HONG KONG, Aug 22, 2022 – (ACN Newswire) – Peijia Medical Limited ("Peijia Medical" or the "Company", together with its subsidiaries, the "Group", stock code: 9996), a leading domestic player in the high-growth transcatheter valve therapeutic and neurointerventional procedural medical device markets in China, announced its interim results for the six months ended June 30, 2022 (the "Period").

|

|

|

Performance Summary:

— Revenue was RMB118.8 million, representing an increase of 129.8% from the same period of 2021.

— Gross profit (excluding the amortization cost from purchase price allocation) was RMB87.6 million, representing an increase of 133.5% from the same period in 2021, and gross margin (excluding the amortization cost from purchase price allocation) reached 73.7%.

Key Operational Statistics:

— Even under the impact of Covid-19, revenue from theTranscatheter Valve Therapeutic Business and Neurointerventional Business were RMB52.1 million and RMB66.7 million, representing an increase of 455.4% and 57.6% from the same period in 2021, respectively.

— For the Transcatheter Valve Therapeutic Business, both product adoption by new hospitals and the utilization rate of its products in the adopted hospitals exceeded expectation. As of July 31, 2022, within a short period of about one year after TaurusOne(R) and TaurusElite(R) received NMPA approvals, a total of 209 hospitals were entered and the implantation volume repeatly reached monthly highs, accounting for close to 20% of the market share in July. The total implantation volume of the six months ended June 30, 2022 has far exceeded that of the whole year of 2021. The pipeline for the Transcatheter Valve Therapeutic Business was progressing smoothly as scheduled.

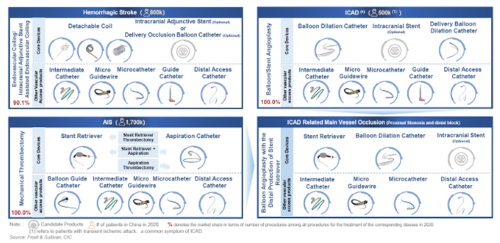

— The Group's registration applications of four ischemic products have been approved by the NMPA, and the product portfolio for the ischemic product line has been preliminarily established. The Group can provide a complete set of solutions for hemorrhagic and ischemic stokes. In the first half of 2022, the Group continued expanding its share in the sizable hemorrhagic market, constantly consolidating its leading position in the neurointerventional industry.

— The Group made continuous efforts to optimize the supply chain and optimize the production process to achieve long-term success, and continued to maintain stable production to meet the rapid sales demand growth in the first half of the year.

During the period, the Group recorded a revenue of RMB118.8 million, representing an increase of 129.8% as compared to the same period in 2021. Revenue from the Transcatheter Valve Therapeutic Business and Neurointerventional Business were RMB52.1 million and RMB66.7 million , representing a substantial increase of 455.4% and 57.6% as compared to the same period in 2021, respectively. The increase in revenue was primarily attributable to: (i) commercialization of the second-generation retrievable TAVR product TaurusElite(R); (ii) increased sales revenue from existing neurointerventional products including Tethys(R) Intermediate Catheter and SacSpeed(R) Balloon Dilation Catheter; and (iii) commercialization of multiple new neurointerventional products including Jasper(R) SS Detachable Coil, etc. Gross profit (excluding the amortization cost from purchase price allocation) was RMB87.6 million, representing an increase of 133.5% from the same period in 2021, and gross margin (excluding the amortization cost from purchase price allocation) reached 73.7%.

The impact of Covid-19 in the first half of 2021 further validated the Group's execution capability and operational efficiency. Both business lines exceeded their respective commercialization targets. The Group's pipeline projects progressed smoothly and its production operation and supply chain were well managed. Production fulfillment rate of core products reached around 60% (50% as the baseline) in the first half of the year.

Transcatheter Valve Therapeutic business: The commercialization platform was preliminarily established, setting up a strong foundation for commercialization success. Pipeline products also progressed smoothly, bringing sustainability to the long-term business development.

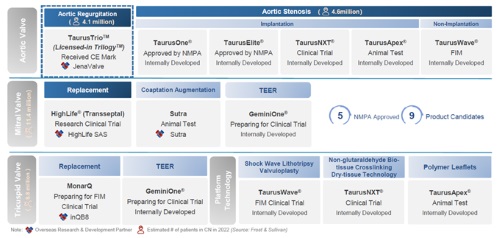

For the Transcatheter Valve Therapeutic Business, the Group had five registered products and nine product candidates at various development stages. The sales of TaurusOne(R) and TaurusElite(R) products were in good progress. The revenue of the Transcatheter Valve Therapeutic Business increased by 455.4% as compared to the same period in 2021 despite the impact of the pandemic. As of June 30, 2022, the Group had a sales and marketing team of 151 employees dedicated to the sales and marketing of its Transcatheter Valve Therapeutic Business.

Thanks to its outstanding product performance and professional market education and promotion, both product adoption by new hospitals and the utilization rate of our products in the adopted hospitals have accelerated for our Transcatheter Valve Therapeutic Business. As of July 31, 2022, the products of the Group entered 209 hospitals, repeatedly setting new monthly highs in implantation volume. The implantation volume reached close to a market share of 20% in July. For the seven months ended July 31, 2022, the total implantation volume reached close to 650 units, more than twice the implantation volume for the whole year 2021. The second half of the year started with strong momentum. The Group are steadily increasing our market share and striving to outperform other players. The Group have become the top player in certain cities and hospitals, with huge development potential.

The Transcatheter Valve Therapeutic Business has progressed rapidly since its commercial launch, thanks to its cross functional teams comprised of marketing, sales and medical professionals. The all-round support ranges from academic promotion to new technology cooperation, from patient identification to physician training, and from preoperative, intraoperative and postoperative clinical support to meticulous sales service. The rapid development of commercialization has built a solid cash foundation for the long-term development of the Company.

The Group has developed a competitive product pipeline through external acquisitions and internal development, with a wide range of innovative products in development covering major valvular diseases and next-generation technologies. As of August 19, 2022, the Group has four BD projects, which are deployed in the fields of aortic valve replacement for AR, mitral valve replacement, tricuspid valve replacement and mitral valve coaptation augmentation, respectively. In addition to BD projects, its internally developed projects are also widely recognized. Areas of the Group are exploring include improving the durability of prosthetic valves, creating non-implant treatment solution for valve diseases and developing innovative mitral valve repair products.

Among them, three projects are entering into significant clinical trial stages: GeminiOne(R) and MonarQ will enter the registration clinical trial and overseas FIM clinical trial stages, respectively, and HighLife(R) will enter the registration clinical trial stage.

Neurointerventional Business: With the Group's successive launch of four ischemic products, the product portfolio for the ischemic product line has been preliminarily established. The Group are able to provide a complete set of solutions for hemorrhagic and ischemic strokes. With increasing sales from hemorrahagic products and upcoming commercialization of recently approved ischemic products, the revenue composition of the Neurointerventional Business will further diversify.

In the first half of 2022, the registration applications of four products have been approved by the NMPA, namely, Syphonet(R) Stent Retriever, Tethys AS(R) Aspiration Catheter, Fastunnel(R) Delivery Balloon Dilation Catheter and Fluxcap(R) Balloon Guide Catheter. The product portfolio for the ischemic product line has been preliminarily established, with all major devices readily in place, forming a complete solution for patients with AIS and ICAD.

As of now, for the Neurointerventional Business, the Group had fourteen registered products and seven product candidates at various development stages. The Group have a comprehensive portfolio of registered and pipeline products that target both hemorrhagic and ischemic stroke markets, providing one-stop solution for both hemorrhagic and ischemic strokes with a complete line of core products. This will not only build its resilience in times of change and uncertainty, but also enhance the attractiveness and synergy of its product portfolio among physicians and distributors.

Thanks to the superior product performance, strong marketing capability as well as stable and in-depth distributor network, revenue from the Neurointerventional Business increased by 57.6% during the period, as compared to the same period in 2021. The revenue generated from the sales of hemorrhagic, ischemic and vascular access products accounted for 44.2%, 25.0% and 30.6% of the total revenue of the Neurointerventional Business, respectively. With increasing sales from hemorrahagic products and upcoming commercialization of recently approved ischemic products, the revenue composition of its Neurointerventional Business will further diversify.

As of June 30, 2022, the Group had 177 distributors, covering more than 1,800 hospitals in 31 provinces nationwide. The Group will continue to build on its sales team and distributor coverage in response to its expanding ischemic product portfolio. As of June 30, 2022, the Group had a sales and marketing team of 74 employees focusing on the sales and marketing of neurointerventional products.

As of June 30, 2022, the Group had a robust intellectual property portfolio, consisting of a total of 89 granted and valid patents and 100 patents under application. Specifically, there are 53 granted and valid patents and 74 patents under application for our Transcatheter Valve Therapeutic Business, and 36 granted and valid patents and 26 patents under application for its Neurointerventional Business.

Dr. Yi Zhang, Executive Director, Chairman of the Board and Chief Executive Officer of Peijia Medical Limited, said "As one of the world-class medical device leader rooted in China, Peijia Medical will strive to strengthen the Group's leading position in the industry by implementing a series of future strategies and plans. Looking forward, the company will continue to develop and commercialize interventional solutions for structural cardiac and neurovascular diseases in China and globally in line with its corporate vision. Meanwhile, the Group will continue to actively promote the clinical trials of pre-clinical products in development, and try our best to bring positive and effective treatment options to patients as soon as possible."

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com