TORONTO, ON, Feb 23, 2023 – (ACN Newswire) – Palladium One Mining Inc. (TSXV: PDM) (OTCQB: NKORF) (FSE: 7N11) (the "Company" or "Palladium One") is pleased to report drill results from the Smoke Lake Zone and reconnaissance drilling in the RJ Area, where the Company has discovered a new mineralized Chonolith / Feeder Dyke on the Tyko Nickel – Copper Project, in Ontario, Canada.

President and CEO, Derrick Weyrauch commented, "These latest results confirm the high-grade nature of the deeper portion of the Smoke Lake Zone. The Smoke Lake area continues to suggest the presence of additional mineralization given the presence of ultramafic rocks that were intersected in several holes and IP anomalies that are still to be fully tested.

"Significantly, reconnaissance drilling north of the RJ Zone discovered a new mineralized Chonolith / Feeder Dyke. Importantly, this drill hole (TK22-093 Figure 2) tested a magnetic high with no ElectroMagnetic ("EM") response. This provides further confirmation of widespread occurrences of Chonolith / Feeder Dyke mineralization on the property, and that these occurrences are not necessarily detectable by airborne EM surveys. Additional drilling at the RJ Zone also returned wide zones (up to 50 meters, Table 1) of at surface disseminated nickel sulphide mineralization similar to historic hole TK16-002 which returned 85.4 meters of 0.5% Ni and 0.2% Cu.

"The 2023 exploration program will continue to focus on these newly identified and interpreted Chonolith / Feeder Dyke structures on the 30,000 hectare Tyko Project (Figure 1)."

The 18 holes which comprise the current release were drilled with two drill rigs, a land-based rig in the Smoke Lake Zone and a helicopter portable rig for reconnaissance holes.

The Smoke Lake Zone drilling focused on testing Induced Polarization ("IP") anomalies (Figure 3) for which Exploration Permits had been received, as well as infill drilling on the deeper part of the Smoke Lake Zone (Figure 4). Ultramafic rocks were intersected (hole TK22-079) in the IP anomaly interpreted to represent the southeast extension of the Smoke Lake Zone (Figure 3). However, further testing is warranted as no sulphide mineralization was intersected and the IP anomaly remains unexplained. The IP anomaly located to the north of Smoke Lake, which also hosts a coincident magnetic anomaly and copper in soils anomaly of up to 195ppm (Figure 3) was tested by hole TK22-095 but also remains unexplained. A yet to be received Exploration Permit is required to fully test this IP anomaly. The presence of several occurrences of ultramafic rocks in drilling, the unexplained IP and soil anomalies suggest that additional mineralization is yet to be found in the larger Smoke Lake area.

The reconnaissance drilling program focused on testing the historic RJ and Tyko zones, a new single line EM anomaly and Interpreted Chonolith Structures (TK22-093). Hole TK22-093 is significant as this target was identified by magnetics alone, with no EM signature and consisted of sheared ultramafic rocks with disseminated nickel sulphide mineralization.

The drilling on the RJ and Tyko zones assisted in establishing the geometry of the mineralization, with the RJ zone confirmed to be dipping steeply to the north, similar to the West Pickle Zone located 3 kilometers to the west. Two 400 meter Borehole ElectroMagnetic ("BHEM") platform holes (TK22-083 and 085) were also drilled at RJ and Tyko to test for massive sulphide mineralization at depth. Within the typical 200-meter observation radius of the holes, no conductors were identified. Hole TK22-083 at RJ intersect several local zones of scattered disseminated nickel mineralization, locally to 0.6% Ni and 0.26% Cu (Table 1.) indicating that the zone does continue to depth.

The 2022 drill program consisted of 70 holes totaling 13,038 meters, of which 27 holes are pending assay results. The 2023 field season is currently underway, with a high-resolution magnetic survey having been completed. The survey was designed to refine the geometry of the interpreted feeder dykes / chonoliths across the Tyko project's 30-kilometer strike length prior to additional drill testing.

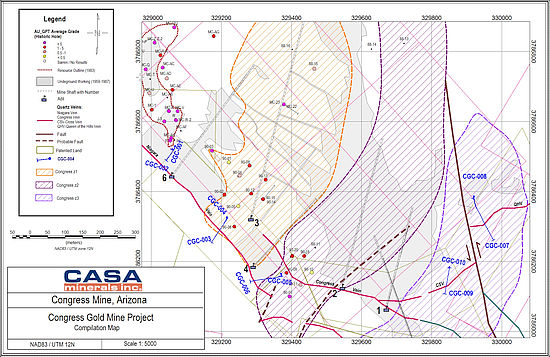

Figure 1. Tyko Property map showing various mineralized zones and multi-line VTEM anomalies, background is Calculated Vertical Gradient Magnetics ("CVG").

https://images.newsfilecorp.com/files/6502/155807_3d335b08143a2a07_001full.jpg

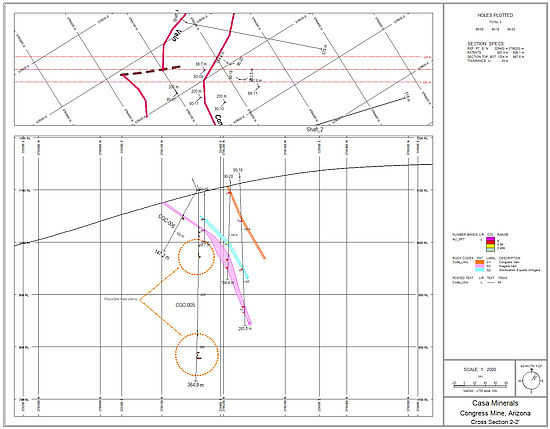

Figure 2. Plan and stylized long section looking north perpendicular to the interpreted chonolith structures linking the West Pickle, RJ and Tyko zones showing potential for massive sulphide mineralization beyond the depth detectable by the 2021 VTEM airborne survey. Note, hole TK22-093, in the top right corner of the plan map intersected nickel mineralization in a new chonolith structure.

https://images.newsfilecorp.com/files/6502/155807_3d335b08143a2a07_002full.jpg

Figure 3. Smoke Lake area showing all drilling to date, along with IP chargeability anomalies, VTEMax EM trends (dashed white line), Copper in soil anomalies, and ultramafic rock intersects. Background is total field magnetics.

https://images.newsfilecorp.com/files/6502/155807_3d335b08143a2a07_003full.jpg

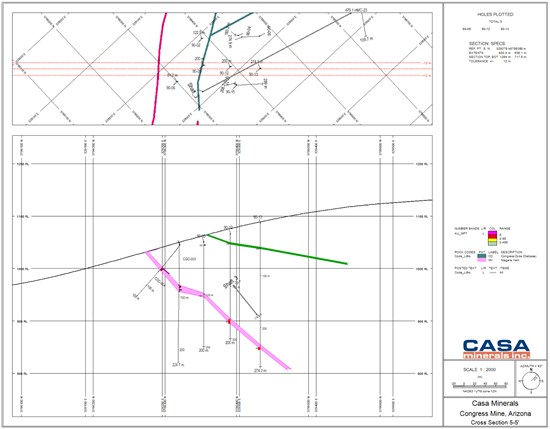

Figure 4. Plan map of Smoke Lake Zone showing all drilling to date, (red collars are 2022 drill holes, black collars are 2020-2021 drill holes) background is 1st vertical magnetics.

https://images.newsfilecorp.com/files/6502/155807_3d335b08143a2a07_004full.jpg

Table 1: Assay Results: Tyko 2022 Drill Results Smoke Lake, RJ and Tyko Zones

https://www.acnnewswire.com/docs/Multimedia/Low_PalladiumOne202302231.jpg

Table 2: Drill Hole Locations for assay results from this News Release

https://www.acnnewswire.com/docs/Multimedia/Low_PalladiumOne202302232.jpg

QA/QC

The drilling program was carried out under the supervision of Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration, and a Director of the Company.

Drill core samples were split using a rock saw by Company staff, with half retained in the core box and stored onsite at the Tyko exploration camp core yard facility.

Samples were transported in secure bags directly from the logging facility at the onsite exploration camp, to the Activation Laboratories Ltd. ("Actlabs") in Thunder Bay, Ontario. Actlabs, which is ISO 17025 accredited with CAN-P-1579 (Mineral Lab). In addition to ISO 17025 accreditation, Actlabs is accredited/certified to ISO 9001:2015. All samples are crushed to 2 millimeters with a 250-gram split pulverized to 105 microns. Analysis for PGEs is performed using a 30 grams fire assay with an ICP-OES finish and for Ni, Cu, and Co using 0.25 grams by 4 acid digestion with ICP-OES finish. Ni, Cu and Co samples over 1.0 wt% were re-analysed by ore grade methods using 4 acid digestion with ICP-OES finish.

Certified standards, blanks and crushed duplicates are placed in the sample stream at a rate of one QA/QC sample per 10 core samples. Results are analyzed for acceptance within the defined limits of the standard used before being released to the public.

About Tyko Nickel – Copper – Cobalt Project

The Tyko Nickel – Copper – Cobalt Project, is located approximately 65 kilometers northeast of Marathon Ontario, Canada. Tyko is an early stage, high sulphide tenor, nickel – copper (2:1 ratio) project and currently has five known mineralized zones spanning over a 20 kilometer strike length.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. (TSXV: PDM) is focused on discovering environmentally and socially conscious Metals for Green Transportation. A Canadian mineral exploration and development company, Palladium One is targeting district scale, platinum-group-element (PGE)-copper-nickel deposits in Canada and Finland. The Lantinen Koillismaa (LK) Project in north-central Finland, is a PGE-copper-nickel project that has existing NI43-101 Mineral Resources, while both the Tyko and Canalask high-grade nickel-copper projects are located in Ontario and the Yukon, Canada, respectively. Follow Palladium One on LinkedIn, Twitter, and at www.palladiumoneinc.com.

ON BEHALF OF THE BOARD

"Derrick Weyrauch"

President & CEO, Director

For further information contact:

Derrick Weyrauch, President & CEO

Email: info@palladiumoneinc.com

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release is not an offer or a solicitation of an offer of securities for sale in the United States of America. The common shares of Palladium One Mining Inc. have not been and will not be registered under the U.S. Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable exemption from registration.

Information set forth in this press release may contain forward-looking statements. Forward-looking statements are statements that relate to future, not past events. In this context, forward-looking statements often address a company's expected future business and financial performance, and often contain words such as "anticipate", "believe", "plan", "estimate", "expect", and "intend", statements that an action or event "may", "might", "could", "should", or "will" be taken or occur, or other similar expressions. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause our actual results, performance or achievements, or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. Such factors include, among others, risks associated with project development; the need for additional financing; operational risks associated with mining and mineral processing; fluctuations in palladium and other commodity prices; title matters; environmental liability claims and insurance; reliance on key personnel; the absence of dividends; competition; dilution; the volatility of our common share price and volume; and tax consequences to Canadian and U.S. Shareholders. Forward-looking statements are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change. Investors are cautioned against attributing undue certainty to forward-looking statements.

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com