Brisbane, Queensland, Australia–(ACN Newswire – December 19, 2023) – Graphene Manufacturing Group Limited (TSXV: GMG) (“GMG” or the “Company”) is pleased to announce the commissioning of its cutting-edge natural gas to graphene production plant in manufacturing facility at Richlands, Australia.

The facility is based on the GMG plasma technology with which the Company’s existing production plant has been making graphene for over five years, however this new plant is built in a modular fashion which can allow more production units to be installed as the sales of Company’s products grows.

GMG expects to be able to install at least an additional 20 graphene production units in the Richlands manufacturing facility with most of the supporting infrastructure for these additional production units already installed as part of this initial project.

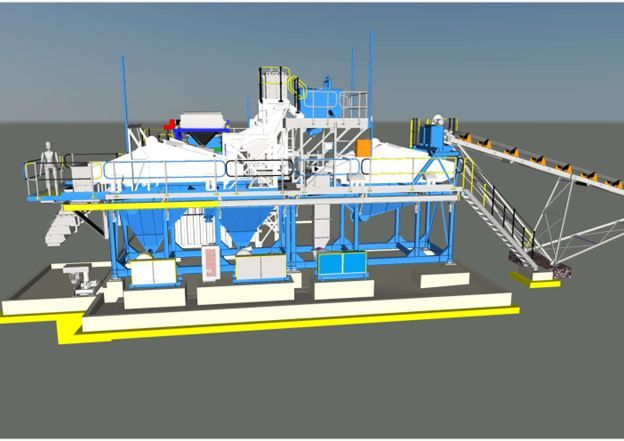

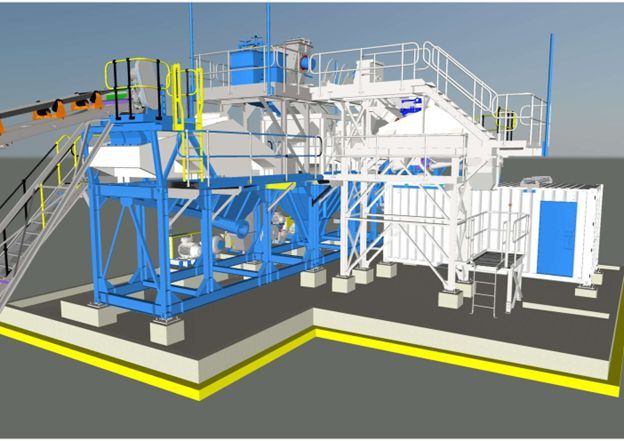

Figure 1: Graphene Production Plant Project Team

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8082/191561_fe3fb3fb542d4851_001full.jpg

The details of the new modular Graphene Production Plant:

- Technology is based on GMG’s self developed plasma technology which splits natural gas into graphene and hydrogen gas.

- The production plant’s automation allows for repeatable graphene quality, higher plant reliability and lower operator time.

- The graphene production technology has been developed internally by GMG staff and continuously optimised over the past five years to be able to make the different graphene required for GMG’s end products – including THERMAL-XR(R) and G(R) LUBRICANT and Graphene Aluminium Ion Battery.

- The Company expects that Graphene production from both its existing plant and this newly started up plant will be adequate for next year’s production.

- The expected final cost of the facility is approximately AU $2.9 million – which also includes the infrastructure for other future modular production units.

- More production units will be installed as required for the Company’s sales.

- The modular plant can be built in various locations around the world, for example in North America where natural gas cost is low and abundantly available, significantly reducing the cost of the graphene. At scale the GMG graphene production process will produce large amounts of hydrogen.

GMG’s Managing Director and CEO, Craig Nicol, commented: “We are very excited to have started up this new modular graphene manufacturing plant – it is a significant milestone for the company. It uses GMG’s self developed cutting edge plasma technology which creates the high quality graphene GMG’s end products need to deliver their astounding benefits.”

THERMAL-XR(R) EPA Update:

The United States Environmental Protection Agency (EPA) has requested a 30-day extension to review the GMG/Nu-Calgon Premanufacture Notice (PMN) for the THERMAL-XR(R) power GMG Graphene(R) Low Volume Exemption (LVE) application to be able to sell THERMAL-XR(R) into the United States of America. The extension will allow the EPA to continue their assessment of the detailed submission put forward by GMG and Nu-Calgon. GMG is expecting a decision on the PMN LVE to be finalised in the first quarter of 2024.

About GMG www.graphenemg.com

GMG is a clean-technology company which seeks to offer energy saving and energy storage solutions, enabled by graphene, including that manufactured in-house via a proprietary production process.

GMG has developed a proprietary production process to decompose natural gas (i.e. methane) into its elements, carbon (as graphene), hydrogen and some residual hydrocarbon gases. This process produces high quality, low cost, scalable, ‘tuneable’ and low/no contaminant graphene suitable for use in clean-technology and other applications. The Company’s present focus is to de-risk and develop commercial scale-up capabilities, and secure market applications.

In the energy savings segment, GMG has focused on graphene enhanced heating, ventilation and air conditioning (“HVAC-R”) coating (or energy-saving paint), lubricants and fluids. In the energy storage segment, GMG and the University of Queensland are working collaboratively with financial support from the Australian Government to progress R&D and commercialization of G+AI Batteries.

For further information please contact:

- Craig Nicol, Chief Executive Officer & Managing Director of the Company at craig.nicol@graphenemg.com, +61 415 445 223

- Leo Karabelas at Focus Communications Investor Relations, leo@fcir.ca, +1 647 689 6041

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as “intends”, “expects” or “anticipates”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would” or will “potentially” or “likely” occur. This information and these statements, referred to herein as “forward‐looking statements”, are not historical facts, are made as of the date of this news release and include without limitation: statements relating to the new plant allowing more production units to be installed; statements relating to the expected cost and construction of the new plant and subsequent plants; that graphene production technology developed internally by GMG staff will make the different graphene required for GMG’s end products – including THERMAL-XR(R) and G(R) LUBRICANT and Graphene Aluminium Ion Battery; that Graphene production from both its existing plant and this newly started up plant will be adequate for next year’s production; that at scale the GMG graphene production process will produce large amounts of hydrogen; and the expected timing of the EPA’s decision on the PMN LVE.

Such forward-looking statements are based on a number of assumptions of management, including, without limitation: assumptions relating to the costs of engineering, installation and materials being as expected; the construction of the initial plant and subsequent plants proceeding as planned; the Graphene production from both the Company’s existing plant and this newly started up plant being as anticipated; that the Company will obtain appropriate funding in the future to install more plants; and that the EPA’s decision of the PMN LVE will be delivered on the expected timeline.

Additionally, forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of GMG to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: that the costs of engineering, installation and materials are not as expected; that the construction of the initial plant and subsequent plants do not proceed as planned or at all; that the Graphene production from both the Company’s existing plant and this newly started up plant is not as expected; that the Company does not obtain appropriate funding in the future to install more plants; that the EPA’s decision of the PMN LVE is not delivered on the expected timeline; risks relating to the extent and duration of the conflict in Eastern Europe and its impact on global markets; the volatility of global capital markets; political instability; the failure of the Company to obtain regulatory approvals, attract and retain skilled personnel; unexpected development and production challenges; unanticipated costs; and the risk factors set out under the heading “Risk Factors” in the Company’s annual information form dated October 12, 2023 available for review on the Company’s profile at www.sedarplus.ca.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/191561

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com