- P. D. Vaghela, Chairman, TRAI, launches Wisely ATP at Mobile World Congress 2023

- Wisely ATP is an end-to-end solution aimed to combat the global challenge of SMS phishing

- Single platform to bring together all critical stakeholders in digital communications ecosystem to protect the end users

Hyderabad/Barcelona, Feb 28, 2023 – (ACN Newswire) -Tanla Platforms Limited (NSE: TANLA; BSE:532790), India’s leading digital interactions company, today announced the launch of Wisely ATP – an innovative solution for protection against SMS phishing – at Mobile World Congress (MWC) Barcelona 2023. Wisely ATP is a one-stop platform to combat the challenge of SMS phishing comprehensively.

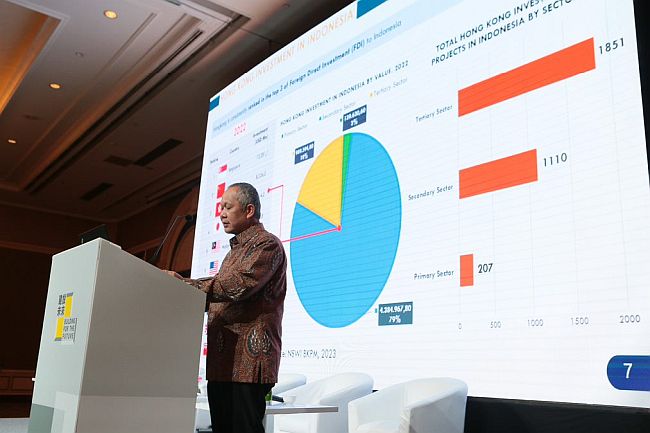

Phishing is a global challenge. With 4.7 billion internet users (nearly 60% of the global population) now spending nearly 7 hours online daily, the global economy continues to digitalize at an increasing rate – and crime is following quickly. According to the Global Anti Scam Alliance (GASA), online scams are now the most common type of crime, amounting to a loss of nearly USD 55 billion per year globally – 96% of Australians claim to have been exposed to an online scam in the last five years; 61% of French claim to have been exposed to “alternative investment offer” phishing attempt; 50% of UK citizens claim to have received a phishing email, SMS or social media message in one month.

India ranks among the largest markets for SMS phishing, with over 6 million citizens scammed annually and an estimated loss of nearly INR 15,000 Cr. The country’s growing mobile user base and low SMS rates have led to SMS phishing becoming one of the most prevalent forms of scam. Our analysis shows that over 5 billion SMS phishing attempts are made in India annually.

Despite the magnitude and criticality of the problem, no established solution currently exists to solve the phishing problem end-to-end. Current solutions are reactive, thus – unable to curb the issue comprehensively. Staying true to its track record of developing revolutionary products, Tanla is launching Wisely ATP to combat this issue. This once-in-a-generation product promises to reimagine the safety of digital communication channels.

Uday Reddy, Chief Executive Officer, Tanla

“Phishing has now become an organized industry: scammers are becoming faster and more sophisticated, consistently finding new ways and clever pretexts to get users to disclose sensitive information. The problem is real. The problem is huge. Now is not the time to experiment. To grow in this digital-first world, it is critical that enterprises urgently take steps to enhance customer safety and build trust. Wisely ATP is a first-of-its-kind revolutionary solution that acts as a single platform to solve the phishing problem end-to-end. It protects the user, disables the scam and eliminates the scammer. It enables brands to always be three steps ahead of the fraudster,” said Uday Reddy, Chief Executive Officer, Tanla.

Regulators across the globe are starting to realize the impact of phishing on society and are seeking solutions that can help mitigate this challenge. In India as well, the Telecom Regulatory Authority of India (TRAI) has been closely watching this space. It recently conducted a regulatory sandbox that successfully validated the effectiveness of Wisely ATP.

“TRAI was the first regulator to introduce blockchain-based DLT solution to curb the menace of spam. Tanla had been a key player in providing the solution. Last year, at our 25 years of TRAI celebration – we announced our focus on phishing problem in the country. I thank Tanla for again stepping up to solve this problem. I had an opportunity of seeing the solution today, and I am genuinely amazed by the initial insights. I commend the efforts by Tanla developers and their product team and I’am sure the product will be a major success in India and worldwide,” said Dr. P.D. Vaghela, Chairman TRAI

Building customer trust with cutting-edge offerings

As phishing events rise across the country, enterprises, telcos, and regulators, have been asking for technology-based solutions that make the digital ecosystem safer. Tanla is responding with Wisely ATP.

Built ground up at Tanla’s innovation and experience centre, this made-in-India solution leverages cutting-edge AI technology to combat phishing. Wisely ATP is a proprietary (patent pending) platform that can process over 1 trillion transactions annually in real-time with an accuracy of over 99%. It processes a transaction in <20 milliseconds, ensuring no impact on user experience. The platform addresses phishing end to end – from protecting the user to disabling the scam and eliminating the scammer.

Wisely ATP comprises of 3 modules:

- Identification: Leveraging best-in-class Artificial Intelligence (AI) algorithms, Wisely ATP comprehensively detect phishing messages in real-time. This is enabled by four proprietary (patent pending) engines powered by large language models, natural language processing, web of trust and deep-learning algorithms

- Prevention: Wisely ATP ensures messages identified as phishing are dropped from being delivered. Additionally, it can proactively sends warning alerts to users and generates actionable insights for the entire ecosystem

- Elimination of root cause: Wisely ATP will provide evidence to all the ecosystem stakeholders (technology giants, law enforcement, regulators etc.) enabling them to eliminate the root cause of SMS phishing

Wisely ATP acts as a single thread connecting all critical stakeholders to deliver an end-to-end solution. It is powered by a global network of threat intelligence and is built 100% on the cloud – as a true SaaS platform enabling quick and easy global scalability.

“In this highly sophisticated and rapidly evolving phishing landscape, traditional solutions such as rule- based firewall deployments have proven to be ineffective. Before Wisely ATP, there was no real established solution. Wisely ATP is an AI-based solution to eliminate phishing completely. After identifying the scam, the Wisely ATP also helps eliminate fraudulent assets (such as fake URLs, WhatsApp accounts etc.) and provides evidence to apprehend the fraudster. It is a true end-to-end solution,” said Sunil Bajpai, Chief Trust Officer, Tanla.

What customers are saying about Wisely ATP HDFC Bank

“At HDFC Bank, we obsess over customer safety and security,” said Ravi Santhanam, Chief Marketing Officer. “With the rising threat of phishing in India, the bank has been raising customer awareness through two large public campaigns. Taking another step in this direction, we are delighted to partner with Tanla to curb phishing at the source and offer end-to-end protection to our customers.,” he added

About Tanla

Tanla transforms the way the world collaborates and communicates through innovative CPaaS solutions. Founded in 1999, it was the first company to develop and deploy A2P SMSC in India. Today, as one of the world’s largest CPaaS players, it processes more than 800 billion interactions annually and about 63% of India’s A2P SMS traffic is processed through Trubloq, making it the world’s largest Blockchain use case.

Wisely, our patented enterprise grade platform offers private, secure, and trusted experiences for enterprises and mobile carriers. Tanla Platforms Limited is headquartered in Hyderabad. Tanla is listed on two national exchanges, the NSE and BSE, (NSE: TANLA; BSE:532790) and included in prestigious indices such as the Nifty 500 and BSE 500, Nifty Digital Index, FTSE Russell and MSCI.

For additional information, please contact:

Ritu Mehta

Director- Investor relations

ritu.mehta@tanla.com

Chandra Sekhar. K

Head-Media relations

chandrasekhar.k@tanla.com

Safe Harbor

This document contains “forward-looking” statements, and these statements involve substantial risks and uncertainties. All statements other than statements of historical fact could be deemed forward-looking, including, but not limited to, expectations of future operating results, market size and growth opportunities, the calculation of certain of our key assumptions relating to resolving future challenges operating metrics, estimated figures, plans for future operations, competitive position, technological capabilities, and strategic relationships, as well as assumptions relating to the foregoing. Forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quanti- fied. In some cases, you can identify forward-looking statements by terminology such as “expect,” “anticipate,” “should,” “believe,” “hope,” “target,” “project,” “plan,” “goals,” “estimate,” “potential,” “predict,” “may,” “will,” “might,” “could,” “intend,” “shall,” and variations of these terms or the negative of these terms and similar expressions. You should not put undue reliance on any forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of the times at, or by, which such performance or results will be achieved, if at all.

Forward-looking statements are subject to a number of risks and uncertainties, many of which involve factors or circumstances that are beyond our control. Our actual results could differ materially from those stated or implied in forward-looking statements due to a number of factors. If the risks or uncertainties ever materialize or the assumptions prove incorrect, our results may differ materially from those expressed or implied by such forward-looking statements. We assume no obligation and do not intend to update these forward-looking statements or to conform these statements to actual results or to changes in our expectations, except as required by law.

This document contains statistical data, estimates and forecasts that are based on independent industry publications or other publicly available information, as well as other information based on our internal sources. This information involves many assumptions and limitations, and you are cautioned not to give undue weight to these estimates. We have not independently verified the accuracy or completeness of the data contained in these industry publications and other publicly available information. Accordingly, we make no representations as to the accuracy or completeness of that data nor do we undertake to update such data after the date of this document.

By receiving this document, you acknowledge that you will be solely responsible for your own assessment of the market and our market position and that you will conduct your own analysis and be solely responsible for forming your own view of the potential future performance of our business.

Any logos or trademarks (other than Tanla, Karix, Gamooga. Trubloq & Wisely) included herein are the property of the owners thereof and are used for reference purposes only.

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com