TOKYO, Aug 30, 2022 – (ACN Newswire) – TANAKA Kikinzoku Kogyo K.K. (Head office: Chiyoda-ku, Tokyo; Representative Director & CEO: Koichiro Tanaka), which operates the TANAKA Precious Metals manufacturing business, announced today that its subsidiary TANAKA Denshi Kogyo K.K. (Head office: Kanzaki-gun, Saga; Representative Director & President: Toshiya Yamamoto), which is engaged in the production of various types of bonding wires, will start taking orders for gold (Au) bonding wires manufactured using only “RE Series” 100% recycled precious metals. This is in addition to existing products which use raw materials that include gold directly produced from mines.

A compound for plating solutions has already been launched as the first product to use the RE Series supplied by TANAKA Kikinzoku Kogyo as raw materials. As a secondary use, the RE Series is being expanded*1 to gold bonding wires manufactured by TANAKA Denshi Kogyo.

Boasting the world’s highest market share*2, TANAKA Denshi Kogyo’s gold bonding wires support the world’s semiconductor industry. A stable worldwide supply of the RE Series is possible as it is being produced at four locations – Japan, Singapore, Malaysia, and China – and has obtained third-party verification.

TANAKA Precious Metals hopes to contribute toward the establishment of a sound material-cycle society and increased demand for sustainable materials and products by supplying the RE Series. In the future, TANAKA Precious Metals will further expand the business of recycling precious metals—which are natural resources with limited reserves—to the global level with the goal of achieving a stable supply.

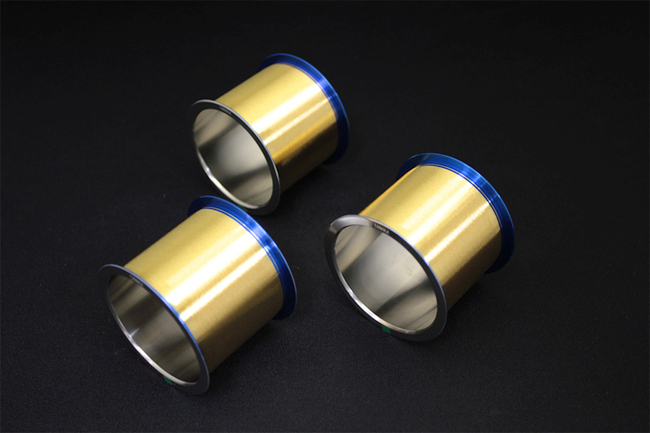

■ About Gold (Au) Bonding Wires

Bonding wire is the metal wire that electrically connects semiconductor chips to external electrodes. They mainly use extremely fine wires (10+ microns thick) made from gold, silver, copper, and aluminum. In particular, bonding wires made using gold have better corrosion resistance, workability, connectivity, and chemical stability than those composed of other metals. Besides electronic products such as computers and mobile phones, semiconductors are also widely used in home appliances and vehicles. In addition, semiconductors are gaining greater attention as a critical component in electric vehicles and digital transformation, contributing to the realization of a carbon-neutral society.

■ About the RE Series

The RE Series is composed of materials refined only from recycled precious metals rather than from sources such as mined bullion. TANAKA Kikinzoku Kogyo has been operating a recycled precious metals business since it was established in 1885. By expanding its RE Series production line, it is working to supply products that use 100% recycled precious metal materials, starting in 2022.

In addition, TANAKA Kikinzoku Kogyo offers services using a comprehensive system of management within the Group, from product recovery to refining and remanufacturing into new products. Using advanced precious metal analysis technologies* developed through many years of research and development, it is able to accurately evaluate the rate of precious metal content in recovered materials, which is important for recycling.

*One measure of precious metal analysis capabilities is the status of Good Delivery Referee, an accreditation of the LBMA and LPPM, the most prestigious organizations in the field globally, which TANAKA Kikinzoku Group received as one of only five companies globally and the only company in Japan and the rest of Asia. The Group is also the first in Japan to acquire ISO/IEC 17025 accreditation for its analysis technologies for platinum, gold, silver, and palladium.

■ About TANAKA Denshi Kogyo bonding wires

TANAKA Denshi Kogyo has produced various types of bonding wire since it was founded more than 50 years ago, and today it boasts a leading share of the global market. After establishing its first overseas production base in Singapore in 1978, the company has constructed additional production bases in Malaysia, China, and Taiwan. It now supplies its wires to countries engaged in the production of semiconductors around the world.

Press release in PDF: https://www.acnnewswire.com/docs/files/20220830_EN.pdf

■ About TANAKA Precious Metals

Since its foundation in 1885, TANAKA Precious Metals has built a portfolio of products to support a diversified range of business uses focused on precious metals. TANAKA is a leader in Japan regarding the volumes of precious metals handled. Over the course of many years, TANAKA has not only manufactured and sold precious metal products for industry but also provided precious metals in such forms as jewelry and assets. As precious metals specialists, all Group companies in Japan and around the world collaborate and cooperate on manufacturing, sales, and technology development to offer a full range of products and services. With 5,225 employees, the Group’s consolidated net sales for the fiscal year ending March 31, 2022, were 787.7 billion yen.*

*From the current consolidated fiscal year, the amounts of sales for some transactions are indicated as net values due to the application of the Accounting Standard for Revenue Recognition.

■ Global industrial business website

https://tanaka-preciousmetals.com/

■ Product inquiries

TANAKA Kikinzoku Kogyo K.K.

https://tanaka-preciousmetals.com/en/inquiries-on-industrial-products/

■ Press inquiries

TANAKA Holdings Co., Ltd.

https://tanaka-preciousmetals.com/en/inquiries-for-media/

*1 It is possible to continue placing orders for gold bonding wires manufactured using the conventional process.

*2 Source: SEMI Industry Research and Statistics/TECHCET, April 2020

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com