SHENZHEN, CHINA, Dec 6, 2022 – (ACN Newswire) – China Medical System Holdings Limited (CMS, 867.HK) acquired another blockbuster innovative product in dermatology filed. On December 2, CMS announced that it had, through one of its subsidiaries, a dermatology medical aesthetic company (“CMS Aesthetics”), reached a collaboration agreement with Incyte, a global biopharmaceutical company, obtaining the license for the development, production, registration and commercialization of Ruxolitinib Cream in mainland China, Hong Kong, Macau, Taiwan and eleven countries in Southeast Asia (“Territory”), commencing on its effective date and with a royalty term of ten years from the date of the products’ first commercialization in the Territory, which, after expiration, may be renewed for another 10 years or longer as per certain conditions.

Ruxolitinib Cream is the only topical JAK inhibitor and the first vitiligo repigmentation drug approved by the U.S. FDA. Through this transaction, CMS once again brings a novel treatment option for patients with unmet medical needs.

The first and only vitiligo repigmentation therapy approved by the U.S. FDA

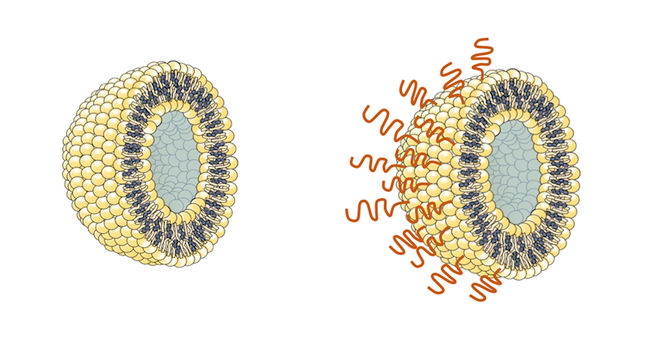

Ruxolitinib Cream is a cream formulation of Incyte’s first-in-Class medicine, ruxolitinib, selectively inhibits Janus kinase 1 and 2 (JAK1/JAK2), with composition patent, formulation patent and use patent.

The product was approved by the FDA in July 2022 for the topical non-segmental vitiligo patients. Previously, it was approved by the FDA in September 2021 for the topical short-term and non-continuous chronic treatment of mild to moderate atopic dermatitis (AD) in non-immunocompromised adult and pediatric patients 12 years of age and older whose disease is not adequately controlled with topical prescription therapies or when those therapies are not advisable. The product also has the potential to meet the clinical needs of other autoimmune inflammatory dermatological diseases.

In July this year, Ruxolitinib Cream became the first and only drug approved by the U.S. FDA for vitiligo patients repigmentation. This approval was mainly supported by the positive results of two pivotal Phase 3 clinical studies (TruE-V1 and TruE-V2), specifically:

- Primary endpoint: At week 24, approximately 30% of patients treated with Opzelura (Ruxolitinib Cream) achieved ≥75% improvement from baseline in the facial Vitiligo Area Scoring Index (F-VASI75), compared to approximately 8% and 13% of patients treated with vehicle in TRuE-V1 and TRuE-V2, respectively. At Week 52, approximately 50% of Opzelura-treated patients achieved F-VASI75.

- Key secondary endpoints: at Week 24, more than 15% of patients treated with Opzelura (Ruxolitinib Cream) achieved ≥90% improvement from baseline in F-VASI (F-VASI90), compared to approximately 2% of patients treated with vehicle. At week 52, the percentage of patients treated with Opzelura (Ruxolitinib Cream) that achieved F-VASI90 doubled to approximately 30%.

Ruxolitinib Cream is a topical preparation with long-term safety performance proven by pivotal clinical trials for 52 weeks, in which no serious drugs-related adverse events reported.

Ruxolitinib Cream brings novel treatment option for vitiligo patients

Vitiligo is an autoimmune disease characterized by localized or generalized depigmentation of the skin and mucous pigment and gradually enlarged and irreversible white spots. Vitiligo is more likely to occur in areas with exposed skin such as the face, neck and limbs, and it is initially found in heads and faces of about 40% vitiligo patients. As the disease seriously affects the appearance of patients, and the incidence among young people and women is high, extensive patient with vitiligo are suffering from the “appearance anxiety”. At the same time, some people prejudice against vitiligo patients and estrange from them with the misconception that vitiligo is contagious, hereditary, etc., which have aggravated the patients’ stigma in their daily life. According to a paper published in The Lancet, it is estimated that there are about 14 million people with vitiligo in China, and nearly 6.5 million people with vitiligo in 11 countries in Southeast Asia.

At present, vitiligo is generally treated with off-label drugs combined with laser treatment in China. As vitiligo is a chronic disease, patients need long-term and continuous treatment. However, the existing off-label drugs for vitiligo, such as topical glucocorticoids (TCS) and calcineurin inhibitors (TCI), have clinical pain points such as adverse reactions and uncertain efficacy with long-term medication.

Ruxolitinib Cream, with good efficacy and limited side effects, will fulfill the unmet clinical needs, provide an effective innovative therapy for vitiligo patients, and improve their quality of life.

Joining hands with Incyte, CMS wins Ruxolitinib Cream with strong competitiveness in dermatology filed

As a global biopharmaceutical company headquartered in the United States founded in 2002, Incyte, in partnership with CMS, is continuously advancing its drug pipeline in the fields of hematology/oncology and inflammation/autoimmunity. Incyte has licensed-out a number of its products to well-known pharmaceutical companies at home and abroad, such as Novartis (ruxolitinib tablets, for the treatment of myelofibrosis, etc.), Lilly (JAK inhibitors with oral administration, for the treatment of severe alopecia areata, etc.), Innovent (FGFR1 /2/3 inhibitors and other oncology drugs), Zai Lab (PD-1, for the treatment of hematologic and solid tumors).

Ruxolitinib is a flagship product of Incyte. Since the first indication for Ruxolitinib Cream was approved in September 2021, its sales has grown rapidly. According to Incyte’s Report, the sales of Ruxolitinib Cream in the United States in 2021 was approximately USD$5 million, and approximately USD$30 million in the first half of 2022; Following approval of the indication for vitiligo, its sales revenue in the third quarter alone of 2022 rose rapidly to about $38 million, has surpassed total sales revenue in the first half of 2022.

As a flagship product, the collaboration on Ruxolitinib Cream in China and Southeast Asia markets must be very attractive to many well-known pharmaceutical companies in China. In the selection of partners for its flagship products, Incyte has clear criteria. According to public reports, the partner chosen by Incyte for the Ruxolitinib Cream in the Japan market is Maruho Co., Ltd. (founded in 1915), a leading dermatology pharmaceutical company in the Japanese market. With Ruxolitinib Cream as a medium, Incyte has obvious intentions to bring together top dermatology specialty companies.

The partnership between Incyte and CMS creates strong alliance that could make the most of respective strengths of each other in the dermatology field.

CMS has deeply rooted in the dermatology field for years, and promoted the independent operation of its dermatology line in January 2021, to improve scale efficiency of the business with in-depth development. As at June 30, 2022, CMS has built a dermatology promotion team of about 600 people, covering more than 20,000 dermatologists. Of its marketed dermatology products with professional brand image, Hirudoid (a skin barrier repair agent with multiple functions) has gained a leading market position in China; Aethoxysklerol is an international brand for the treatment of sclerotherapy of varicose veins with years of clinical application. At present, CMS Aesthetics has 8 marketed products and more than 10 pipelines products, covering dermatology prescription medicines, light medical aesthetic products, energy-based medical aesthetic devices and dermatology grade skincare products, and etc. While continuously enriching its product matrix, CMS Aesthetics is committed to becoming a leader in the dermatology field.

“We are excited to partner with CMS and leverage their dermatology expertise to expand the global opportunities for Ruxolitinib Cream as a potential treatment for patients with immune-mediated dermatologic conditions in China.” said Hervé Hoppenot, Chief Executive Officer, Incyte.

For this transaction, CMS expressed that it will leverage its own advantages in clinical development and commercialization to realize the marketing and sales of Ruxolitinib Cream in China and Southeast Asia as soon as possible, benefiting more patients. Meanwhile, it will continue to introduce high-quality innovative products globally with flexible, mutually beneficial collaboration models, and develop CMS Aesthetics into a leading company in dermatology, medical aesthetic health management in China.

Media Contact

Media Team, CMS

Email: ir@cms.net.cn

Website: http://www.cms.net.cn/

Source: China Medical System Holdings Ltd.

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com