BROSSARD, QC, Jul 18, 2022 – (ACN Newswire) – G Mining Ventures Corp. ("GMIN" or the "Corporation") is pleased to announce that the Corporation has entered into binding commitments with respect to a comprehensive construction financing package totaling $481 million for the development and construction of its 100% owned Tocantinzinho Gold Project ("TZ" or the "Project"). The Project remains on track to achieve production in the second half of 2024. Securing financing on schedule, despite a volatile market environment, represents a strong statement of support for the management team, as well as the technical and economic merits of the Project.

|

| Figure 1 – Sources and Uses of Funds Summary |

|

| Figure 2 – Expansion of Exploration Camp |

|

| Figure 3 – Freight forwarder base in Moraes Almeida |

|

| Figure 4 – Access Road Upgrade |

|

| Figure 5 – Mr. Severino, Director of Education of Itaituba, with Louis-Pierre Gignac |

Financing Package Highlights – $481 million

– $116 million equity financing via a private placement with strategic investors (the "Strategic Investors") priced at C$0.80 per common share

— $68.8 million investment by La Mancha Investments S.a r.l. ("La Mancha")

— $27.5 million investment by Franco-Nevada Corporation ("Franco-Nevada")

— $20.0 million investment by Eldorado Gold Corporation ("Eldorado Gold")

– $250 million gold stream with Franco-Nevada

— Represents one of Franco-Nevada's largest gold streams on a primary gold mine

– $75 million senior secured term loan from Franco-Nevada

– $40 million in equipment financing with Caterpillar Financial Services Limited ("Cat Financial")

– The gold stream and term loan financings are closed, and the remainder of the financing package is expected to close in Q3-22

Louis-Pierre Gignac, President & Chief Executive Officer of GMIN, commented: "We are delighted to welcome two new cornerstone partners in Franco-Nevada and La Mancha who are committed to the long-term success and growth of GMIN. Their commitment, along with Eldorado Gold's continued support, further validates the management team and the work done to advance the Project since its acquisition in 2021. Building on our positive Feasibility Study released earlier this year, this financing package marks the next step in the progression of GMIN and allows us to continue to unlock value at TZ. The imminent development of TZ will deliver value to our growing stakeholder group, including generating attractive job opportunities and economic prosperity in Para State."

Paul Brink, President & Chief Executive Officer of Franco-Nevada, commented: "We are delighted to support GMIN with this construction financing package. Tocantinzinho is an attractive project in a prolific district and located in a good jurisdiction. The GMIN team has a track-record as one of the most capable mine building teams in the industry. The debt and equity investments that accompany our stream investment reflect our confidence in the capabilities of the GMIN team and in the potential of the project."

Karim Nasr, Managing Partner of La Mancha Capital Advisory LLP, commented: "The La Mancha Group has a long track record of successful investments in the mining industry, and we look to build further on this track record with La Mancha's investment in GMIN. We are impressed with the unique skillset of the management team, and with both the quality and potential of TZ. We look forward to being a part of GMIN's journey towards becoming an intermediate producer through the development of TZ, and as the Corporation evaluates future growth opportunities beyond this initial Project."

Overview of Project Financing

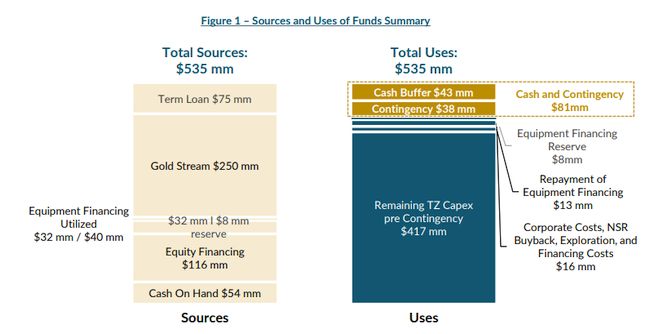

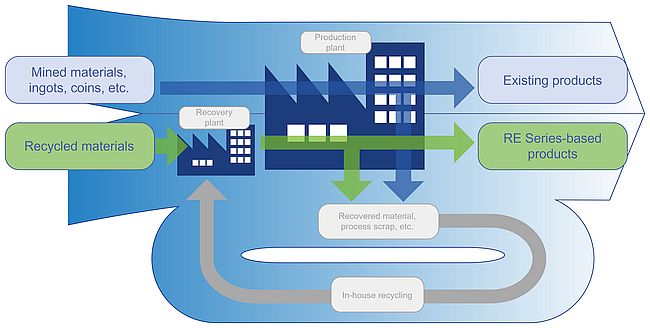

As detailed in the Feasibility Study published in Q1-2022, the initial Project capital cost is estimated to be $427 million, which is inclusive of $38 million of contingency (10% before taxes). After taking into consideration $49 million of payable taxes, the total funding required is $476 million. GMIN is eligible for $18 million of recoverable taxes and tax credits, which have not been deducted in calculating development capital required as this will only be received after the commencement of production.

As of June 30, 2022, GMIN has incurred capital expenditures of $21 million, resulting in remaining estimated capital costs of $455 million, or $417 million exclusive of $38 million of contingency. Procurement to date totaling $71 million is tracking on budget and has largely focused on major equipment for the process plant and mining equipment. GMIN is progressing well on its procurement strategy that focuses on maximizing Brazilian sources when sourcing equipment and supplies.

The total financing package of $481 million, combined with $54 million of cash on hand as at June 30, 2022, totals $535 million of available capital, and provides GMIN with committed capital sources in excess of the remaining estimated capital balance. It is estimated that $32 million of the equipment financing provided by Cat Financial will be utilized during the construction period, with $8 million to stay in reserve.

After taking into consideration corporate costs, working capital, and debt service, GMIN estimates cash and budgeted contingency totaling $81 million (18%), as detailed below.

Figure 1 – Sources and Uses of Funds Summary

https://www.acnnewswire.com/topimg/Low_GMining202207181.jpg

Financing Package Summary

In connection with the financing package, GMIN and Franco-Nevada have executed final documentation with respect to: (i) a definitive purchase and sale agreement under which Franco-Nevada (Barbados) Corporation will pay GMIN a deposit of $250 million to acquire a percentage of payable gold production from TZ, (ii) the provision by Franco-Nevada, through one of its wholly-owned subsidiaries, of a senior secured term loan in the principal amount of $75 million, and (iii) the purchase by Franco-Nevada, on a private placement basis, of approximately 44.7 million GMIN common shares at a subscription price of C$0.80 per share, for total proceeds of $27.5 million (C$35.8 million).

Concurrently, GMIN, La Mancha, and Eldorado Gold have executed final documentation with respect to the purchase by La Mancha and Eldorado Gold, on a private placement basis, of 111.9 million and 32.5 million, respectively, GMIN common shares at a subscription price of C$0.80 per share, for gross proceeds of $68.8 and $20.0 million (C$89.5 and C$26.0 million), respectively.

Equity Private Placement – Strategic Investors

– C$151.3 million ($116.4 million) in equity financing, priced at C$0.80 per share, via a non-brokered private placement

– La Mancha has agreed to subscribe for a total of 111,879,265 common shares of GMIN for aggregate proceeds of C$89.5 million ($68.8 million)

— La Mancha will subscribe for 82,875,000 common shares on closing to hold 19.8% of GMIN's common shares outstanding, and subscribe for a further 29,004,265 common shares to hold 25.0% following approval of the disinterested GMIN shareholders

— GMIN and La Mancha will enter into an investor rights agreement that grants La Mancha the right to nominate two directors to GMIN's Board of Directors, as long as La Mancha maintains a minimum ownership of 15%

— Karim Nasr, Managing Partner of La Mancha Capital Advisory LLP, will be nominated on the closing date of the first tranche, with a second director to follow at a later date

— La Mancha will be granted customary anti-dilution, registration, and information rights, and has agreed to a 24-month standstill period that includes restrictions on dispositions

– Franco-Nevada has agreed to subscribe for 44,687,500 common shares of GMIN for aggregate proceeds of C$35.8 million ($27.5 million)

— Franco-Nevada will hold 9.9% of GMIN's common shares outstanding

— GMIN and Franco-Nevada have entered into an investor rights agreement that grants Franco-Nevada a right of first refusal on any future royalty and stream sales by GMIN as long as Franco-Nevada maintains a minimum ownership of 5.0% of GMIN's common shares outstanding

— Franco-Nevada has also been granted customary anti-dilution rights and has agreed to a 24-month standstill period that includes restrictions on dispositions

– Eldorado Gold has substantially exercised its anti-dilution right and has agreed to subscribe for 32,500,000 common shares of GMIN for aggregate proceeds of C$26.0 million ($20.0 million)

— Eldorado Gold will hold 17.7% of GMIN's common shares outstanding

Members of the Gignac Family, along with GMIN directors and officers (collectively "Insiders") hold 34,722,869 common shares, which will represent 7.8% of GMIN's common shares outstanding pro-forma the transaction. To further align with the Strategic Investors, the Insiders have agreed to a 24-month restriction on sales or transfers of any GMIN securities.

The private placement is subject to the acceptance of the TSX Venture Exchange ("TSXV") and will be completed in two tranches, with the first tranche closing in July 2022. The second tranche, which will consist of the issuance to La Mancha of approximately 29.0 million GMIN common shares for proceeds of approximately C$23.2 million ($17.8 million), and which will be subject to a majority approval of the disinterested GMIN shareholders pursuant to the policies of the TSXV, is expected to close in Q3-22. At the time of writing, voting support agreements that comprise more than 45% of the disinterested GMIN shareholders have been entered into with the Strategic Investors and Insiders.

Gold Stream – Franco-Nevada

– Deposit: $250.0 million

– Deliveries: 12.5% of the gold production from TZ, reducing to 7.5% after delivery of 300,000 ounces

– Ongoing Payments: 20% of the spot gold price at the time of delivery

– ESG Initiatives: Up to $250,000 per year for four years for investment towards environmental initiatives and social projects in the communities surrounding TZ

– Drawdown of the deposit is subject to satisfaction of certain customary conditions for a transaction of this nature

Term Loan – Franco-Nevada

– Facility Amount: $75.0 million

– Term: 6.0 years

– Availability Period: Multi-draw facility available after the stream deposit is fully drawn, at GMIN's discretion for up to 3.5 years

— Standby fee on undrawn amounts of 1.0% per annum, which GMIN has the option of accruing and capitalizing for the first 2-year period

– Coupon: 3-Month Term Secured Overnight Financing Rate plus a margin of 5.75% per annum pre-project completion, with the margin reducing to 4.75% after completion

— 2-year interest deferral period during which GMIN has the option of accruing and capitalizing interest

– Amortization: Principal, accrued interest, and accrued fees are repayable starting in December 2025 as follows:

— 10 equal quarterly payments equal to 7.5% of the balance outstanding; and

— Bullet payment equal to 25.0%

– Original Issue Discount: 2.0% applicable on amounts drawn

– Franco-Nevada will be granted 11.5 million warrants with a five-year term and an exercise price of C$1.90 per share

— Exercise price equals the exercise price of the existing 37.5 million warrants issued as part of GMIN's September 2021 financing, the only currently outstanding warrants

— Warrants will have a cashless exercise mechanism to enable Franco-Nevada to avoid its holdings from exceeding 9.9% of GMIN's common shares outstanding at time of exercise

Equipment Financing

– Up to $40 million in equipment financing via a credit-approved term sheet with Cat Financial, for the supply of Caterpillar primary and ancillary mining fleet and construction machinery

– Pending completion of final documentation, the Cat Financial lease financing will be available to the Corporation upon a final construction decision by GMIN's Board of Directors and other customary conditions

Tocantinzinho Development Update

Since the most recent project update released on May 26, 2022, GMIN has advanced the following aspects of the Project:

Procurement

– Procurement to date totals $71 million, is tracking on budget, and has largely focused on major equipment for the process plant and mining equipment

— Procured equipment contains significant Brazilian content

– Purchase orders for equipment with long lead times have been executed to achieve the construction schedule in order to achieve production in the second half of 2024

– Equipment deliveries will be staggered over time with first machines delivered to site in September 2022

– Primary mining equipment is currently being funded using cash on hand, but will be refinanced through the abovementioned $40 million equipment financing package

Power Supply

– Detailed engineering of transmission line and Novo Progresso substation is complete

Construction – Early Works Activities

– Exploration camp capacity has been increased to 350 beds with the addition of 10 dormitories

— New water well, lunchroom and kitchen equipment in operation

– Temporary explosives storage facility is progressing, with berms in place and fencing to be completed

– The logistics base in Moraes Almeida is nearing completion

— Once delivered, the facility will be managed by the logistics freight forwarder, which will allow for consolidation of goods for delivery to site

– Access road upgrades have continued with the arrival of the dry season

Figure 2 – Expansion of Exploration Camp

https://www.acnnewswire.com/topimg/Low_GMining202207182.jpg

Figure 3 – Freight forwarder base in Moraes Almeida

https://www.acnnewswire.com/topimg/Low_GMining202207183.jpg

Figure 4 – Access Road Upgrade

https://www.acnnewswire.com/topimg/Low_GMining202207184.jpg

Tocantinzinho Benefit to Local Community

Local Employment

– The Project is expected to create up to 1,200 jobs during the construction phase and over 600 permanent jobs during the operation stage

– A minimum of 30% of employees are to be hired from the local communities of Itaituba, Morais Almeida, Jardim de Ouro and Mamoal

– In addition to the training during the construction phase, GMIN plans to invest over 85,000 hours on internal training to develop the skills of the local workforce

Community Programs

– GMIN provided internet access and IT infrastructure for Escola Municipal de Ensino Fundamental Cesar Almeida, the local elementary and middle school of Moraes Almeida

— The school has 1,700 enrolled students and 80 staff members

– GMIN will support local community requests related to education, health and cultural initiatives through provision of funding and expertise

– Franco-Nevada is providing up to $250,000 per year, for four years, for investment towards environmental initiatives and social projects in the communities surrounding TZ

Figure 5 – Mr. Severino, Director of Education of Itaituba, with Louis-Pierre Gignac

https://www.acnnewswire.com/topimg/Low_GMining202207185.jpg

Other Long-term Local Benefits

– Creation of long-lasting shared infrastructure, such as the 190km transmission line

— In addition to powering the project through 80% renewable energy, the transmission line will become part of the state utility infrastructure, providing reliable power to the region

– Construction of a bypass road in Jardim do Ouro to improve safety by diverting heavy traffic from current industrial activities by other companies (and future GMIN operations) away from the village

– GMIN will prioritize local procurement to enable capacity building and business development

Advisors:

BMO Capital Markets is acting as exclusive financial advisor to GMIN in connection with the La Mancha strategic investment. Stikeman Elliott LLP, Blake, Cassels & Graydon LLP, Grebler Advogados and Mattos Filho Advogados acted as GMIN's legal advisors.

Timetable and Next Steps

With the financing package secured, the Corporation will be focused on the following activities:

– Positive construction decision;

– Finalization and results of 10,000-meter exploration and drilling program in Q3-22;

– Completion of detailed engineering through H1-23; and

– Expected first gold production in H2-24 with the first year of full production in 2025.

Feasibility Study 3D VRIFY Presentation

To view a 3D VRIFY presentation of the Study please click on the following link: Feasibility Study 3D VRIFY Presentation, or visit the Corporation's website at www.gminingventures.com.

Tocantinzinho Financing Package Conference Call Details

GMIN will host a conference call to discuss the financing package.

Date: Monday, July 18, 2022

Time: 10:30 a.m. Eastern Time.

Participants may join the call as follows:

Dialing North American Toll Free: +1-888-506-0062

International: 973.528.0011

Access Code: 564993

Webcast URL: https://www.webcaster4.com/Webcast/Page/2892/46159

For those unable to participate, a web-based archive of the conference call will be available for playback through Tuesday, July 18, 2023 at the same Webcast URL above. Also, an audio replay will be available from 1:30 p.m. Eastern Time on Monday, July 18, 2022 through Monday, August 1, 2022. To access the replay, please call 1.877.481.4010 (U.S. & Canada) or 1.919.882.2331 (International) and enter confirmation code 46159 #.

Additional Information

For further information on GMIN, please visit the website at www.gminingventures.com or contact:

Jessie Liu-Ernsting

Director, Investor Relations and Communications

647.728.4176

info@gminingventures.com

About G Mining Ventures Corp.

G Mining Ventures Corp. (TSXV: GMIN) (OTCQX: GMINF) is a mineral exploration company engaged in the acquisition, exploration and development of precious metal projects, to capitalize on the value uplift from successful mine development. GMIN is well-positioned to grow into the next mid-tier precious metals producer by leveraging strong access to capital and proven development expertise. GMIN is currently anchored by its flagship Tocantinzinho Project in mining friendly and prospective Para State, Brazil.

About Franco-Nevada

Franco-Nevada is the leading gold-focused royalty and streaming company with the largest and most diversified portfolio of cash-flow producing assets. Its business model provides investors with gold price and exploration optionality while limiting exposure to cost inflation. Franco-Nevada is debt-free and uses its free cash flow to expand its portfolio and pay dividends. It trades under the symbol FNV on both the Toronto and New York stock exchanges. Franco-Nevada is the gold investment that works.

About La Mancha and La Mancha Fund SCSp

La Mancha is a wholly-owned subsidiary of La Mancha Fund SCSp (the "Fund"), a Luxembourg based investment fund advised by La Mancha Capital Advisory LLP that is focused on investments in the precious metals and energy transition space. La Mancha's head office is located at 31-33 Avenue Pasteur L-2311 Luxembourg. La Mancha will file an early warning report in accordance with applicable Canadian securities laws, which will be available under GMIN's profile on the SEDAR website at www.sedar.com, and may also be obtained by contacting Karim-Michel Nasr as provided for below.

About La Mancha Capital Advisory LLP

La Mancha Capital Advisory LLP advises the Fund on strategic investments made in publicly listed and private exploration, royalty, and mining companies with a global outlook. La Mancha Capital Advisory LLP is a long-term minded investment advisor, with a mandate to support mining companies to achieve sustained growth by providing long-term equity capital as well as operational and board level expertise, to further portfolio company performance and expansion.

La Mancha Capital Advisory LLP is an Appointed Representative of G10 Capital Limited, which is authorised and regulated by the Financial Conduct Authority (FRN 648953).

Additional Information

For further information on La Mancha Capital Advisory LLP, please visit the website at www.lamanchacapitaladvisory.com or contact:

Karim-Michel Nasr

Managing Partner and Co-CIO

+44.203.960.2020

contact@lamancha.com

About La Mancha's Subscription

On July 18, 2022, La Mancha entered a subscription agreement (the "Subscription Agreement") with GMIN pursuant to which La Mancha agreed to subscribe for an aggregate of 111,879,265 common shares in the capital of GMIN ("Common Shares") by way of a private placement at a price of C$0.80 per Common Share for aggregate cash consideration of C$89,503,412 (the "Subscription").

Subject to satisfaction or waiver of all closing conditions, the Subscription will close in two tranches: (i) on or before July 29, 2022, La Mancha will subscribe for 82,875,000 Common Shares at a purchase price of C$0.80 per Common Share for aggregate cash consideration of C$66,300,000 (the "Initial Subscription"); and (ii) by no later than November 30, 2022, La Mancha will subscribe for 29,004,265 Common Shares at a purchase price of C$0.80 per Common Share for aggregate cash consideration of C$23,203,412 (the "Subsequent Subscription").

La Mancha does not otherwise currently own or have control or direction over any Common Shares. Following completion of the Initial Subscription, La Mancha will beneficially own and have control and direction over an aggregate of 82,875,000 Common Shares, representing approximately 19.8% of the then issued and outstanding Common Shares of GMIN. Following completion of the Subsequent Subscription, La Mancha will beneficially own and have control and direction over an aggregate of 111,879,265 Common Shares, representing approximately 25% of the then issued and outstanding Common Shares.

At the closing of the Initial Subscription, La Mancha, and GMIN will enter an investor rights agreement, upon which La Mancha will be granted certain director nomination, anti-dilution, and registration rights. The Common Shares to be acquired by La Mancha on completion of the Subscription will be acquired for investment purposes. In the future, La Mancha may, from time to time, increase or decrease its investment in GMIN through market transactions, private arrangements, treasury issuances or otherwise.

About Eldorado Gold

Eldorado is a gold and base metals producer with mining, development and exploration operations in Turkey, Canada, Greece and Romania. The Company has a highly skilled and dedicated workforce, safe and responsible operations, a portfolio of high-quality assets, and long-term partnerships with local communities. Eldorado's common shares trade on the Toronto Stock Exchange (TSX: ELD) and the New York Stock Exchange (NYSE: EGO).

Eldorado Gold currently owns 46,926,372 GMIN common shares representing approximately 18.2% of the outstanding GMIN common shares. Following and subject to completion of the purchase of 32,500,000 GMIN common shares by Eldorado Gold described above, Eldorado Gold would own 79,426,372 GMIN common shares representing 19.0% of the outstanding GMIN common shares upon closing of the first tranche, and 17.7% upon closing of the second tranche.

Eldorado Gold advises that the securities will be acquired for investments purposes. Eldorado Gold may, depending on the market and other conditions, increase or decrease its beneficial ownership of GMIN's securities, whether in the open market, by privately negotiated agreements or otherwise, subject to a number of factors, including general market conditions and other available investment and business opportunities.

This disclosure is provided pursuant to Multilateral Instrument 62-104, which also requires an early warning report to be filed containing additional information with respect to the foregoing matters. A copy of the early warning report will be available on SEDAR under GMIN's issuer profile at www.sedar.com and may be obtained upon request from Eldorado Gold by contacting Eldorado Gold at the contact information below.

Contact Information:

Eldorado Gold Corporation

1188 – 550 Burrard Street Bentall 5

Vancouver, British Columbia

V6C 2B5

Tel: 604.601.6656

Lisa Wilkinson

Vice President, Investor Relations

604.757 2237 or 1.888.353.8166

lisa.wilkinson@eldoradogold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this press release.

Cautionary Statement on Forward-Looking Information

All statements, other than statements of historical fact, contained in this press release constitute "forward-looking information" and "forward-looking statements" within the meaning of certain securities laws and are based on expectations and projections as of the date of this press release. Forward-looking statements contained in this press release include, without limitation:

A. Those related to the Project financing, such as:

(i) the closing of the financing package in Q3-22;

(ii) the fulfilment of all conditions to effect drawdown and receive the $250 million deposit under the Franco-Nevada gold stream;

(iii) the approval of the disinterested GMIN shareholders for the second tranche of the La Mancha equity placement;

(iv) the private placement acceptance of the TSXV;

(v) the volume of gold deliveries under the Franco-Nevada gold stream;

(vi) the completion of ESG initiatives as per the Franco-Nevada agreements; and

(vii) the closing of the Cat Financial lease financing;

B. Those related to the Project itself, such as:

(i) commencement of full construction in Q3-22, subject to approval of the Board of Directors;

(ii) achievement of production in the second half of 2024;

(iii) on time deliveries of equipment and prioritizing of local procurement;

(iv) near completion of certain early works activities;

(v) job creation during the construction period as well as the operation stage, notably through employment from local communities;

(vi) development of local workforce skills through training programs;

(vii) responsiveness to local community requests relating to education, health and cultural initiatives;

(viii) creation of long-lasting infrastructure; and

(ix) completion of drilling program in Q3-22, and of detailed engineering through H1-23;

C. And, more generally, the President & Chief Executive Officer's comments hereinabove and those of the Franco-Nevada Chief Executive Officer and La Mancha Capital Advisory LLP's Managing Partner, as well as the contents of the above sections entitled "Timetable and Next Steps" and "About G Mining Ventures Corp.".

Forward-looking statements are based on expectations, estimates and projections as of the time of this press release. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Corporation as of the time of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. These estimates and assumptions may prove to be incorrect. Such assumptions include, without limitation, a USD:CAD exchange rate of 1.30 and also those underlying the items listed on the above sections entitled "Timetable and Next Steps" and "About G Mining Ventures Corp.".

Many of these uncertainties and contingencies can directly or indirectly affect, and could cause, actual results to differ materially from those expressed or implied in any forward-looking statements. There can be no assurance that, notably but without limitation, the Corporation will (i) close all components of its project financing as outlined in this press release, (ii) make a positive construction decision regarding the Project in 2022 or ever, (iii) bring the Project into commercial production or (iv) become an intermediate gold producer, as future events could differ materially from what is currently anticipated by the Corporation.

By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, and risks exist that estimates, forecasts, projections and other forward-looking statements will not be achieved or that assumptions do not reflect future experience. Forward-looking statements are provided for the purpose of providing information about management's expectations and plans relating to the future. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important risk factors and future events could cause the actual outcomes to differ materially from the beliefs, plans, objectives, expectations, anticipations, estimates, assumptions and intentions expressed in such forward-looking statements. All of the forward-looking statements made in this press release are qualified by these cautionary statements and those made in the Corporation's other filings with the securities regulators of Canada including, but not limited to, the cautionary statements made in the relevant sections of the Corporation's (i) Annual Information Form dated June 3, 2022, for the financial year ended December 31, 2021, and (ii) Management Discussion & Analysis. The Corporation cautions that the foregoing list of factors that may affect future results is not exhaustive, and new, unforeseeable risks may arise from time to time. The Corporation disclaims any intention or obligation to update or revise any forward-looking statements or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law.

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com