HONG KONG, Sep 13, 2022 – (ACN Newswire) – Under the market divergence, the long-term allocation value of gold stocks becomes more prominent.

In September when over half of the year has passed, with the frequent "black swan" incidents taking place in 2022, the downward pressure and market volatility of the global economy has become more severe than in previous years. In such a capital winter, gold stocks are expected to become one of the most valuable assets for investment to hold for an extended period of future time.

On the one hand, from a macro perspective, there have been more and more catalyst factors that drive the price of gold to rise recently, meanwhile the logic behind the medium and long-term upward trend of gold prices is also strengthening. On the other hand, in terms of valuation, the current gold industry is at the bottom value of the ten-year cycle. Hence the gold industry's profitability and return level are now maintained at a stable and optimized state, providing effective investment values.

When it comes to selecting individual stocks, Zhaojin Mining (01818), listed in HKSE, deserves your attention.

In addition to the expectation that the rising gold price will boost the company's profits, Zhaojin Mining's endogenous growth momentum is also very strong. From the perspective of Zhitong Finance APP, the biggest attraction of Zhaojin Mining itself is Haiyu goldmine.

Zhaojin Mining's two main mines used to be Dayingezhuang goldmine and Xiadian goldmine, with reserves of 229.2 tons and 108.6 tons, respectively. In 2015, the company acquired Haiyu goldmine, the largest single gold mine in China, with reverses of 562.4 tons, getting Zhaojin's total reserves to be over 1,000 tons.

As for the current progress, Haiyu goldmine has obtained a 15-year mining license issued by the Shandong Provincial Department of Natural Resources in July 2021. According to the disclosed information, the area of mineral exploration right in Haiyu is 17.91 square kilometers. As of December 2020, it has retained 562.37 tons of mineral reserves, with an average ore grade of 4.20 grams per ton.

It is also understood that Zhaojin has sunk a total investment of RMB 7.3 billion to the Haiyu goldmine project, with a designed mining goal of 3.96 million tons per year. The mine is set to start production in 2023 and to achieve its target production in 2-3 years, with an annual output of 16-20 tons after the project is completed. For reference, Zhaojin Mining's gold output in 2021 was 12.6 tons. In other words, Zhaojin Mining's annual output will double after Haiyu goldmine reaches its designed production capacity.

On the cost side, thanks to the large production scale and high ore grade of Haiyu goldmine, the overall gold cost is expected to be as low as RMB 100/gram after full establishment of production, holding obvious advantages. For reference, Zhaojin Mining's overall gold cost in the first half of this year was about RMB 193.98/gram.

It is also worth mentioning that the linear distance between Haiyu goldmine and the Zhaojin port is only 45 kilometers, which can generate a significant regional synergistic effect in the future.

Given all the above, after the production Haiyu goldmine is completed, the overall profitability of Zhaojin Mining's goldmining business will usher in a qualitative leap forward.

According to Zhaojin Mining's latest disclosure, the design of the safety facilities of Haiyu goldmine has passed the review of the relevant departments earlier this year, and the project has recently obtained the approval of the "Safety Three Simultaneousness". Therefore, the construction of the project will soon be carried out.

In summary, Zhitong Finance APP believes that now is the perfect time to enter the left side trading of Zhaojin Mining. As we all know, the logic that drives the rise of cyclical stock prices can be divided into two categories: one is beta – rising commodity prices driving company profits and thus the stock prices; the other is alpha – stock prices and company profits driven by other factors besides commodity price fluctuations, such as an increase of an individual company's market share, an increase in product yield, etc.

Long-term investors clearly prefer alpha logic to beta logic, as alpha is trendier and lasts longer.

At present, Zhaojin Mining undoubtedly has investment opportunities with a strong alpha under the resonance of two advantages: the expectation of the rising gold price, as well as the upcoming stable increase of gold production contributed by Haiyu goldmine. Moreover, if we consider the fact that Zhaojin's share price has been unsatisfying in recent months due to the decline of the overall Hong Kong stock market, this is an even more rare opportunity for investors to go long.

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Tag: Metals & Mining

TANAKA Memorial Foundation to Offer Precious Metals Research Grants of up to 5 Million Yen

TOKYO, Sep 1, 2022 – (ACN Newswire) – The TANAKA Memorial Foundation (Representative Director: Hideya Okamoto) announced that it will take applications for research themes for FY2022 Precious Metals Research Grants between September 1 (Thu) and November 30 (Wed). Applications will be accepted from Japanese educational institutions and public research institutes conducting research and development using precious metals. In this 24th year of the research grant, recipients will receive 5 million yen for the Platinum Award, 2 million yen for the Gold Award, 1 million yen for the Silver Award, 1 million yen for the Young Researcher Award, and 300,000 yen for the Encouragement Award.

Applications for the Precious Metals Research Grants are open to themes in all fields related to new technology and research and development in which precious metals can make a contribution. Applications can be submitted using the application form on the TANAKA Memorial Foundation website ( https://tanaka-foundation.or.jp ), and, after strict examination, award recipients will be announced at the end of March 2023.

The TANAKA Memorial Foundation aims to contribute to the development and cultivation of new fields for precious metals and to the development of science, technology, and the social economy by conducting activities that enable more people to experience a prosperous society. This program is being implemented to help support the various challenges faced in the "new world opened up by precious metals." Last year, the research on "Enhancing development of model-based design and production technologies for electronic parts containing precious metals" won a Gold Award for being able to significantly contribute toward the development of processing technologies and improvement of performance through the development of model-based designs using numerical analysis methods – represented by methods such as the finite element method – to minimize cost and takt time related to product design, prototyping, and process design. Another Gold Award was presented for research and development on "Formation of backside power delivery network using precious metal wires" related to the formation of precious metal wires, which is an element technology for three-dimensional mounting that is gaining attention as an integration technology for advanced logic devices.

Overview of the 2022 Precious Metals Research Grants

Theme:

– Themes that involve any of the following: new technologies to which precious metals can make a contribution, research related to precious metals that will bring innovative evolution to products, or research and development of new products using precious metals

Grant Amounts:

– Platinum Award: 5 million yen (1 award)

– Gold Award: 2 million yen (1 award)

– Silver Awards: 1 million yen (4 awards)

– Young Researcher Awards: 1 million yen (2 awards)

– Encouragement Award: 300,000 yen (several awards)

* The grant amount is treated as a scholarship donation.

* Awards may not be granted in some cases.

* The number of awards is subject to change.

Eligible Candidates:

– Personnel who belong to (or work for) educational institutions in Japan (universities, graduate schools, or technical colleges) or public and related research institutions may participate.

* As long as the applicant is affiliated with a research institution in Japan, the base of activity can be in Japan or overseas.

* The Young Researcher Awards are for researchers under the age of 37 as of April 1, 2022.

Application Period:

– 9am, September 1, 2022 (Thu) – 5pm, November 30, 2022 (Wed)

Application Method:

– Enter the required information on the application form available on the TANAKA Memorial Foundation website ( https://tanaka-foundation.or.jp ) and upload details of the research (papers and supplementary material on the theme).

Announcement:

– Results will be announced on the TANAKA Memorial Foundation website around the end of March 2023.

* TANAKA will contact the award recipients directly.

Conditions:

Research content that falls under any of the following

– New technology related to precious metals

– Research and development related to precious metals that bring about innovative evolution in products

– Research and development of new products using precious metals

* Precious metal refers to eight elements of platinum, gold, silver, palladium, rhodium, iridium, ruthenium and osmium.

* If development is conducted jointly (or planned to be) with other material manufacturers, please indicate so.

* Products that have already been commercialized, put to practical use, or that are planned are not eligible.

Inquiries Concerning the Research Grant Program:

Precious Metals Research Grants Office

Global Marketing / R&D Supervisory Department, TANAKA Kikinzoku Kogyo K.K.

22F Tokyo Building, 2-7-3 Marunouchi, Chiyoda-ku, Tokyo 100-6422

E-mail: joseikin@ml.tanaka.co.jp

TANAKA Memorial Foundation website: https://tanaka-foundation.or.jp

TANAKA Memorial Foundation

Established: April 1, 2015

Address: 22F Tokyo Building, 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

Representative: Hideya Okamoto

Purpose of Business: To provide grants for research related to precious metals to contribute to the development and cultivation of new fields for precious metals, and to the development of science, technology, and the social economy.

Areas of Business: Provision of grants for scientific and technological research related to precious metals. Recognition of excellent analysis of precious metals and holding of seminars and other events.

TANAKA Kikinzoku Kogyo K.K.

Headquarters: 22F, Tokyo Building, 2-7-3 Marunouchi, Chiyoda-ku, Tokyo

Representative: Koichiro Tanaka, Representative Director & CEO

Founded: 1885

Incorporated: 1918

Capital: 500 million yen

Employees: 2,429 (as of March 31, 2022)

Sales: JPY 389,646,820,000 (FY2021)

Main businesses: Manufacture, sales, import and export of precious metals (platinum, gold, silver, and others) and various types of industrial precious metals products.

URL: https://tanaka-preciousmetals.com

* From the current consolidated fiscal year, the amounts of sales for some transactions are indicated as net values due to application of the Accounting Standard for Revenue Recognition.

Press Inquiries

TANAKA Holdings Co., Ltd.

https://tanaka-preciousmetals.com/en/inquiries-for-media/

This press release in PDF: https://www.acnnewswire.com/docs/files/20220901_EN.pdf

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

TANAKA Starts Taking Orders for Gold Bonding Wires Using “RE Series” 100% Recycled Precious Metals

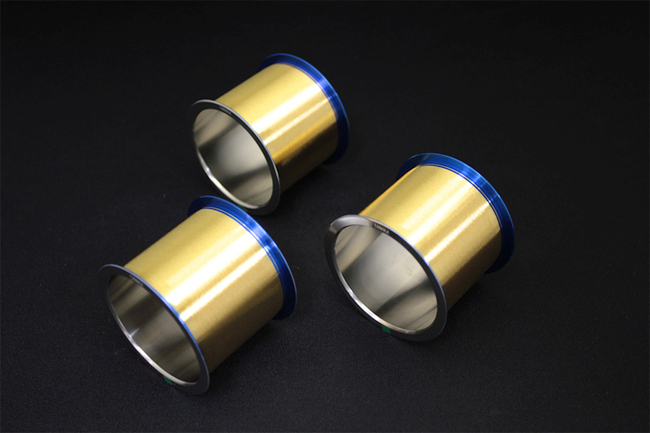

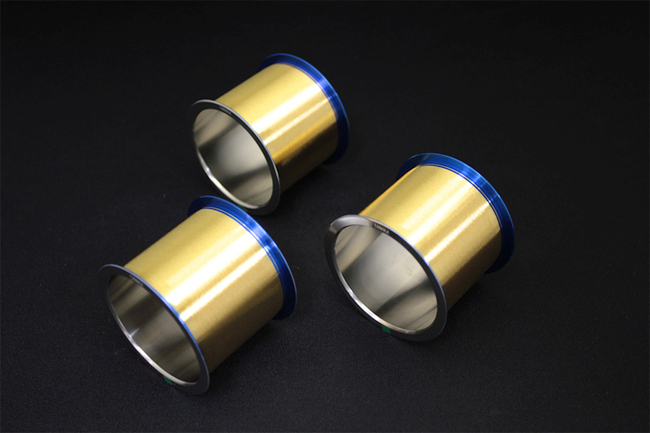

TOKYO, Aug 30, 2022 – (ACN Newswire) – TANAKA Kikinzoku Kogyo K.K. (Head office: Chiyoda-ku, Tokyo; Representative Director & CEO: Koichiro Tanaka), which operates the TANAKA Precious Metals manufacturing business, announced today that its subsidiary TANAKA Denshi Kogyo K.K. (Head office: Kanzaki-gun, Saga; Representative Director & President: Toshiya Yamamoto), which is engaged in the production of various types of bonding wires, will start taking orders for gold (Au) bonding wires manufactured using only "RE Series" 100% recycled precious metals. This is in addition to existing products which use raw materials that include gold directly produced from mines.

|

|

|

A compound for plating solutions has already been launched as the first product to use the RE Series supplied by TANAKA Kikinzoku Kogyo as raw materials. As a secondary use, the RE Series is being expanded*1 to gold bonding wires manufactured by TANAKA Denshi Kogyo.

Boasting the world's highest market share*2, TANAKA Denshi Kogyo's gold bonding wires support the world's semiconductor industry. A stable worldwide supply of the RE Series is possible as it is being produced at four locations – Japan, Singapore, Malaysia, and China – and has obtained third-party verification.

TANAKA Precious Metals hopes to contribute toward the establishment of a sound material-cycle society and increased demand for sustainable materials and products by supplying the RE Series. In the future, TANAKA Precious Metals will further expand the business of recycling precious metals – which are natural resources with limited reserves – to the global level with the goal of achieving a stable supply.

About Gold (Au) Bonding Wires

Bonding wire is the metal wire that electrically connects semiconductor chips to external electrodes. They mainly use extremely fine wires (10+ microns thick) made from gold, silver, copper, and aluminum. In particular, bonding wires made using gold have better corrosion resistance, workability, connectivity, and chemical stability than those composed of other metals. Besides electronic products such as computers and mobile phones, semiconductors are also widely used in home appliances and vehicles. In addition, semiconductors are gaining greater attention as a critical component in electric vehicles and digital transformation, contributing to the realization of a carbon-neutral society.

About the RE Series

The RE Series is composed of materials refined only from recycled precious metals rather than from sources such as mined bullion. TANAKA Kikinzoku Kogyo has been operating a recycled precious metals business since it was established in 1885. By expanding its RE Series production line, it is working to supply products that use 100% recycled precious metal materials, starting in 2022.

In addition, TANAKA Kikinzoku Kogyo offers services using a comprehensive system of management within the Group, from product recovery to refining and remanufacturing into new products. Using advanced precious metal analysis technologies* developed through many years of research and development, it is able to accurately evaluate the rate of precious metal content in recovered materials, which is important for recycling.

*One measure of precious metal analysis capabilities is the status of Good Delivery Referee, an accreditation of the LBMA and LPPM, the most prestigious organizations in the field globally, which TANAKA Kikinzoku Group received as one of only five companies globally and the only company in Japan and the rest of Asia. The Group is also the first in Japan to acquire ISO/IEC 17025 accreditation for its analysis technologies for platinum, gold, silver, and palladium.

About TANAKA Denshi Kogyo bonding wires

TANAKA Denshi Kogyo has produced various types of bonding wire since it was founded more than 50 years ago, and today it boasts a leading share of the global market. After establishing its first overseas production base in Singapore in 1978, the company has constructed additional production bases in Malaysia, China, and Taiwan. It now supplies its wires to countries engaged in the production of semiconductors around the world.

Press release in PDF: https://www.acnnewswire.com/docs/files/20220830_EN.pdf

About TANAKA Precious Metals

Since its foundation in 1885, TANAKA Precious Metals has built a portfolio of products to support a diversified range of business uses focused on precious metals. TANAKA is a leader in Japan regarding the volumes of precious metals handled. Over the course of many years, TANAKA has not only manufactured and sold precious metal products for industry but also provided precious metals in such forms as jewelry and assets. As precious metals specialists, all Group companies in Japan and around the world collaborate and cooperate on manufacturing, sales, and technology development to offer a full range of products and services. With 5,225 employees, the Group's consolidated net sales for the fiscal year ending March 31, 2022, were 787.7 billion yen.*

*From the current consolidated fiscal year, the amounts of sales for some transactions are indicated as net values due to the application of the Accounting Standard for Revenue Recognition.

Global industrial business website

https://tanaka-preciousmetals.com/

Product inquiries

TANAKA Kikinzoku Kogyo K.K.

https://tanaka-preciousmetals.com/en/inquiries-on-industrial-products/

Press inquiries

TANAKA Holdings Co., Ltd.

https://tanaka-preciousmetals.com/en/inquiries-for-media/

*1 It is possible to continue placing orders for gold bonding wires manufactured using the conventional process.

*2 Source: SEMI Industry Research and Statistics/TECHCET, April 2020

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

TANAKA Starts Taking Orders for Gold Bonding Wires Using “RE Series” 100% Recycled Precious Metals

TOKYO, Aug 30, 2022 – (ACN Newswire) – TANAKA Kikinzoku Kogyo K.K. (Head office: Chiyoda-ku, Tokyo; Representative Director & CEO: Koichiro Tanaka), which operates the TANAKA Precious Metals manufacturing business, announced today that its subsidiary TANAKA Denshi Kogyo K.K. (Head office: Kanzaki-gun, Saga; Representative Director & President: Toshiya Yamamoto), which is engaged in the production of various types of bonding wires, will start taking orders for gold (Au) bonding wires manufactured using only “RE Series” 100% recycled precious metals. This is in addition to existing products which use raw materials that include gold directly produced from mines.

A compound for plating solutions has already been launched as the first product to use the RE Series supplied by TANAKA Kikinzoku Kogyo as raw materials. As a secondary use, the RE Series is being expanded*1 to gold bonding wires manufactured by TANAKA Denshi Kogyo.

Boasting the world’s highest market share*2, TANAKA Denshi Kogyo’s gold bonding wires support the world’s semiconductor industry. A stable worldwide supply of the RE Series is possible as it is being produced at four locations – Japan, Singapore, Malaysia, and China – and has obtained third-party verification.

TANAKA Precious Metals hopes to contribute toward the establishment of a sound material-cycle society and increased demand for sustainable materials and products by supplying the RE Series. In the future, TANAKA Precious Metals will further expand the business of recycling precious metals—which are natural resources with limited reserves—to the global level with the goal of achieving a stable supply.

■ About Gold (Au) Bonding Wires

Bonding wire is the metal wire that electrically connects semiconductor chips to external electrodes. They mainly use extremely fine wires (10+ microns thick) made from gold, silver, copper, and aluminum. In particular, bonding wires made using gold have better corrosion resistance, workability, connectivity, and chemical stability than those composed of other metals. Besides electronic products such as computers and mobile phones, semiconductors are also widely used in home appliances and vehicles. In addition, semiconductors are gaining greater attention as a critical component in electric vehicles and digital transformation, contributing to the realization of a carbon-neutral society.

■ About the RE Series

The RE Series is composed of materials refined only from recycled precious metals rather than from sources such as mined bullion. TANAKA Kikinzoku Kogyo has been operating a recycled precious metals business since it was established in 1885. By expanding its RE Series production line, it is working to supply products that use 100% recycled precious metal materials, starting in 2022.

In addition, TANAKA Kikinzoku Kogyo offers services using a comprehensive system of management within the Group, from product recovery to refining and remanufacturing into new products. Using advanced precious metal analysis technologies* developed through many years of research and development, it is able to accurately evaluate the rate of precious metal content in recovered materials, which is important for recycling.

*One measure of precious metal analysis capabilities is the status of Good Delivery Referee, an accreditation of the LBMA and LPPM, the most prestigious organizations in the field globally, which TANAKA Kikinzoku Group received as one of only five companies globally and the only company in Japan and the rest of Asia. The Group is also the first in Japan to acquire ISO/IEC 17025 accreditation for its analysis technologies for platinum, gold, silver, and palladium.

■ About TANAKA Denshi Kogyo bonding wires

TANAKA Denshi Kogyo has produced various types of bonding wire since it was founded more than 50 years ago, and today it boasts a leading share of the global market. After establishing its first overseas production base in Singapore in 1978, the company has constructed additional production bases in Malaysia, China, and Taiwan. It now supplies its wires to countries engaged in the production of semiconductors around the world.

Press release in PDF: https://www.acnnewswire.com/docs/files/20220830_EN.pdf

■ About TANAKA Precious Metals

Since its foundation in 1885, TANAKA Precious Metals has built a portfolio of products to support a diversified range of business uses focused on precious metals. TANAKA is a leader in Japan regarding the volumes of precious metals handled. Over the course of many years, TANAKA has not only manufactured and sold precious metal products for industry but also provided precious metals in such forms as jewelry and assets. As precious metals specialists, all Group companies in Japan and around the world collaborate and cooperate on manufacturing, sales, and technology development to offer a full range of products and services. With 5,225 employees, the Group’s consolidated net sales for the fiscal year ending March 31, 2022, were 787.7 billion yen.*

*From the current consolidated fiscal year, the amounts of sales for some transactions are indicated as net values due to the application of the Accounting Standard for Revenue Recognition.

■ Global industrial business website

https://tanaka-preciousmetals.com/

■ Product inquiries

TANAKA Kikinzoku Kogyo K.K.

https://tanaka-preciousmetals.com/en/inquiries-on-industrial-products/

■ Press inquiries

TANAKA Holdings Co., Ltd.

https://tanaka-preciousmetals.com/en/inquiries-for-media/

*1 It is possible to continue placing orders for gold bonding wires manufactured using the conventional process.

*2 Source: SEMI Industry Research and Statistics/TECHCET, April 2020

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Leon Fuat Berhad Posts 35.8% Increase in Q2 Revenue to RM250.93 Million

SHAH ALAM, Malaysia, Aug 29, 2022 – (ACN Newswire) – Leon Fuat Berhad, a manufacturer and trader of steel products specialising in rolled long and flat steel, today reported a 35.8% increase in revenue to RM250.93 million for the second quarter ended 30 June 2022 (Q2FY2022) compared with RM184.78 million recorded in the corresponding quarter of the preceding financial year (Q2FY2021).

|

|

The Group recorded profit before tax (PBT) of RM18.04 million for Q2FY2022, a 57.6% decrease from RM42.57 million registered in Q2FY2021 while recording profit after tax (PAT) of RM14.02 million, which is a 56.3% decrease from RM32.12 million reported in the corresponding quarter of the preceding financial year.

For the quarter under review, the trading segment contributed 38.4% to revenue while the processing segment contributed 61.5%.

For the six months ended 30 June 2022 (1H 2022), Leon Fuat registered a 32.2% increase in revenue to RM523.95 million compared with RM396.26 million recorded in the six months ended 30 June 2021 (1H 2021). For the period under review, the Company reported PBT of RM49.85 million, a 41.4% decrease from RM85.10 million recorded in 1H 2021 while for 1H 2022, PAT decreased 44.4% to RM37.91 million compared with RM68.23 million recorded in 1H 2021.

Calvin Ooi Shang How, Executive Director of Leon Fuat said, "We saw higher overall revenue on the increased contributions from the trading and processing of steel products, but a combination of lower overall gross profit margin and inventories written down of RM13.88 million in the current quarter as certain inventories were measured at its estimated net realisable value weighed on PBT."

"The outlook for the global economy remains volatile on a combination of China's slowdown, the Russia-Ukraine war and tighter monetary policy in response to inflation. While the domestic economy has so far weathered the challenges on a combination of resilient exports and private consumption, uncertainties remain because of the potential risks from supply-chain disruptions and rising commodity prices leading to inflationary pressure."

"We are more neutral as to the prospects for the remaining quarters of the year given these challenges especially with the softening of steel prices and the weaker ringgit. We have increased monitoring of steel prices and related currencies and continue to take proactive measures including negotiating forward contracts, where necessary, as well as prudent inventory management, to reduce any negative impact which may arise. The Group will strive to keep operating costs at manageable levels while enhancing operating capabilities and efficiencies to meet customer requirements and to ensure timely satisfaction of customer orders."

Leon Fuat Berhad: [BURSA: LEFU] , https://www.leonfuat.com.my/

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Minetech’s Revenue for 1Q Rises 43.0% to RM24 Million

KUALA LUMPUR, Aug 25, 2022 – (ACN Newswire) – Minetech Resources Berhad, a civil engineering specialist and bituminous products manufacturer, today announced that the Company registered a 43.2% rise in revenue for the first quarter ended 30 June 2022 (1Q FY2023) to RM24.05 million compared with RM16.80 million in the corresponding quarter of the last financial year (1Q FY2022).

|

For the quarter under review, the Company recorded a loss before tax (LBT) of RM1.66 million compared with LBT of RM4.35 million in 1Q FY2022.

On a segmental basis, Minetech's civil engineering division posted revenue contribution of RM13.7 million for 1Q FY2023, a gain of 34.3% compared with RM10.2 million in 1Q FY2022. The manufacturing division, which produces bituminous products for pipe coating, waterproofing and sealing, recorded revenue contribution of RM5.85 million, a gain of 75.1% compared with RM3.34 million in 1Q FY2022.

Matt Chin, Executive Director of Minetech, said, "The civil engineering division's contribution was supported by higher revenue from the Selinsing Gold Mine in the quarter under review compared to the corresponding quarter of the previous financial year as production regained traction while the manufacturing division saw a significant rise in revenue due to an increase in sales as a result of improved demand from water piping and road paving projects."

"Recent news flow point to firmer domestic economic growth and the announcement of the MRT3 project together with the continuation of other large civil infrastructure projects is positive for the construction sector as there will be need for civil engineering services as well as bituminous products."

"We will continue to be vigilant given the more challenging global economic outlook. We have rationalised our corporate structure and in recent years diversified into other businesses to enhance our financial performance while ensuring more stable recurring income. Our narrower losses for the quarter are a result of these measures."

Minetech Resources Berhad: 7219 [BURSA: MINE], https://minetech.com.my/

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Zijin Mining Announces 2022 Interim Results: Achieved 89.95% Increase in Net Profit Attributable to Owners

HONG KONG, Aug 16, 2022 – (ACN Newswire) – Zijin Mining Group Co., Ltd. (2899.HK; 601899:SH; "Zijin Mining" or "The Company") announced its interim results for the six months ended 30 June 2022 ("Reporting Period"). The Company realised RMB132.46 billion in operating income, up 20.57% year-on-year, while net profit attributable to owners surged to RMB12.63 billion, representing an increase of 89.95% compared with the same period last year. The profit increase was largely driven by the completion of major mine projects, including Serbia Zijin Mining, Kamoa Copper in the Democratic Republic of the Congo (DRC) and Julong Copper in China, which have commenced production and reached their designated production capacities on schedule. During the reporting period, the production volume of mine-produced copper and mine-produced gold amounted to 410,000 tonnes and 27 tonnes, representing an increase of approximately 70.47% and 22.79%, respectively.

Zijin Mining 2022 Interim Results Highlights:

For the six months ended 30 June 2022, the Group realised an operating income of RMB132.46 billion, representing an increase of 20.57% compared with the same period last year (same period last year: RMB109.86 billion).

For the six months ended 30 June 2022, the Group realised a profit before tax of RMB18.57 billion, representing an increase of 61.90% compared with the same period last year (same period last year: RMB11.47 billion).

For the six months ended 30 June 2022, the Group realised a net profit attributable to owners of the listed company of RMB12.63 billion, representing an increase of 89.95% compared with the same period last year (same period last year: RMB6.65 billion).

As of 30 June 2022, the Group's total assets was RMB271.57 billion, representing an increase of 30.19% compared with the beginning of the year (beginning of the year: RMB208.60 billion).

As of 30 June 2022, the Group's net assets attributable to owners of the listed company was RMB77.47 billion, representing an increase of 9.06% compared with the beginning of the year (beginning of the year: RMB71.03 billion).

CHEN Jinghe, Chairman of Zijin Mining, commented, "Our strong performance in the first half of 2022 is attributable to the strengths of the Company's global growth strategy. By leveraging Zijin Mining's strong financial resources and track record of mining expertise, we will continue to seek opportunities and add to our global asset mix. As the world races towards a 'net-zero' transition, we have also allocated resources globally to increase our competitiveness in new energy minerals. Looking forward, Zijin Mining will continue to work closely with in-country local communities and government authorities to ensure our mission of 'Mining for a Better Society'."

Heralding new energy minerals boom

With a 15% equity stake in the DRC Manono Lithium-tin project and the completed acquisition of Neo Lithium Corp and its flagship 3Q Lithium Project in Argentina, the Company has continued to prioritize new energy minerals such as copper, lithium and other metallic minerals. Zijin Mining currently owns over 10 million tonnes of lithium carbonate equivalent resources, with long-term development plans to boost annual production capabilities to over 150,000 tonnes per year, laying the foundation for becoming a leading lithium producer and meeting growing demand amid the global 'clean energy transition'.

Construction at the 3Q Lithium Project has accelerated and first-stage trials of brine mining and solar evaporation have been concluded. Completion of the 3Q Project and commercial production is planned for the end of 2023. The Company has also accelerated the construction and development of the Lakkor Tso project and Xiangyuan project, with the Company having finalised a 70% acquisition of the former and is near completion on a 71% acquisition of the latter.

Increased investment to tackle global climate change

During the reporting period, the Company prioritized strict controls of pollution emissions. SO2 and NOx emissions intensity by revenue decreased by 25.59% and 4.22%, respectively. The Company's investment in environmental protection measures also continued to increase during the first half of 2022, amounting to RMB577 million, of which RMB271 million was used for ecological restoration, representing an increase of 67% compared with the same period last year.

Zijin Mining's efforts at the Kamoa-Kakula Mining Complex in the DRC have also ensured the project is on track to become one of the world's 'greenest copper producers'. With RMB120 million already invested as of the end of 2021, the Company continues to enhance and invest in the rehabilitation of the Mwadingusha, Inga G25 and related networks to realise the overall electrification of the mining fleet, and further reduce the GHG emissions per tonne of copper produced from the project.

During the reporting period, the Company obtained a 25.04% equity share in Fujian Longking Co., Ltd. (Longking) and secured controlling rights through corporate governance and other arrangements. Zijin Mining aims to leverage this new acquisition's leading environmental management service expertise to further minimize the Company's global carbon footprint; and promote Longking's strategic 'environmental protection + new energy' transformation to achieve greater industrial synergy.

During the reporting period, the Company continued its biodiversity and restoration efforts, with a total area of restored vegetation amounting to 7.92 million m2, and over 839,000 trees planted.

Mining for a Better Society

Adhering to the United Nations Sustainable Development Goals, Zijin Mining remains steadfast in promoting its core value of 'Mining for a Better Society'. The Company's efforts have been widely applauded for its contributions to the social and economic development of local communities and host countries where projects are located.

With global operations, the Company has continued to deliver on its social development and responsibility commitments, including the USD4.4 million development plan for the Musonoie community in the DRC and support of the 'Sustainable Livelihoods Program' at the Kamoa-Kakula Mining Complex providing approximately 12,000 community members with clean water. Zijin Mining also supports the coffee growers of Western Antioquia, Colombia, through training, construction of infrastructure and maintenance of coffee plantations, helping coffee-growing families increase their scale and ability in 'going abroad'. In Serbia, the Company also maintains investments for environmental protection and community support, amounting to over USD200 million since 2018. During the reporting period, the Company also launched the 'For a Better Future Program' to support local Serbian students, by offering scholarships and providing school supplies.

ZOU Laichang, President of Zijin Mining and Director of the ESG Management Committee, commented, "We have made significant steps towards our goal of 'Mining for a Better Society' as Zijin Mining strives for even higher-quality sustainable development. The Company actively promotes local industries, local employment and local procurement policies across our global network, aiming to contribute to global economic growth and supporting the betterment of all people in all countries."

* USD1 = RMB6.7423

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Alaska Mining Sells 51% Interest to Australian Nanotechnology Specialist

KUALA LUMPUR, Aug 15, 2022 – (ACN Newswire) – Alaska Mining Sdn Bhd is pleased to announce that its sole shareholder, Lee Hon Kit, is selling a 51% interest in the Company amounting to A$5.0 million (RM15.2 million) under a share sale agreement to Nanopac Alaska Sdn Bhd (NASB).

|

NASB is a unit of Nanopac Innovation Limited, which is listed on the Sydney-based National Stock Exchange of Australia. Nanopac principally engages in the research and development, manufacturing, distribution and servicing of nanotechnology materials and products. Nanopac's other businesses include Nano-Solar panels and raw materials for paint industry. Mr. Lee is the sole shareholder of Alaska Mining, which is an earthworks and mining specialist as well as a trader of a variety of goods and logistics services provider.

Under the agreement, the sale of the 51% interest in Alaska Mining by Mr. Lee to NASB will be satisfied through the issuance of new shares in Nanopac to be paid in two tranches. The first tranche of new shares amounting to A$2.5 million (RM7.77 million) will be paid up front following the share sale agreement while the second tranche of new shares amounting to A$2.5 million (RM7.77 million) will be paid out after the Company has achieved A$5.0 million (RM15.2 million) in net profit. As part of the share sale agreement, Mr. Lee will be appointed the managing director of Alaska Mining.

Alaska Mining has been granted rights to mine sands to be processed into silica and ilmenite, from which a Chinese business group has agreed to an offtake agreement in relation to part of the ilmenite produced.

Mr. Lee expressed that he is looking forward to working with NASB and Nanopac to grow the mining business and at the same time ensure there is a steady flow of silica for Nano-Solar panel production and ilmenite for its paint products.

"This acquisition is advantageous to Nanopac as this secures a steady flow of raw materials for Nano-Solar and existing line of products, which it would otherwise have to source through third parties."

"The mining operations will also give Nanopac a source of recurring income as the silica and ilmenite that it does not require will be sold to others while ensuring that the mining operations remain commercially sustainable, as the offtake agreement with the Chinese business group shows."

Mr. Tobby Tan, Acting Chief Executive Officer of NASB said, "We welcome Mr. Lee to the Nanopac family and we have no doubt that with his knowledge and experience, we will be able to grow the mining business to greater heights. We also believe that the acquisition of the stake will add to our production capabilities and is positive for the growth of Nanopac's solar panels and paints businesses."

Nanopac Alaska Sdn Bhd https://www.nanopac.com.my/

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Announcement of Intention to Delist American Depositary Shares from the New York Stock Exchange and Intention to Deregister and Terminate Reporting Obligations under the U.S. Securities Exchange Act

BEIJING, CHINA, Aug 12, 2022 – (ACN Newswire) – Aluminum Corporation of China Limited ("Chalco" or the "Company")(NYSE: ACH; HKEx: 2600; SSE: 601600) today announced that it has notified the New York Stock Exchange ("NYSE") on August 12, 2022 (U.S. Eastern Time) of its proposed application for voluntary delisting of its American depositary shares (the "ADSs") from the NYSE and deregistration of such ADSs and the underlying overseas listed foreign shares (the "H Shares", with a par value of RMB1 each) under the U.S. Securities Exchange Act of 1934, as amended (the "Exchange Act"). Due to a number of considerations, including the limited trading volume of the ADSs of the Company as compared to the worldwide trading volume of H Shares of the Company, and the considerable administrative burden and costs associated with maintaining the listing of the ADSs on the NYSE and the registration of the ADSs and the underlying H Shares with the U.S. Securities and Exchange Commission (the "SEC") and complying with the periodic reporting and related obligations under the Exchange Act, the board of directors (the "Board") of the Company approved the delisting of the ADSs from the NYSE and the deregistration of the ADSs and underlying H Shares under the Exchange Act.

As such, the Company intends to file a Form 25 with the SEC on or around August 22, 2022, to delist its ADSs from the NYSE. Such delisting is expected to become effective ten days after the filing of Form 25. The last trading day of ADSs on the NYSE will be on or about 1 September 2022. On and after such date, the ADSs of the Company will no longer be listed on the NYSE and whether or not the Company's ADSs will be traded on the over-the-counter market thereafter will depend on the actions of shareholders and independent third parties, without the Company's involvement.

After the delisting becomes effective, once the Company satisfies the conditions for deregistration, the Company intends to file a Form 15F with the SEC to deregister the ADSs and underlying H Shares under the Exchange Act. Thereafter, the reporting obligations for the Company under the Exchange Act will be suspended unless Form 15F is subsequently revoked or rejected. The deregistration and the termination of the reporting obligations of the Company under the Exchange Act are expected to become effective 90 days after the filing of Form 15F. Upon the filing of Form 15F, the Company will make available the information required by Rule 12g3-2(b) under the Exchange Act on its website at www.chalco.com.cn. The Company, as a listed issuer, will also continue to comply with its financial reporting and other obligations under the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited (the "Listing Rules").

The Company intends to terminate its ADSs program in an appropriate manner in accordance with the deposit agreement in due course after the delisting of the ADSs from the NYSE.

The Company reserves its right in all aspects to postpone or withdraw the above filings prior to their effectiveness; if necessary, the Company will make any further announcement as required by the Listing Rules and other applicable laws.

ABOUT CHALCO

Chalco is a leading enterprise in the non-ferrous metal industry in China, ranking among the top in the global aluminum industry in terms of comprehensive strengths, and is a large manufacturer and operator with the integration of exploration and mining of bauxite, coal and other resources; production, sales and technology research of alumina, primary aluminum, aluminum alloy and carbon products; international trade and logistics services, as well as electricity generation from coal and new energy.

CAUTIONARY STATEMENT FOR PURPOSES OF THE "SAFE HARBOR" PROVISIONS OF THE PRIVATE SECURITIES LITIGATION REFORM ACT OF 1995

This announcement may contain, in addition to historical information, "forward-looking statements" within the meaning of the "safe harbor" provisions of the U.S. Private Securities Litigation Reform Act of 1995 and Section 27A of the U.S. Securities Act of 1933 and Section 21E of the U.S. Securities Exchange Act of 1934. These forward-looking statements are based on the Company's current assumptions, expectations and projections about future events. The Company uses words like "believe", "anticipate", "intend", "estimate", "expect", "project" and similar expressions to identify forward-looking statements, although not all forward-looking statements contain such words. These forward-looking statements are necessary estimates reflecting the judgment of the Company's senior management and involve significant risks, both known and unknown, uncertainties and other factors that may cause the Company's actual performance, financial condition, or results of operations to be materially different from those suggested by the forward-looking statements. Except as required by law, the Company undertakes no obligation and does not intend to update any forward-looking statement, whether as a result of new information, future events or otherwise.

For enquiries, please contact:

Aluminum Corporation of China Limited

Mr. Ge Xiaolei, Company Secretary

Tel: (86-10) 8229 8322

Fax: (86-10) 8229 8158

Email: xl_ge@chalco.com.cn; IR@chalco.com.cn

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Lab-Grown Diamond Facility in Singapore to Commence Commercial Production

Singapore, Aug 8, 2022 – (ACN Newswire) – SGX-listed Metech International Limited ("Metech" or the "Company", and together with its subsidiaries, the "Group"), is pleased to announce that the lab-grown diamond facilities in Singapore of its joint venture company, Asian Eco Technology Pte. Ltd. ("Asian Eco"), can commence commercial production, following the receipt of the fire safety certificate issued by Singapore Civil Defence Force.

A pilot test of the lab-grown diamond facilities has been successfully completed.

As announced previously, Asian Eco entered into a 3-year lease agreement for an industrial property located at Kallang for the production of lab-grown diamonds.

A wholly-owned subsidiary, Zhongxin Minghua (Shanghai) International Trade Co., Ltd. (formerly known as Nolash (Shanghai) Pte Ltd.), is now a registered member of the Shanghai Diamond Exchange with effect from 13 July 2022.

Growing Industrial Applications of Lab-Growth Diamonds

Diamonds are more widely known to be used in jewellery but diamonds are also commonly used for industrial applications in oil & gas, medical equipment, aerospace, among others.

With an impressive combination of chemical, physical and mechanical properties that are ideal for a wide array of industrial applications, there is increasing commercialisation of scientific discoveries for the industrial applications of diamond in the next generation of semiconductors, aerospace, electric vehicles, medical equipment, among others.

To harness such opportunities, Asian Eco has previously entered in various memorandum of understandings and collaboration agreements with strategic partners and prominent institutions in the areas of research and development and commercialisation.

Commenting on the commencement of Asian Eco's commercial production of lab-grown diamonds in Singapore, Ms. Samantha Hua, Executive Director and Chief Executive Officer of Metech, said: "This is a major milestone in our business strategy, accelerating our growth ambitions within the global lab-grown diamond industry that continues to exhibit positive growth prospects with its sustainability features.

Aligned with the macro trends of the global lab-grown diamond market, we aim to progressively scale up our production capabilities in Singapore and harness new opportunities."

About Metech International Limited

(Bloomberg: CENR:SP / Reuters: METE.SI / SGX Stock Code: V3M)

Listed on the Singapore Stock Exchange, Metech International Limited ("Metech") has a multi-pronged business model that aligns with the macro trends in the area of environmental and sustainability.

While proactively evaluating new business opportunities to broaden its business model, Metech continues to build on its capabilities and extend the value propositions of its business units.

Media & Investor Contacts:

This announcement has been prepared by the Company and reviewed by the Company's Sponsor, Novus Corporate Finance Pte. Ltd. (the "Sponsor"), in compliance with Rule 226(2)(b) of the Singapore Exchange Securities Trading Limited (the "SGX-ST") Listing Manual Section B: Rules of Catalist.

This announcement has not been examined or approved by the SGX-ST and the SGX-ST assumes no responsibility for the contents of this announcement, including the correctness of any of the statements or opinions made or reports contained in this announcement.

The contact person for the Sponsor is Mr. Pong Chen Yih, Chief Operating Officer, at 7 Temasek

Boulevard, #18-03B Suntec Tower 1, Singapore 038987, telephone (65) 6950 2188.

Issued on behalf of Metech International Limited by 8PR Asia Pte Ltd.

Mr. Alex TAN

Mobile: +65 9451 5252

Email: alex.tan@8prasia.com

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com