TORONTO, ON, Mar 30, 2023 – (ACN Newswire) – Palladium One Mining (TSXV: PDM) (FSE: 7N11) (OTCQB: NKORF) ("Palladium One" or "PDM") is pleased to announce that it has entered into a subscription agreement for a C$4,252,050 non-brokered private placement financing (the "Private Placement") with a wholly owned subsidiary of Glencore plc ("Glencore"). Pursuant to the Private Placement, PDM will issue 28,347,000 common shares ("Common Shares") at C$0.15 per Common Share. Upon completion of the Private Placement, Glencore will own approximately 9.99% of the issued and outstanding Common Shares on a non-diluted basis.

"We welcome Glencore as a shareholder and are pleased that our efforts to build a portfolio of nickel – copper sulphide projects in Tier 1 jurisdictions has been recognized and endorsed by an industry leader. We believe this transaction highlights the deep discount to fundamental value and strategy that PDM's shares represent.

"By utilizing its financial resources and expertise Palladium One will continue to execute its strategy of maximizing exposure to critical minerals on a per share basis.

"We look forward to working with Glencore's exploration team to advance our common exploration and development goals," commented Derrick Weyrauch, Chief Executive Officer of PDM.

"We are very pleased to become a cornerstone investor in Palladium One. The management team has been able to put together a sizeable land package focused on critical minerals. The exploration results to date have been very encouraging and we look forward to working with Palladium One to build on the success the team has had to date," commented Wayne Ashworth, Head of Nickel Assets for Glencore.

Net proceeds of the Private Placement are intended to be used for exploration and development activities at the Company's nickel projects, for future exploration and development activities, working capital and general and administrative expenses.

In connection with the Private Placement, Palladium One and Glencore will enter into an investor rights agreement (the "Investor Rights Agreement"), pursuant to which Glencore will be entitled to certain customary rights including participation rights on future equity security issuances and a right to nominate an individual to the technical committee of Palladium One (such committee will be formed on execution of this investment). Under the Investor Rights Agreement, Glencore will agree to certain customary transfer and standstill restrictions.

The Private Placement is expected to close on or about April 11, 2023, subject to customary conditions, including acceptance by the TSX Venture Exchange. The Common Shares issued pursuant to the Private Placement will be subject to a four-month hold period from the date of issuance in accordance with applicable securities laws. No commissions or finder fees are payable in connection with the Private Placement.

About Palladium One

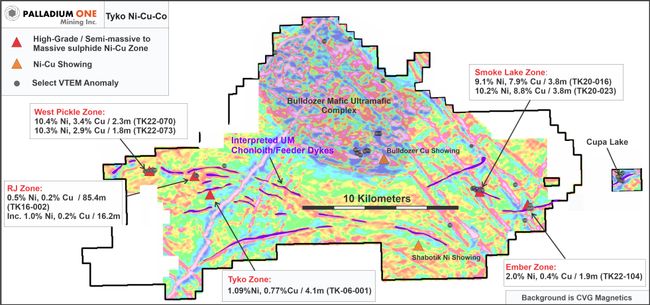

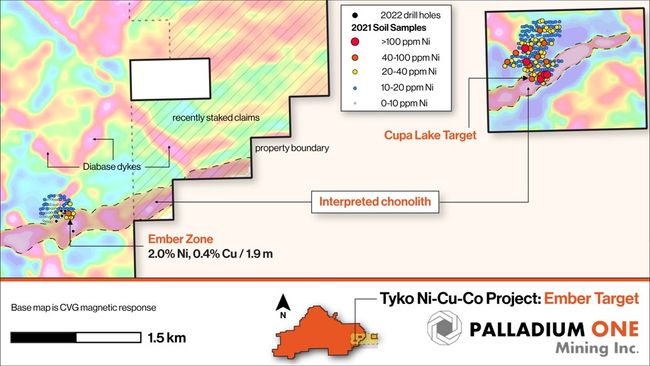

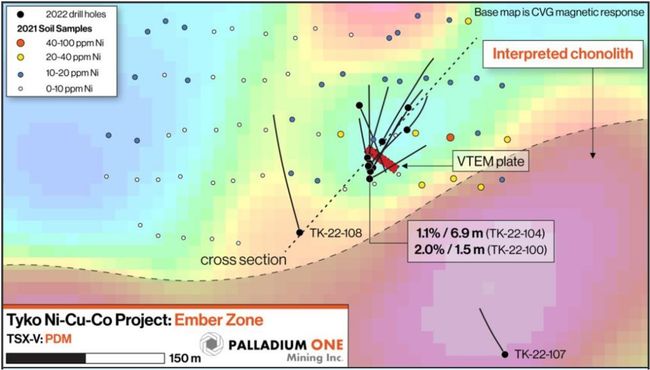

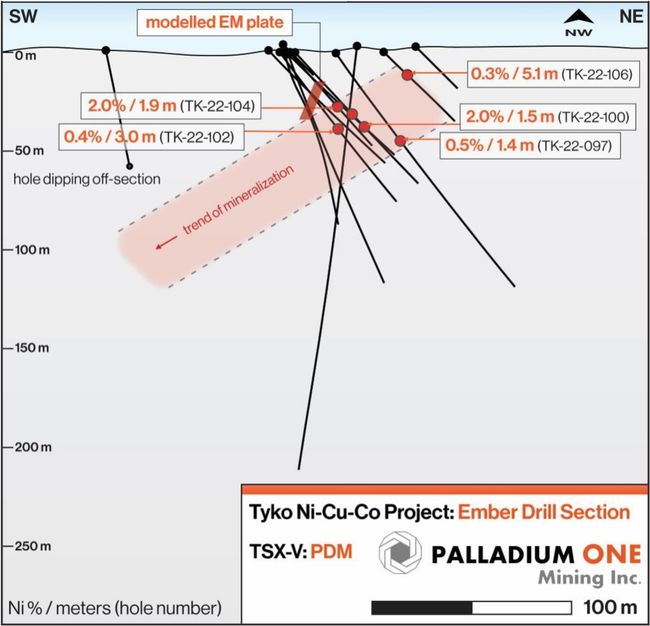

Palladium One Mining Inc. (TSXV: PDM) is focused on discovering environmentally and socially conscious Metals for Green Transportation. A Canadian mineral exploration and development company, Palladium One is targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in Canada and Finland. The Lantinen Koillismaa (LK) Project in north-central Finland, is a PGE-copper-nickel project that has existing NI43-101 Mineral Resources, while both the Tyko and Canalask high-grade nickel-copper projects are located in Ontario and the Yukon, Canada, respectively. Follow Palladium One on LinkedIn, Twitter, and at www.palladiumoneinc.com.

ON BEHALF OF THE BOARD

"Derrick Weyrauch"

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions.

These forward-looking statements include, but are not limited to, statements relating to the proposed Private Placement; expected future attributes, capitalization and strategy of Palladium One following the completion of the Private Placement; the anticipated benefits of, and rationale for, the Private Placement; plans, strategies and initiatives for Palladium One; terms and conditions of the Separation, including the expected use of proceeds of the Private Placement; the anticipated timing for completion of the Private Placement; the terms and conditions of the Investor Rights Agreement; and other statements that are not historical facts.

By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made, and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com