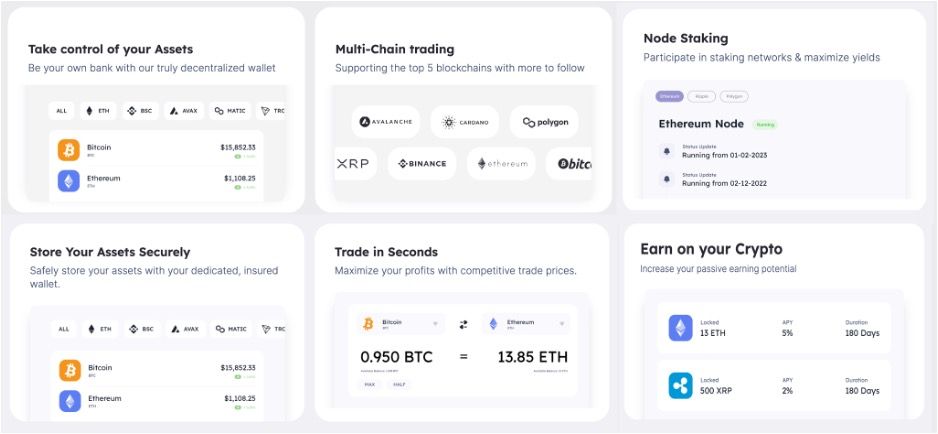

This partnership will see Blockpass strengthening AYA’s compliance procedures and providing: risk assessment and risk classification of onboarding customers, customized forms based on the customer’s and regulator’s requirements, regular rigorous wallet compliance checks to protect user transactions, and evaluation of risks associated with wallets to ensure the absence of fraudulent and suspicious transactions. This will involve the gamut of Blockpass’ products, including KYC, KYB and AML solutions, the new Advanced KYC Bot™, ongoing monitoring, and Blockpass’ Unhosted Wallet KYC™.

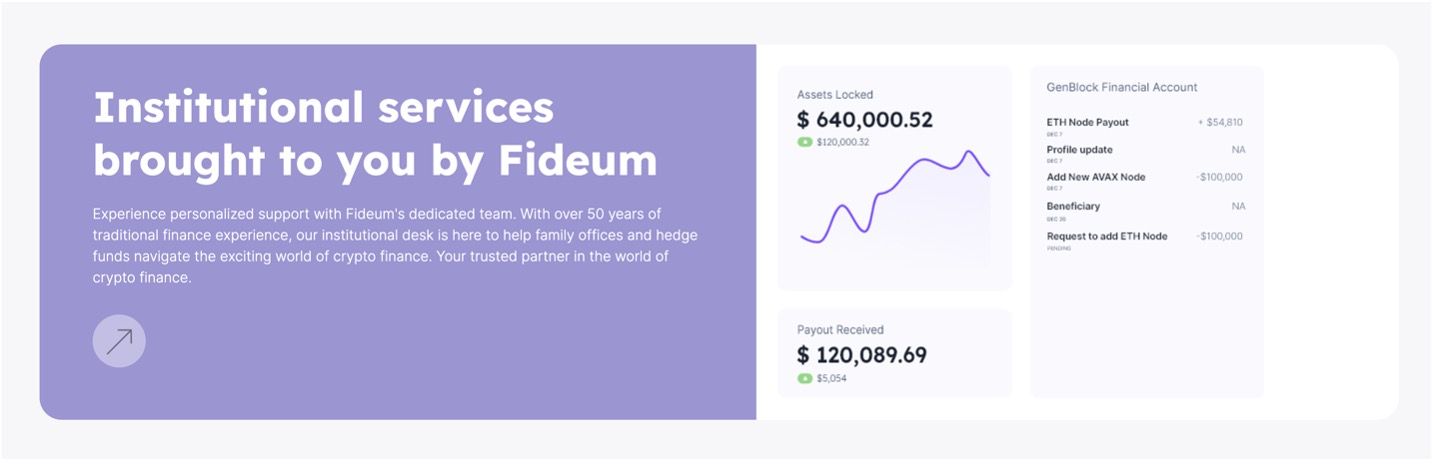

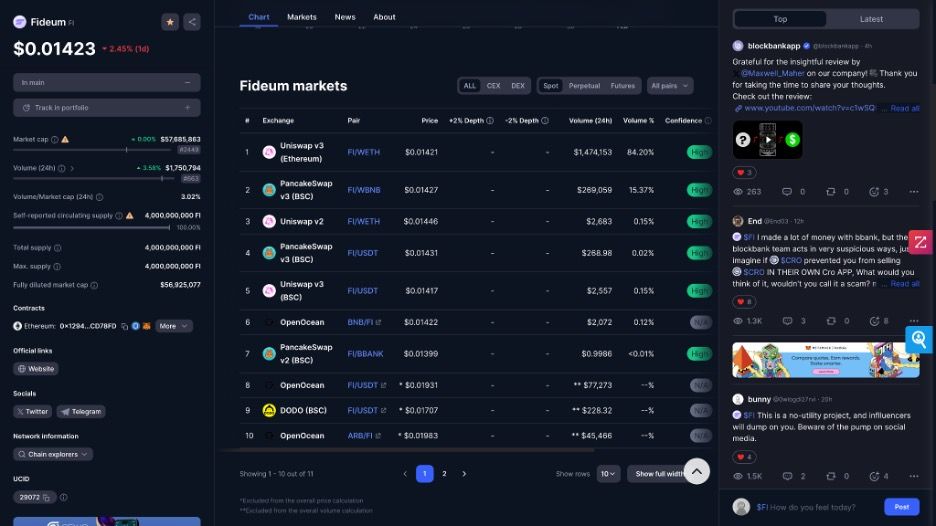

Blockpass, known as “Web3’s OG Identity Verifier,” has pioneered reusable identities and crypto-native KYC/AML solutions. Its turnkey suite of compliance tools is designed to lower onboarding costs, automate remediation, prove humanity and protect against malicious actors, fraudulent activities, bots, and AI. Businesses can set up services quickly, test them for free, and start verifying users. With around one million verified identity profiles, Blockpass facilitates instant onboarding, and to date over a thousand businesses have taken advantage of this opportunity to benefit from Blockpass’ compliant network.

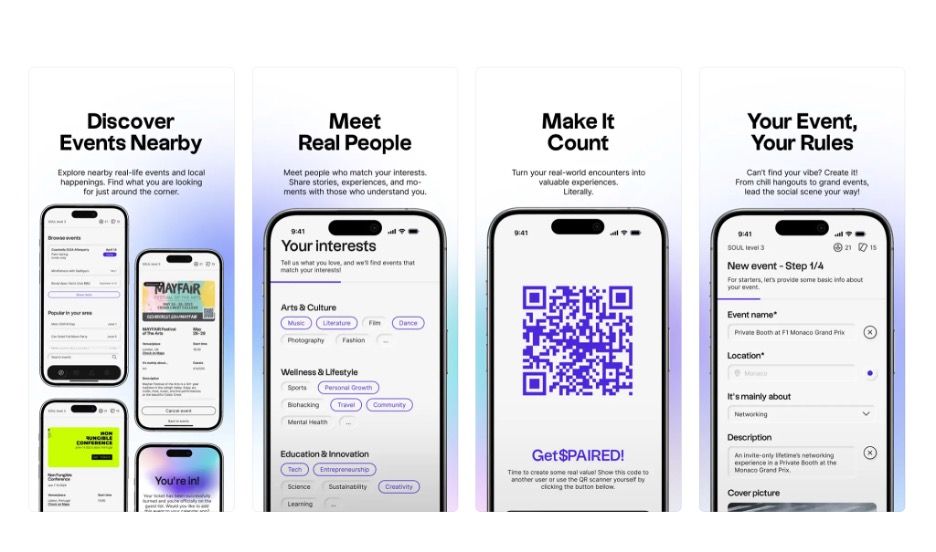

AYA is the Middle East and North Africa region’s first fully regulated Climate Finance Platform, regulated by Dubai’s Virtual Assets Regulatory Authority (VARA) in 2023. Built on blockchain technology, AYA focuses on helping climate tech projects raise capital from its community of investors, utilizing carbon and nature-based credits as assets. AYA will leverage its team’s experience from building and running Enjinstarter – an extensive crowdfunding platform focused on gaming, entertainment, and the metaverse – to curate a nurturing ecosystem of mentorship, funding and collaboration where trailblazers can leave a lasting legacy of sustainability for future generations.

“Through our strategic partnership with Blockpass, we at AYA reaffirm our commitment to upholding the highest standards of AML and KYC practices in the industry. This collaboration underscores our dedication to fostering a secure, compliant, and trustworthy environment for our users, laying the foundation for a more responsible and sustainable future in the virtual asset space.” said Vasseh Ahmed, Managing Director of AYA.

“We’re delighted to be working with a company that is so focused on the future of both blockchain technology and the planet.” said Blockpass CEO Adam Vaziri. “We have previously worked with Enjinstarter and it’s an honor to be chosen once again to work with such a visionary team on such an important project.”

By working together, Blockpass and AYA will ensure that the sustainable futures of blockchain technology and the world are secured against identity fraud and money laundering. In ensuring regulatory compliance, Blockpass will help AYA grow and flourish as it seeks to nourish suitable projects and innovate in a responsible manner.

About Blockpass

Ditch tedious onboarding and say hello to seamless compliance with Blockpass, the ultimate turnkey solution for KYC, KYB, and AML. Experience the market’s most efficient and cost-effective compliance suite, built by seasoned compliance veterans and crypto-natives. Automate compliance processes, eradicate fraud, and onboard globally with confidence. Verify businesses worldwide, launch bank-grade verification for your organization, and instantly activate compliant KYC/AML for DeFi, exchanges, token launchpads, NFT mintings and beyond. Through Blockpass’ decentralized network of a million pre-verified crypto-enthusiasts and a thousand pre-verified businesses, you can expand your reach effortlessly. Leverage Advanced KYC Bot™ for intelligent remediation, On-Chain KYC® for data-free anonymity, and Unhosted Wallet KYC™ to meet Crypto Travel Rule regulations. Join Animoca Brands, Cardano, Polygon, Chainlink, Delta Exchange, National Geographic, TinyTap, Seedify, ChainGPT, Iskra and many more in partnering with Blockpass for compliance you can trust, growth you can accelerate and an experience you can enjoy. Join the cutting edge of secure, streamlined onboardings.

Learn more and engage the Blockpass team:

Website: http://www.blockpass.org

Email: sales@blockpass.org

About AYA

Born from a vision to bridge the gap in climate finance, AYA leverages blockchain to democratise fundraising for projects that aim for a greener Earth. From supporting startups aligned with the UN Sustainable Development Goals to ensuring each project meets rigorous regulatory and environmental standards.

Our mission is to empower everyone to contribute to a sustainable future. We’re making it possible for community members to not just witness change but be a part of it.

Learn more and engage with AYA’s team:

Website: https://www.aya.foundation/

Email: support@aya.foundation

Copyright 2024 ACN Newswire. All rights reserved. http://www.acnnewswire.com