TORONTO, ON, Aug 31, 2023 – (ACN Newswire) – Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQX: APAAF) (FSE: A0I0) (the "Company" or "Appia") Appia is pleased to announce the deployment of a third drill on-site to investigate a significant geophysical anomaly at depth below Target IV at Appia's PCH Ionic Adsorption Clay Project, Goias State, Brazil.

Summary:

– Appia is currently using three (3) drills – one RC, one Auger, and one Diamond drill.

– A comprehensive geophysical investigation has led to the identification of a significant magnetic anomaly at over 300 metres and open at depth.

– The initial target will be drilled to 250 metres depth to test both the ionic clay and hardrock mineralization below Appia's priority ionic clay structures which reach an average depth from surface of +/- 12 metres.

– This program is designed to expand on the diamond drilling that was completed by the Vendor in prior seasons.

"A study by a Brazilian Geographer/Geophysicist Master's student from the University of Brasilia was conducted on Target IV of the PCH Project, where an induced polarization (IP) program as well as detailed ground magnetics, and gamma surveys were carried out, inverted, and subsequently analyzed by senior University, and Appia, geologists and geophysicists. This comprehensive investigation led to the identification of a significant magnetic anomaly at over 300 metres and open at depth," commented Stephen Burega, President.

"The arrival of the diamond drill marks a pivotal advancement in our exploration initiative. It underscores our commitment to investigating not only the potential genesis of Ionic Adsorption Clay but also the exciting opportunity for REE mineralization in hard rock formations," Burega continued.

The ongoing diamond drill hole operation aims to extend the investigation below the known ionic clay through saprolite structures to greater depths of up to 250 metres to test the continuation of mineralization at depth.

Furthermore, Appia's ongoing Reverse Circulation (RC) and auger drilling program of 300 holes is in full swing. (See August 24th, 2023 Press Release – Click Here). The Company's primary objective is to accurately delineate the extent of the mineralized zone and to assess its economic significance.

To achieve this, a rigorous sampling procedure is being employed, including one-meter samples that will be carefully collected and subsequently shipped to SGS Geosol laboratory. Assays from this program are expected to be received within 2 months of being submitted.

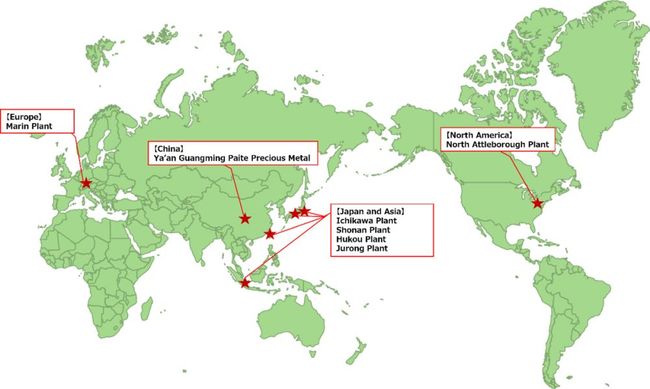

Image #1 – Diamond drilling at the PCH Target IV in Goais State, Brazil

https://images.newsfilecorp.com/files/5416/179202_appiaimage1.jpg

Background on the PCH Project

The PCH Ionic Adsorption Clay Project is located within the Tocantins Structural Province in the Brasilia Fold Belt, more specifically, the Arenopolis Magmatic Arc. The PCH Project is 17,551.07 ha in size and located within the Goias State of Brazil. It is classified as an alkaline intrusive rock occurrence with highly anomalous REE and Niobium mineralization. This mineralization is related to alkaline lithologies of the Fazenda Buriti Plutonic Complex and the hydrothermal and surface alteration products of this complex by supergene enrichment in a tropical climate. The positive results of the recent geochemical exploration work carried out to date indicates great potential for REEs and Niobium within lateritic ionic adsorption clays.

The technical content in this news release was reviewed and approved by Mr. Don Hains, P.Geo, Consulting Geologist, and a Qualified Person as defined by National Instrument 43-101.

About Appia Rare Earths & Uranium Corp. (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 113,837.15 hectares (281,297.72 acres) in Saskatchewan. The Company also has a 100% interest in 12,545 hectares (31,000 acres), with rare earth element and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. Lastly, the Company holds the right to acquire up to a 70% interest in the PCH Ionic Adsorption Clay Project which is 17,551.07 ha. in size and located within the Goias State of Brazil. (See June 9th, 2023 Press Release – Click Here). https://api.newsfilecorp.com/redirect/BpWOKTLNgA

Appia has 130.5 million common shares outstanding, 143.3 million shares fully diluted.

Cautionary Note Regarding Forward-Looking Statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words "believes", "expects", "anticipates", "estimates", "intends", "plans" or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward-looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For more information, visit www.appiareu.com.

As part of our ongoing effort to keep investors, interested parties and stakeholders updated, we have several communication portals. If you have any questions online (Twitter, Facebook, LinkedIn) please feel free to send direct messages.

To book a one-on-one 30-minute Zoom video call, please click here.

For further information, please contact:

Tom Drivas, CEO and Director: 416- 546-2707, (fax) 416-218-9772 or (email) tdrivas@appiareu.com

Stephen Burega, President: (cell) 647-515-3734 or (email) sburega@appiareu.com

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com