Vancouver, British Columbia–(ACN Newswire – October 16, 2023) – Doubleview Gold Corp. (TSXV: DBG) (OTCQB: DBLVF) (FSE: 1D4) (the “Company or “Doubleview”) is pleased to announce further assay results from drill holes H054, H055 and H056 at the Hat deposit located in northwest British Columbia. Drill hole H054 contains assays with a higher gold content of 0.43 g/t, when generally balanced in comparison with copper 0.32%, scandium 27.3 g/t and cobalt 136.9 g/t, with a 1.29% copper equivalent intercept** over 143 meters. Drill hole H054 has extended the Buck Zone within the Lisle Deposit for another 250m south-southwest. The Hat polymetallic porphyry project in British Columbia’s Golden Triangle, has demonstrated that it contains several of the metals deem as “critical metals” by the Canadian and American federal governments.

- The assay results summarized in Table 1 are open to the south and southwest of the Hat mineralization complex.

- The mineralization starts from near the surface and strengthens in mineral content at depth,

- Gold and cobalt mineralization are of higher grades in comparison with copper towards the south and southwest of the Lisle Deposit,

- Strength of all metals with increased depth is notable in all drill holes to date in the Buck Zone,

- The Buck Zone within the Lisle Deposit currently covers an area more than 400m x 450m and is open to the north-northeast, south, southwest, and to depth,

- The Buck Zone connects the West Lisle, Main Lisle and Southern Lisle zones with strong mineralization.

The gradual approach to increasing the Buck Zone’s dimensions is anticipated to add more value to the upcoming Q1 2024 resource estimate. All drill holes in this news release (H054 – H056) have expanded the mineralized envelope of the Lisle Deposit. Table 2 depicts the location of drill holes H054, H055 and H056.

Farshad Shirvani, Doubleview’s president and CEO, commented, “The ongoing drilling campaign continues to exceed all expectations and the Company will continue working as long as weather permits. The 2023 program is designed to increase the dimensions of the Hat Deposit with the intention, upon completion of the NI 43-101 Resource Estimate, of having the project recognized as containing an outstanding resource, with exceptional metals extraction and recoveries. All holes drilled in 2023 are expected to be included in the forthcoming resource evaluation.”

Mr. Shirvani continued, “The 2023 drilling campaign continues to advance the Hat polymetallic deposit, and the total meters drilled this season now exceeds 8,700 meters.”

TABLE 1. Assay results

| DDH | From (m) | To (m) |

Length (m) | Ag (g/t) |

Au (g/t) |

Co (g/t) |

Cu (%) |

Sc (g/t) |

CuEq (%)* incl Sc2O3 |

| H054 | 23.8 | 641.2 | 617.5 | 0.31 | 0.15 | 74.4 | 0.16 | 29.0 | 0.95 |

| Inc. | 90.6 | 600.7 | 510.2 | 0.34 | 0.16 | 79.2 | 0.17 | 29.0 | 0.97 |

| Inc. | 92.8 | 469.2 | 376.4 | 0.39 | 0.19 | 86.9 | 0.18 | 26.7 | 0.95 |

| and | 180.0 | 600.7 | 420.7 | 0.39 | 0.19 | 87.2 | 0.20 | 29.5 | 1.03 |

| Inc. | 186.0 | 469.2 | 283.2 | 0.49 | 0.24 | 102.2 | 0.23 | 26.8 | 1.03 |

| Inc. | 304.7 | 469.2 | 164.5 | 0.61 | 0.38 | 136.9 | 0.32 | 27.5 | 1.23 |

| Inc. | 325.9 | 469.2 | 143.3 | 0.64 | 0.43 | 134.6 | 0.36 | 27.3 | 1.29 |

| Inc. | 392.0 | 469.2 | 77.2 | 0.90 | 0.64 | 147 | 0.48 | 26.7 | 1.51 |

| H055 | 27.0 | 645.0 | 618.0 | 0.22 | 0.06 | 48.1 | 0.09 | 30.5 | 0.86 |

| Inc. | 336.0 | 642.9 | 306.9 | 0.28 | 0.09 | 58.7 | 0.15 | 32.0 | 0.98 |

| Inc. | 396.6 | 621.0 | 224.5 | 0.31 | 0.10 | 57.7 | 0.18 | 33.0 | 1.03 |

| Inc. | 396.6 | 522.8 | 126.3 | 0.24 | 0.10 | 52.7 | 0.17 | 31.8 | 0.99 |

| Inc. | 504.8 | 524.8 | 20.0 | 0.74 | 0.41 | 116.6 | 0.73 | 34.5 | 1.75 |

| Inc. | 507.8 | 519.8 | 12.0 | 0.96 | 0.57 | 139.0 | 0.99 | 34.8 | 2.09 |

| H056 | 66.0 | 398.5 | 332.5 | 0.25 | 0.05 | 58.7 | 0.08 | 31.4 | 0.88 |

| Inc. | 189.0 | 301.0 | 112.0 | 0.37 | 0.06 | 67.7 | 0.09 | 27.8 | 0.81 |

| Inc. | 189.0 | 216.0 | 27.0 | 0.67 | 0.11 | 74.8 | 0.20 | 31.3 | 1.02 |

| Inc. | 272.8 | 301.0 | 28.2 | 0.48 | 0.10 | 123.2 | 0.09 | 26.2 | 0.83 |

| Notes: – Metal equivalents should not be relied upon for future evaluations. – Drill hole intercepts included in this news release are core lengths that may or may not be true widths of mineralization. It is not possible to determine true widths. **Copper Equivalent (CuEq%) is estimated using the following metal values and equations: – *CuEq(%) =(Ag(g/t) x Price_Ag x Rec_Ag/31.1035 + Au(g/t) x Price_Au x Rec_Au/31.1035 + Co(%) x Price_Co x Rec_Co x 22.0462 + Cu(%)x Price_Cu x Rec_Cu x 22.0462 + Sc(g/t) x Price_Sc x Rec_Sc x Sc_con) / (Price_Cu x 22.0462) – Price_Ag = $22.20/troy oz, Price_Au=$1,812.14/ troy oz, Price_Co = $23.30/lb, Price_Cu = $3.84/lb, Price_Sc = $1.5/g – Rec_Ag = 68% , Rec_Au = 89% , Rec_Co = 78%, Rec_Cu = 84% , Rec_Sc = 88% |

|||||||||

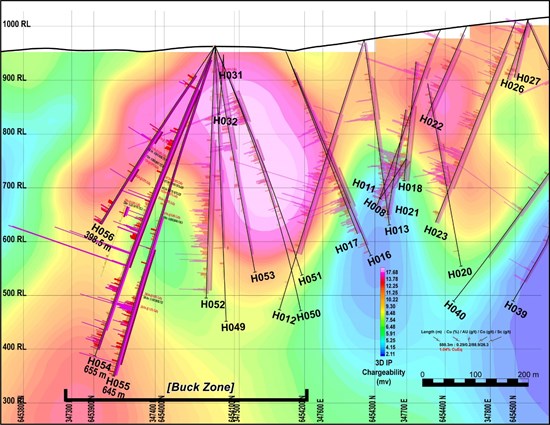

Figure 1. Section along the drill holes

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/184123_60b3e97104c4ba99_001full.jpg

TABLE 2. Drill Hole Data

| Drill Hole ID | UTM – East | UTM – North | Elevation | Max-Depth | Azimuth | Dip | Area |

| H054 | 347,471 | 6,454,073 | 964 | 655 | 180.4 | -59.1 | Lisle West |

| H055 | 347,471 | 6,454,073 | 964 | 645 | 207.9 | -69.8 | Lisle West |

| H056 | 347,471 | 6,454,073 | 964 | 398.5 | 210 | -56.2 | Lisle West |

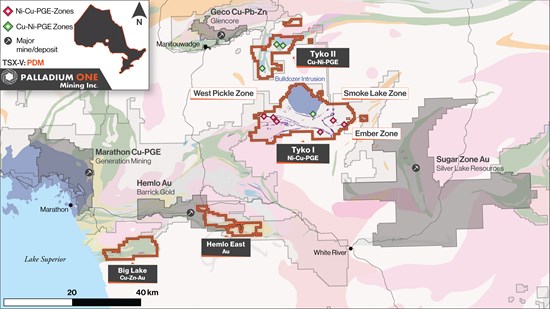

Figure 2. Drill Plan

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8003/184123_60b3e97104c4ba99_002full.jpg

Quality Assurance and Quality Control:

Core samples were prepared at the North Vancouver facility of ALS Canada Ltd. using their PREP-31, PGM-ICP24, ME-MS61, and ME-ICP06 packages. Each core sample is dried, then crushed to 70% passing a 2mm screen. All material is processed in an automatic Riffle splitter to yield a 250g homogenized, representative sample. This sub-sample is then pulverized to 85% passing a 75-micron screen. All samples are analyzed for Au, Pt, Pd by 50g fire-assay fusion/ICP-ES finish, using PGM-ICP24 package. A separate 0.25g pulp split is analyzed by Four Acid digestion/ICP-MS finish, reporting 48 elements. Over limit elements are analyzed by Ore Grade Four Acid digestion/ICP-ES finish using ME-OG62 assay package. All of Doubleview’s core samples are analyzed or assayed at independent ISO 17025 and ISO 9001- certified laboratories.

Doubleview maintains a website at www.doubleview.ca.

Qualified Persons:

Erik Ostensoe, P. Geo., a consulting geologist, and Doubleview’s Qualified Person with respect to the Hat Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed, and approved the technical contents of this news release. He is not independent of Doubleview as he is a shareholder in the company.

Cautionary Note: Although a mineral resource estimation is currently being prepared by an independent engineering firm, no mineral resources have been estimated at the Hat Property and there is no assurance that further work will result in the Lisle Zone, or other zones if present, being classified as mineral resources.

About Doubleview Gold Corp

Doubleview Gold Corp., a mineral resource exploration and development company, is based in Vancouver, British Columbia, Canada, and is publicly traded on the TSX-Venture Exchange [TSX-V: DBG], [OTCQB: DBLVF], [GER: A1W038], [Frankfurt: 1D4]. Doubleview identifies, acquires and finances precious and base metal exploration projects in North America, particularly in British Columbia. Doubleview increases shareholder value through acquisition and exploration of quality gold, copper and silver properties and the application of advanced state-of-the-art exploration methods. The Company’s portfolio of strategic properties provides diversification and mitigates investment risks.

On behalf of the Board of Directors,

Farshad Shirvani, President & Chief Executive Officer

For further information please contact:

Doubleview Gold Corp

Vancouver, BC Farshad Shirvani

President & CEO

T: (604) 678-9587

E: corporate@doubleview.ca

NEITHER TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Certain of the statements made and information contained herein may constitute “forward-looking information.” In particular references to the private placement and future work programs or expectations on the quality or results of such work programs are subject to risks associated with operations on the property, exploration activity generally, equipment limitations and availability, as well as other risks that we may not be currently aware of. Accordingly, readers are advised not to place undue reliance on forward-looking information. Except as required under applicable securities legislation, the Company undertakes no obligation to publicly update or revise forward-looking information, whether as a result of new information, future events or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/184123

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com

Bapak Andrew Mulyadi, Director of PT. Terang Dunia Internusa (United Motors); Marcus Chin Choon Wei, Chief Financial Officer of Artroniq Berhad; H.E Dato’ Indera Hermono, Ambassador Extraordinary and Plenipontentiary of the Republic of Indonesia to Malaysia; Bapak Budihardjo Iduansjah, Chairman of ATEC (Asian Trade, Tourism and Economic Council) cum Chairman of HIPPINDO Indonesia Retail & Tenant Association; Yang Berhormat Senator Jaziri Alkaf Dr. Abdillah Suffian, Member of Pariliament

Bapak Andrew Mulyadi, Director of PT. Terang Dunia Internusa (United Motors); Marcus Chin Choon Wei, Chief Financial Officer of Artroniq Berhad; H.E Dato’ Indera Hermono, Ambassador Extraordinary and Plenipontentiary of the Republic of Indonesia to Malaysia; Bapak Budihardjo Iduansjah, Chairman of ATEC (Asian Trade, Tourism and Economic Council) cum Chairman of HIPPINDO Indonesia Retail & Tenant Association; Yang Berhormat Senator Jaziri Alkaf Dr. Abdillah Suffian, Member of Pariliament