HONG KONG, Jul 7, 2021 – (ACN Newswire) – Global New Material, the global leader in the field of new consumable materials, specifically pearlescent materials, is currently in the offering stage, a step away from its official June 17 listing (6166.HK) on the Stock Exchange of Hong Kong.

Global New Material International Holdings Limited, or Global New Material, has become the largest pearlescent material manufacturer in China and is aiming to be the largest in the world by virtue of its unique technical advantages.

Synthetic mica is expected to replace traditional pigments, while pearlescent materials should further expand in middle and high-end consumption fields, ushering in higher localization rates. We expect Global New Material, benefitting from opportunity in both pearlescent materials and synthetic mica, will develop at a firmer pace with capital market support.

Global New Material remains the industry leader by virtue of its dominant advantages in technology

With the top talent in the industry and synthetic mica as a key base material, Global New Material focuses on R&D and innovation, and has accumulated significant and dominant technical advantages.

Global New Materia's technical team is headed by Professor Jiansheng Fu, a world-renowned pearlescent material expert, and is acclaimed as the premier authority on pearlescent materials in China and as the father of chameleon pearlescent materials. His team authors more than 100 advances in new material research every year, including the silicon ball series, the "Light of the Dawn" series and other innovative material lines already leading international markets.

Global New Material has also hired two doctors from the French Academy of Sciences to run the development of cosmetics products. Global New Material's products have been put into mass production, and have been supplied to several big-name cosmetics companies. Moreover, Global New Material has set up a team dedicated to studying the downstream application of pearlescent materials and has developed thousands of personalized products using pearlescent materials, as well as personalized color product-related services for customers.

In particular, Global New Material has the technical advantages in manufacturing synthetic mica, the second-generation base material used in pearlescent materials. There is an increasingly stronger demand for synthetic mica as natural mica is on the verge of exhaustion. In this context, Global New Material is currently the only company in the industry that has all core technologies required for manufacturing synthetic mica.

To date, Global New Material pearlescent materials are found in 473 natural mica-based products, 266 synthetic mica-based products, 30 glass sheet-based products, and 5 silica-based products. Global New Material pearlescent materials are widely applied for different purposes and in different industries covering automotive coatings, cosmetics, industrial coatings, plastics, printing, textiles, leather and ceramics.

Additionally, Global New Material sells synthetic mica powder products of different particle sizes which are used in pearlescent material products of different grades and produce functional fillers, insulating materials, refractory materials and raw materials of nickel-hydrogen batteries. Global New Material not only remains the industry leader by relying on technical advantage, but it has shaped its business scale as well.

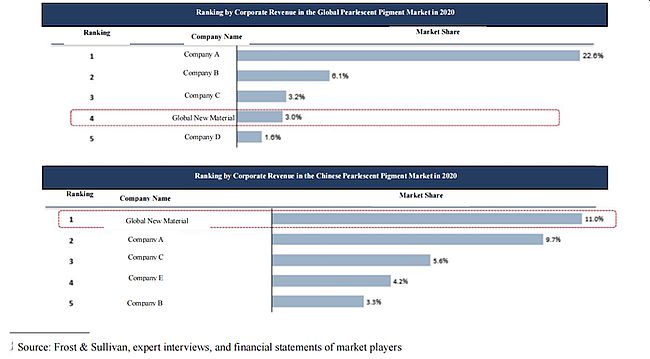

According to the prospectus, Global New Material has sold products to more than 30 countries and regions in Asia (excluding China), Europe, Africa and South America. As shown in a report issued by Frost & Sullivan, in terms of corporate revenue, Global New Material was the largest manufacturer of pearlescent materials and China's industry leader in 2020 with a market share of 11.0%, the only company in China with a market share of over 10%.

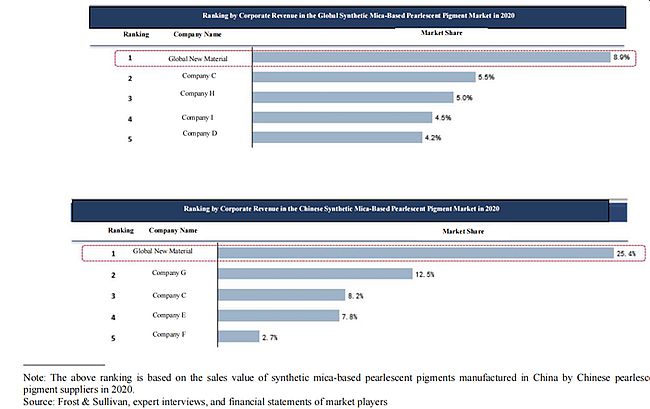

In the global market, Global New Material ranked as the fourth largest manufacturer of pearlescent materials in 2020 with a market share of 3.0%, only 0.2% lower than that of the third largest. In the synthetic mica-based pearlescent materials market, the top five by corporate revenue in 2020 occupied a market share of 28.1%, Global New Material ranked first with a market share of 8.9%, 3.4% higher than that of the second one. In the domestic market, Global New Material ranked first with a market share of 25.4%, more than twice the market share of the second player.

In recent years, Global New Material's production capacity has been on the rise. Specifically, its annual planned production capacity of pearlescent material products reached 10,464 tons, 12,978 tons and 13,740 tons at the end of 2018, 2019 and 2020 respectively, and its annual planned production capacity of synthetic mica powder doubled from 4,752 tons at the end of 2019, which remained stable for two years, to 9,504 tons at the end of 2020.

,

Driven by existing advantages, business performance is growing at a remarkably expedited pace

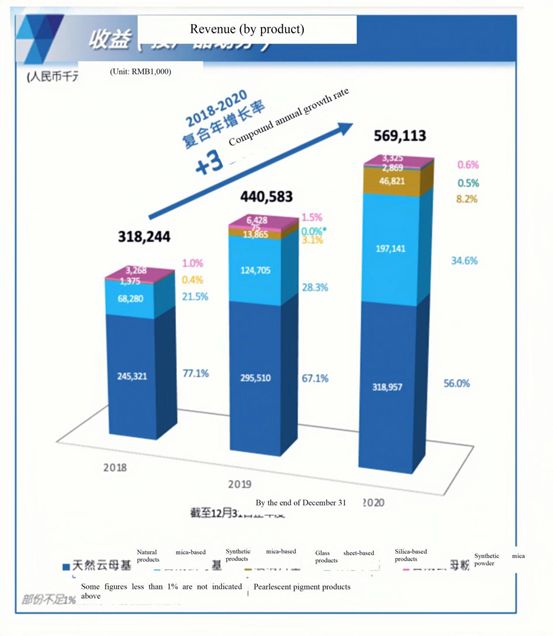

Global New Material's two core business segments, natural mica-based and synthetic mica-based products have been on the marked rise, leading to continued increases in corporate revenue.

According to the prospectus, 2018 to 2020 sales volume of natural mica-based products, which account for the largest percentage of Global New Material's revenue, reached 7,217.9 tons, 8,822.4 tons and 10,056.8 tons respectively, an average annual compound growth rate of 18.04%.

Sales volume of synthetic mica-based products, which account for the second-largest percentage of Global New Material's revenue, reached 1,228.8 tons, 2,231.8 tons and 3,943.5 tons respectively an average annual compound growth rate of 79.14%.

Benefiting from the stable increase in sales volume of the forgoing core business segments and of glass sheet-based and silicon oxide-based products, the overall sales volume of Global New Material increased from 8,535.5 tons in 2018 to 11,264.5 tons in 2019 and even reached 14,243.3 tons in 2020.

In terms of corporate revenue, natural mica-based products contributed RMB245 million, RMB296 million and RMB319 million in 2018, 2019 and 2020 respectively, showing a steady increase. The corporate revenue contributed by synthetic mica-based products rapidly increased from RMB68.28 million in 2018 to RMB197 million in 2020, with the proportion of total corporate revenue increasing from 21.5% to 34.6%.

The corporate revenue contributed by glass sheet-based products increased by 9.1 times and 2.4 times in 2019 and 2020 respectively from RMB1.375 million in 2018, and reached RMB46.821 million in 2020. In the past three years, Global New Material's corporate revenue reached RMB318 million, RMB441 million and RMB569 million respectively, increasing by 38.44% and 29.17% in 2019 and 2020 respectively. In particular, a remarkable increase was achieved during COVID-19 in 2020.

We can see that growth in gross profit margins and optimization of expense ratios continues to enhance Global New Material's profitability.

According to financial data, benefiting from the expansion of business scale and technological improvement, Global New Material's gross profit margin increased from 49.5% in 2019 to 49.9% in 2020 even though it lowered prices of its core products during the epidemic prevention and control period in 2020. Besides, its sales expense ratio, administrative expense ratio and financial expense ratio dropped from 5.29%, 12.87% and 4.19% in 2019 to 4.32%, 12.81% and 3.41% respectively in 2020.

In this context, Global New Material had its net profit reaching RMB153 million in 2020, with an increase of 42.42% which is significantly higher than 31.92% in 2019, and also had its net profit margin increasing from 24.4% in 2019 to 26.9% in 2020.

Benefiting from its production capacity expansion plan and the increasingly stronger demands in the industry, we expect Global New Material to remain on its growth trend with business performance.

The era of pearlescent materials is coming

Pearlescent materials, which replace traditional pigments with new applications under exploration, will be of great potential in the future. Pearlescent pigment is a new composite material produced by imitating the formation principle of pearls, and has a micron-sized mica flake at the core which is coated with a nano-sized metal oxide film. Pearlescent pigments can create beautiful, brilliant and long-lasting colours without harm to human health and the environment, as with natural pearls, and are therefore called "pearlescent materials".

As set forth in the Classification of Strategic Emerging Industries (2018) issued by the Chinese central government, mica products are functional fillers as new energy materials used in strategic emerging industries, and mica-based pearlescent materials are pigments as other new functional materials used in strategic emerging industries.

Compared with traditional pigments, pearlescent materials involve 2 distinct and innovative elements: (1) pearlescent materials abandon the color generation principle requiring three primary colors that applies to traditional pigments, and adopt the principle of light interference effect for color generation to ensure long-lasting colors; and (2) pearlescent pigments are non-toxic and harmless to human health and environment. As a new consumable material without a definite industry life cycle, pearlescent pigments are rapidly replacing traditional organic and metal pigments, and are widely applied in coatings, inks, plastics, cosmetics, automobiles, aerospace and other fields.

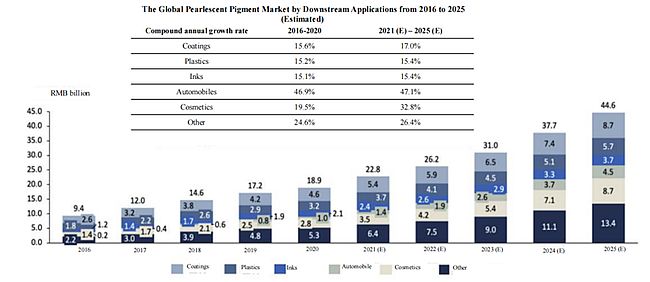

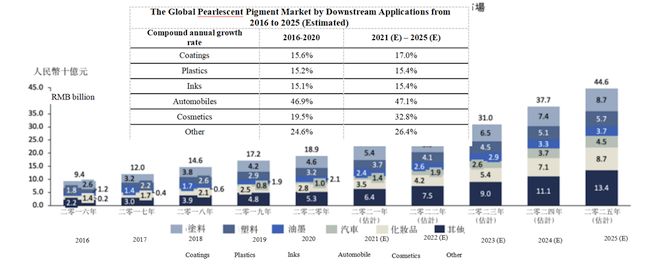

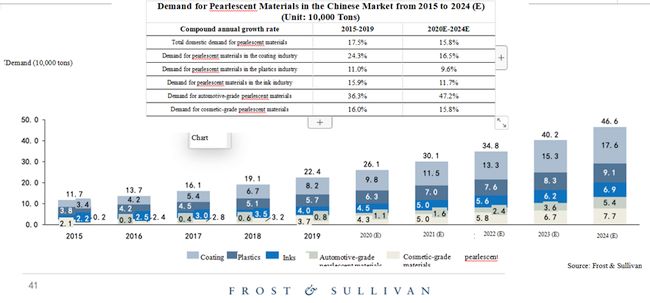

With the benefit of higher market penetration in the automotive market, automotive-grade pearlescent materials reached RMB950 million in 2020, accounting for 5.0% of the overall market size of the pearlescent materials market. The market size of cosmetic-grade pearlescent materials is also on a steady rise. From 2021 to 2025, pearlescent materials to be applied in the global automotive market and the global cosmetics market will experience a compound growth rate of 47.1% and 32.8% respectively.

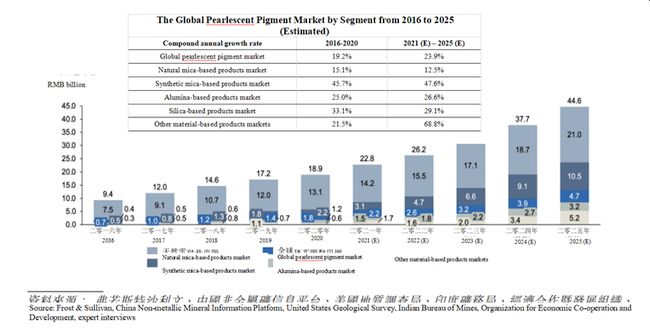

On the whole, the global pearlescent material market is on a steady rise with the market seize reaching RMB18.9 billion in 2020 and with a compound annual growth rate of 19.2% from 2016 to 2020. Considering that the total market size of the global pigment market is currently RMB160 billion, pearlescent pigments are expected to replace other pigments and gain an ever-larger market share.

As forecasted by Frost & Sullivan, in view of consumption upgrade and of the fact that pearlescent materials are gradually replacing other pigments, the market size of the pearlescent material market will reach RMB44.6 billion in 2025, and the compound annual growth rate of the global pearlescent pigment market will further climb to 23.9% from 2021 to 2025.

Meanwhile, the trend of replacing imported products with Chinese-made products is creating great market opportunities for leading companies such as Global New Material.

It is known that pearlescent pigment is included in the Directory of High-tech New Material Products for Export and enjoys export tax benefits, and falls in the new material industry encouraged by the state. At present, the market size of the Chinese pearlescent pigment market is expanding at a pace significantly faster than that of the global pearlescent pigment market.

The market size of the Chinese pearlescent pigment market expanded at a compound annual growth rate of 23.9% from 2016 to 2020, and is expected to expand at a compound annual growth rate of 30.8% from 2021 to 2025. Even though some pearlescent pigments sold in China are still imported from Germany-based Merck, BASF and other overseas suppliers, the trend of replacing imported products with Chinese-made products will empower the development of Chinese leading companies such as Global New Material.

Furthermore, the synthetic mica market is booming

First-generation pearlescent materials are natural mica-based, and all-natural mica materials currently used are imported from India as natural mica in China has been exhausted. In this context, the best solution is to replace natural mica with synthetic mica. In 2015, the Ministry of Industry and Information Technology of the People's Republic of China listed synthetic mica as one of the 18 key basic new materials for the national industrial upgrading project, and only CHESIR was authorized to take on this project.

Given that synthetic mica-based products show better insulation, high-temperature resistance and corrosion resistance than natural mica-based products, synthetic mica-based products are more likely to be used in higher-end fields and broader applications. At present, synthetic mica powder is usually used to produce cosmetic-grade and automotive-grade pearlescent pigment products.

Data shows that the market share of synthetic mica-based pearlescent pigments has increased from 5.3% in 2016 to 11.7% in 2020. Driven by the technology advancement and productivity improvement of synthetic mica, the market share of synthetic mica-based pearlescent pigments in the global market is expected to reach 23.6% in 2025, and the synthetic mica-based pearlescent pigment market will usher in a compound annual growth rate of 47.6% from 2021 to 2025.

Like pearlescent materials, synthetic mica is used in broader applications

In addition to pearlescent materials, mica products are used in producing insulating and refractory materials which are then used in automobiles, cosmetics, electric power, high-temperature smelting, household appliances and other fields. From 2018 to 2020, the market size of mica applied in producing pearlescent materials reached RMB1.38 billion, RMB7.66 billion, and RMB3.70 billion respectively. Additionally, insulating materials will be applied to semiconductors and other cutting-edge fields.

With the improvement of the overall R&D capabilities, synthetic mica with better properties will be applied in more fields such as thermal insulation materials. At present, Global New Material is the only company in the industry that has the core technologies required in producing synthetic mica, and it also occupies the largest market share in the global synthetic mica-based pearlescent material market.

With its production capacity being expanded greatly, we expect Global New Material to be the biggest winner of the upcoming market opportunities.

All existing production facilities producing pearlescent pigment in Global New Material's first-phase plant are near full capacity. In view of this, Global New Material is investing RMB1.338 billion to build a second-phase facility covering an area of 145,200 square meters, including four factories with a planned capacity of 30,000 tons/yr, power supply facilities, ancillary facilities and warehouses.

When the new plant is completed and put into operation, Global New Material should be able to dominate the upstream in the global supply chain of synthetic mica, and therefore become the leading enterprise in the pearlescent material and synthetic mica industry.

In summary, Global New Material remains first in China with its technical advantages and aims to lead the global market, developing at an expedited pace following industry opportunity and based on its expansion strategy. We expect to see a new wave of investment by Global New Material following its HKEx debut later this month.

Contact:

Haolu Wang, Peanutmedia

Email: wanghaolu@czgmcn.com

URL: https://www.Peanutmedia.com

Copyright 2021 ACN Newswire. All rights reserved. http://www.acnnewswire.com