Toronto, Ontario–(ACN Newswire – October 16, 2023) – Appia Rare Earths & Uranium Corp. (CSE: API) (OTCQX: APAAF) (FSE: A0I0.F) (FSE: A0I0.MU) (FSE: A0I0.BE) (the “Company” or “Appia”) announce results from the first 17 drill holes out of 147 completed to date from the Reverse Circulation (RC) drilling campaign at its PCH Ionic Clay Project in Goiás State, Brazil. The results from the first 17 RC drill holes represent a significant doubling in average depth of mineralized zones to 13 metres with overall weighted average grades of 1,566 parts per million (ppm) Total Rare Earth Oxides (TREO) which is comparable to, or surpasses, other well-known international deposits.

Summary:

- Reverse Circulation (RC) drill holes assayed: The first 17 RC drill holes of the Phase 1 drill program are all Rare Earth Element (REE) mineralized. A total of 147 holes have been completed to date with an accumulated total of 2,019 metres drilled.

- Average depth doubled: The average depth of RC drilling is over 13 metres from surface representing a significant doubling in average depth of the mineralized zones.

- Outstanding Grades: The results exhibit overall grades similar to or surpassing known deposits, with remarkable high-grade mineralization identified, including:

- PCH-RC-001 from 0m to 15m End of Hole (EOH):

- 1,914 ppm TREO and 510 ppm Magnet Rare Earth Oxides (MREO), or 27% of TREO, including 9m @ 2,300 ppm TREO and 632 ppm MREO, or 27% of TREO from 2m to 11m; and

- 291 ppm Heavy Rare Earth Oxides (HREO), or 15% of TREO, including 9m @ 366 ppm, or 16 % of TREO.

- PCH-RC-002 from 0m to 15m (EOH):

- 2,671 ppm TREO and 605 ppm MREO, or 23% of TREO, including 6m @ 5,389 ppm TREO and 1,189 ppm MREO, or 23% of TREO from 8m to 14m; and

- 220 ppm HREO, or 8% of TREO, including 6m @ 412 ppm HREO, or 8% of TREO.

- PCH-RC-008 from 0m to 18m (EOH):

- 2,752 ppm TREO and 741 ppm MREO, or 27% of TREO, including 15m @ 3,084 ppm TREO and 839 ppm MREO, or 27% of TREO from 2m to 17m; and 404 ppm HREO, or 15% of TREO, including 15m @ 460 ppm HREO, or 15% of TREO.

- PCH-RC-009 from 0m to 15m (EOH):

- 3,277 ppm TREO and 804 ppm MREO, or 25% of TREO, including 12m @ 3,594 ppm TREO and 886 ppm MREO, or 24% of TREO from 1m to 13m; and

- 251 ppm HREO, or 8 % of TREO, including 12m @ 275 ppm HREO, or 8% of TREO.

- PCH-RC-011 from 0m to 15m (EOH):

- 3,717 ppm TREO and 913 ppm MREO, or 25% of TREO, including 11m @ 4,182 ppm TREO and 1,035 ppm MREO, or 25% of TREO from 0m to 11m; and

- 286 ppm HREO, or 8 % of TREO, including 11m @ 327 ppm HREO, or 8% of TREO.

Table 1 – Highlighted assay composites from 17 reverse circulation drillholes in the Target IV.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/184083_ec21b0a1a4ab4a1b_005full.jpg

TREO = ([CeO2 ppm] + [Dy2O3 ppm] + [Er2O3 ppm] + [Eu2O3 ppm] + [Gd2O3 ppm] + [Ho2O3 ppm] + [La2O3 ppm] + [Lu2O3] ppm] + [Nd2O3 ppm] + [Pr6O11 ppm] + [Sm2O3 ppm] + [Tb4O7 ppm] + [Tm2O3 ppm] + [Yb2O3 ppm]). MREO = ([Dy2O3 ppm] + [Pr6O11 ppm] + [Nd2O3 ppm] + [Sm2O3 ppm] + [Tb4O7 ppm]). HREO = [Dy2O3 ppm] + [Er2O3 ppm] + [Eu2O3 ppm] + [Gd2O3 ppm] + [Ho2O3 ppm] + [Lu2O3] ppm] + [Sm2O3 ppm] + [Tb4O7 ppm] + [Tm2O3 ppm] + [Yb2O3 ppm]).

For a complete listing of all assay results, please click here.

“These exceptional drilling results have confirmed the potential of Target IV,” stated Stephen Burega, president. “The assay results received to date showcase substantial mineralization across 100% of the drill holes.”

Tom Drivas, CEO, said, “It’s very exciting to witness the PCH Ionic Clay project’s potential increasing through this Phase 1 drilling campaign with the average depth of mineralized zones increasing to 13 metres while consistently delivering extraordinary overall assay values which, in many cases, are from top to bottom of the hole.”

He continued, “Ionic Clay Rare Earths Deposits are usually found within the top 10-20m from surface; they are easier to mine, more environmentally friendly because they contain low or no radioactivity; exhibit simpler metallurgy therefore easier and cheaper to process; and contain good amounts of both the very valuable heavy and light magnet rare earths that are in high demand for cleaner electrification and use in a large number of high tech applications.”

The PCH Ionic Clay Project drilling has resulted in 17 holes with a weighted average value of 1,566 ppm TREO, which is comparable to, or surpasses, other well-known international deposits. “This initial batch of samples has revealed MREO that account for approximately 25% of TREO, producing notable overall values up to 1,189 ppm. We have identified high-grade values that are exceptional in terms of both width and grades,” stated Carlos Bastos, Brazilian Qualified Person and Geology Manager.

Target IV marks a significant milestone for Appia’s PCH Ionic Clay project, and the Company eagerly anticipates receiving further assay results from the SGS Geosol labs. “These results reaffirm our commitment to exploring the entire PCH project area which covers an impressive 17,551 hectares with a significant area still open to bluesky early-stage exploration, and we look forward to sharing more exciting developments in the near future,” commented Stephen Burega.

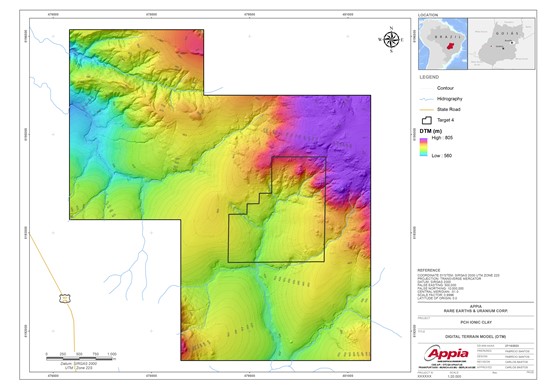

Figure 1. Reverse Circulation drilling program map location.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/184083_ec21b0a1a4ab4a1b_006full.jpg

Figure 2. A representative Cross section of PCH-RC-001, PCH-RC-008, and PCH-RC-009 from Target IV, north-south orientation, and location showed in Figure 1.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/184083_37049f0e74cf6961_007full.jpg

Table 3. Drill hole collar details for 17 RC drilling. SIRGAS 2000 – UTM zone 22S.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5416/184083_ec21b0a1a4ab4a1b_008full.jpg

Background on the PCH Project

The PCH Project is located within the Tocantins Structural Province in the Brasília Fold Belt, more specifically, the Arenópolis Magmatic Arc. The PCH Project is 17,551.07 ha in size and located within the Goiás State of Brazil. It is classified as an alkaline intrusive rock occurrence with highly anomalous REE and Niobium mineralization. This mineralization is related to alkaline lithologies of the Fazenda Buriti Plutonic Complex and the hydrothermal and surface alteration products of this complex by supergene enrichment in a tropical climate. The positive results of the recent geochemical exploration work carried out to date indicates the potential for REEs within lateritic ionic adsorption clays and Niobium.

Reverse circulation (RC) drill holes are sampled at one metre intervals, resulting in higher average sample size of 5-25 kg. A small representative specimen was taken from each sample bag and placed into a chip tray for visual inspection and logging by the geologist. Quartering was performed at Appia’s logging facility using a riffle splitter and continued splitting until a representative sample weighing approximately 500g each was obtained, bagged in a resistant plastic bag, labeled, photographed, and stored for shipment.

The samples were sent to the SGS laboratory in Vespasiano, Minas Gerais. Despite the SGS Lab owning internal QA/QC, Appia has used its own control samples in each batch sent to the laboratory.

Quality control samples, such as blank, duplicate, and standard (CRM) were inserted into each analytical run. For all analysis methods, the minimum number of QA/QC samples is one standard, one duplicate and one blank, introduced every batch which comprise a full-length hole. The rigorous procedures implemented during the sample collection, preparation, and analysis stages underscore the robustness and reliability of the analytical results obtained.

All analytical results reported herein have passed internal QA/QC review and compilation. All assay results of RC samples were provided by SGS Geosol, an ISO/IEC 17025:2005 certified laboratory, which performed their measure of the concentration of rare earth elements (REE) analyses by Inductively Coupled Plasma Mass Spectrometry (ICP-MS) analytical methods.

The technical content in this news release was reviewed and approved by Mr. Don Hains, P.Geo, Consulting Geologist, and a Qualified Person as defined by National Instrument 43-101.

About Appia Rare Earths & Uranium Corp. (Appia)

Appia is a publicly traded Canadian company in the rare earth element and uranium sectors. The Company is currently focusing on delineating high-grade critical rare earth elements and gallium on the Alces Lake property, as well as exploring for high-grade uranium in the prolific Athabasca Basin on its Otherside, Loranger, North Wollaston, and Eastside properties. The Company holds the surface rights to exploration for 113,837.15 hectares (281,297.72 acres) in Saskatchewan. The Company also has a 100% interest in 12,545 hectares (31,000 acres), with rare earth elements and uranium deposits over five mineralized zones in the Elliot Lake Camp, Ontario. Lastly, the Company holds the right to acquire up to a 70% interest in the PCH Ionic Adsorption Clay Project which is 17,551.07 ha. in size and located within the Goiás State of Brazil. (See June 9th, 2023 Press Release – Click Here)

Appia has 130.5 million common shares outstanding, and 143.3 million shares fully diluted.

Cautionary Note Regarding Forward-Looking Statements: This News Release contains forward-looking statements which are typically preceded by, followed by or including the words “believes”, “expects”, “anticipates”, “estimates”, “intends”, “plans” or similar expressions. Forward-looking statements are not a guarantee of future performance as they involve risks, uncertainties and assumptions. We do not intend and do not assume any obligation to update these forward-looking statements and shareholders are cautioned not to put undue reliance on such statements.

Neither the Canadian Securities Exchange nor its Market Regulator (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this release.

For more information, visit www.appiareu.com

As part of our ongoing effort to keep investors, interested parties and stakeholders updated, we have several communication portals. If you have any questions online (Twitter, Facebook, LinkedIn) please feel free to send direct messages.

To book a one-on-one 30-minute Zoom video call, please click here.

For further information, please contact:

Tom Drivas, CEO and Director: 416-546-2707, (fax) 416-218-9772 or (email) tdrivas@appiareu.com

Stephen Burega, President: (cell) 647-515-3734 or (email) sburega@appiareu.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/184083

Copyright 2023 ACN Newswire. All rights reserved. http://www.acnnewswire.com

![Mr Azman Jaafar, Managing Partner of RHTLaw Asia, Mr Erwan Barre, Board Director of ONERHT Foundation, Ms Kaylee Kwok, Chairman of ONERHT Foundation, Guest-of-Honour Mr Gan Kim Yong, Minister for Trade and Industry, Mr Ho Peng Kee, Patron of ONERHT Foundation, and Mr Bernard Tay, Mr Jayaprakash Jagateesan, Mr Yang Eu Jin, Board Directors of ONERHT Foundation. [L-R]](https://photos.acnnewswire.com/20231009.ONERHT.jpg)