HONG KONG, Aug 30, 2021 – (ACN Newswire) – Alltronics Holdings Limited ("Alltronics" or the "Group") (SEHK: 833), a leading electronic products manufacturer and a provider of energy-saving business solutions, has today announced its unaudited interim results for the six months ended 30 June 2021 ("1H2021", "first half of 2021" or "the Period").

During the Period, the Group's revenue increased by 19.0% to HK$860 million (1H2020: HK$722.8 million), mainly attributable to the increase in sales of electronic products. Gross profit amounted to HK$141.6 million (1H2020: HK$147.3 million) and gross profit margin was 16.5% (1H2020: 20.4%). Profit for the Period attributable to owners of the Company was HK$48.1 million, compared to a profit of HK$42.3 million for the same period in 2020. The improvement in net profit was mainly due to the reduction in impairment losses on financial assets and there was no write-off of long term receivables during the Period.

Basic earnings per share were HK5.08 cents. In its appreciation for the shareholders' continuous support, the Board has declared the payment of an interim dividend of HK1.0 cent per share.

Business Review and Prospects

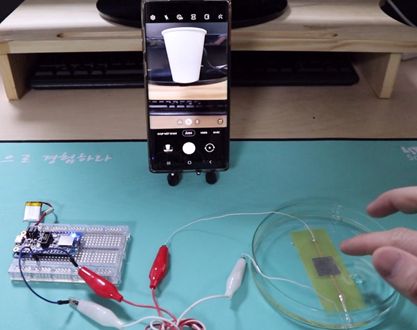

For the electronic products segment, total sales revenue comprises sales of finished electronic products, plastic moulds and components and other components for electronic products. Despite the continuous impact of COVID-19 pandemic on the global economy, total sales revenue from electronic products during the Period had increased by 19.3% from HK$721 million to HK$860 million. Specifically, the demand for the Group's irrigation controller products increased by approximately HK$38 million to HK$295 million, while sales of electronic component products increased by approximately HK$50 million. Sales of walkie-talkie products also increased slightly by approximately HK$4 million, whereas sales of electrostatic disinfectant sprayers remained stable at approximately HK$150 million during the Period. Although the outbreak of COVID-19 last year led to significant increase in demand for the Group's electrostatic disinfectant sprayers, the Group expected that the total sales revenue from electrostatic disinfectant sprayers for this year is unlikely to maintain at the same level. Nevertheless, the management is confident that the performance of the Group's irrigation controller products for this year will remain strong with steady growth. The demand for other electronic products will also remain stable. New products expected to be launched in the fourth quarter of the year will as well provide new momentum for growth in revenue.

The operation of the biodiesel products and energy efficient gas stoves segment in Hong Kong continued to be affected by the pandemic during the Period, with total revenue of approximately HK$0.2 million. The Group expects the business of biodiesel products and energy-efficient gas stoves segment to remain stable during the second half of 2021.

Regarding the energy saving business segment, total sales revenue for the Period were HK$0.2 million as the installation work at the retail stores of Suning.com Co., Ltd. ceased since last year. The Group therefore foresees the revenue will remain at similar level during the second half of 2021.

Looking ahead, the Group will keep alert and remain cautious on its performance, as the uncertainties in the business environment continue, and the ongoing COVID-19 pandemic as well as trade disputes between the United States and the PRC may lead to further negative impact on the global economy. At the same time, the Group will strive to manage these factors and tighten control over production costs and overheads, and also improve production efficiency in order to maximise the gross profit margin.

Mr. Lam Yin Kee, Chairman of Alltronics concluded, "The COVID-19 pandemic continued to affect the business operations of the Group and its associated companies, and we expect the difficult business environment may last for some time. With that being said, the overall performance of the Group during the first half of the year has improved when compared to prior year. We will certainly continue to explore opportunities with other potential customers for new electronic products with the aim to broaden revenue base and maintain growth momentum, as a result contributing to our shareholders and stakeholders."

About Alltronics Holdings Limited (Stock code: 833)

Alltronics Holdings Limited is mainly engaged in the design and manufacture of a wide range of electronic products with quality and style, supplying biodiesel products and energy efficient gas stoves, as well as the provision of energy-saving business solutions. The Company is a constituent stock of the Morgan Stanley Capital International ("MSCI") Hong Kong Micro Cap Index. For more information, please visit the company website http://www.alltronics.com.hk/.

Media enquiries

Strategic Financial Relations Limited

Vicky Lee Tel.: +852 2864 4834 Email : vicky.lee@sprg.com.hk

Angela Wong Tel.: +852 2114 4953 Email : angela.wong@sprg.com.hk

Pinky Hui Tel.: +852 2114 2897 Email : pinky.hui@sprg.com.hk

Website: www.sprg.com.hk

Copyright 2021 ACN Newswire. All rights reserved. http://www.acnnewswire.com