HONG KONG, Sep 2, 2022 – (ACN Newswire) – Legend Capital recently announced that it made its 100th IPO following the listing of its AI medical portfolio company Lunit on the KOSDAQ market on 21 July 2022. In addition, Legend Capital's CRO portfolio company R&G Pharmastudies was successfully listed on the ChiNext of Shenzhen Stock Exchange on 2 August 2022, while on 5 August 2022, the innovative drug portfolio company MicuRx Pharmaceuticals went public on the STAR Market, becoming the 101st IPO and the 102nd IPO in Legend Capital's investment portfolio. In a recent interview, Richard Li, President of Legend Capital, revealed the history of Legend Capital in technology investment and proposed that the logic of technology investment has undergone important changes.

|

|

|

|

Over 100 IPOs and 100 Unicorns

Legend Capital pays more attention to the quality rather than the quantity of IPOs, but the 100th IPO remarks an important milestone for Legend Capital. Richard Li, President of Legend Capital, said in the interview: "What matters is not about the quantity of IPOs, but more about the repeated verification of the investment expertise of Legend Capital team, who has long been rooted in technology investment.

From Lunit to R&G Pharmastudies and MicuRx Pharmaceuticals, these IPO achievements at home and abroad are in line with Legend Capital's development: starting from the USD fund and growing stronger with the RMB fund. Among its peers, Legend Capital stands out with its distinctive feature – it is well-versed in the system of USD funds, but is also rooted in China and inherently adept at a local investment with the RMB fund.

Looking back at Legend Capital's development history, we can see a microcosm of the changes in China's technology investment. In Richard Li's memory, since the company's investment in iFLYTEK in 2001, Legend Capital has been systematically investing in companies that are in the early stages of technological innovation, and many of them have become industry leaders such as iFLYTEK, Spreadtrum, CATL, WuXi AppTec, Pharmaron, Wuxi Lead Intelligent and CNGR Advanced Material, etc., tapping into core sectors of new energy, semiconductor, life science, new materials and so on. So far, among Legend Capital's invested companies, there are over 100 unicorn companies with a valuation of over USD1 billion, creating a huge and systematic technology investment footprint.

With over two decades of expertise, Legend Capital has cultivated a profound understanding of the technology and innovation drives of China, accumulated rich resources around industries, and built a powerful portfolio ecosystem. Legend Capital helps overseas enterprises expand business in the Chinese market and promotes the global expansion of enterprises by bridging key resources in China such as R&D and supply chain.

On the other hand, by leveraging its "China Insights", Legend Capital also helps portfolio companies and entrepreneurs in China to "go global" and achieve strategic objectives across the border by integrating overseas resources and opportunities, helping portfolio companies to respond to complex changes in the global industry landscape and meanwhile generating new investment opportunities.

The Significance of 100 IPOs

Looking back at the 100 IPOs, they are remarkably diverse while at the same time representing a consistent theme. Regarding the breakdown of listing location, 31 of our portfolio companies were successfully listed on Shenzhen Stock Exchange, 20 on Shanghai Stock Exchange, 22 on Hong Kong Stock Exchange, 1 on Taiwan Stock Exchange, 4 on New York Stock Exchange, 16 on Nasdaq, 5 on Korea Stock Exchange, 1 on Japan Exchange Group. With the majority listed on A-share markets, Legend Capital has extensive exit experience in multiple capital markets, which is relatively rare in investment institutions in China.

From the market value (in RMB), there is 1 company with a market value of trillions – CATL; 10 companies with a market value of 100 billion, such as iFLYTEK, Pharmaron, WuXi AppTec, WuXi Biologics, Wuxi Lead Intelligent, Shanghai Putailai New Energy, CNGR Advanced Material, and JD Logistics; 15 companies with a market value of more than 50 billion, and 43 companies with a market value of more than 10 billion; and 25 of them are "little giants" companies with Specialization, Refinement, Differentiation & Innovation features. Legend Capital is active behind the rise of many Chinese technology companies.

Richard Li summarized several characteristics regarding Legend Capital's 100 IPOs: First, it covers multiple sectors. The second is balance, which is also one of the deep impressions that Legend Capital has left on the public – internationalization practices in RMB funds and extremely strong localization capabilities in USD funds. Third, investment in technological innovation projects is the main focus, and investment in pure business model-innovation projects is relatively small. In addition, Legend Capital acts as the lead investor in most of its portfolio with a relatively large shareholding ratio, thus having board seats and could exert a certain influence on the operation of portfolio companies.

Patience capital in industrial chain investment

Founded in 2001, Legend Capital has experienced 20 years of technology iteration and innovation in China. "The founding team of Legend Capital all came from industrial rather than financial backgrounds, which determines the industrial and technology innovation genes of Legend Capital," Richard Li recalled. In China, Legend Capital is a pioneer in making technology investments using USD funds, much earlier than many of today's first-tier USD funds. Since 2015, Legend Capital has changed from a single fund investment business team to a unified platform to manage the operation of multiple funds, including long-term PE funds, TMT specialized funds, health care specialized funds, etc., to compose a more synergistic team.

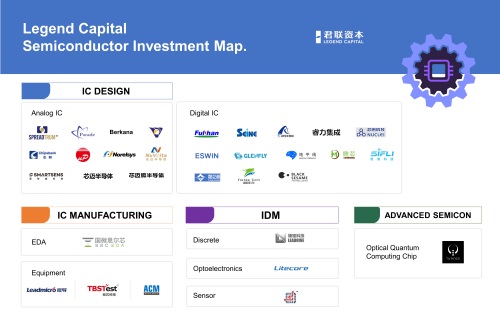

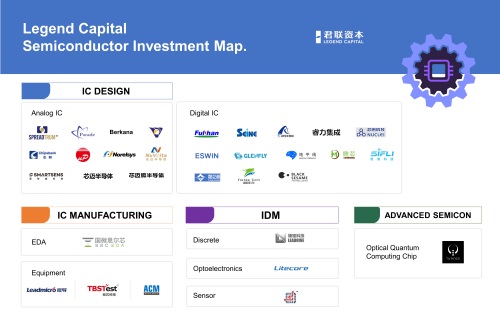

This synergy effect is reflected in Legend Capital's investment across different platforms and funds. With regard to its investment in the semiconductor industry, Legend Capital has systematic research on semiconductor companies and makes selective investments, with different funds investing in different types of targets. For example, Legend Capital invests in some enterprises that integrate resources and iterate products under a mature technology framework. Once successful, they will create a huge market of the replacement of the current framework, and even the first round of financing for these enterprises would reach billions of dollars. In the long run, they will grow into companies with a market value of hundreds of billions of dollars. Under such circumstances, Legend Capital will make a large proportion of investment through mature PE funds.

However, the entire semiconductor industry is still in the early stage of development currently, and the latest semiconductor technology represents a new design concept and architecture, as well as a trend in cutting-edge technology. At this stage, many start-up technology companies need our support in the form of early-stage fund investment that accompanies their development in the long run. This will in turn contribute to the diversification, synergy and expansion of Legend Capital's investment tools and targets.

The investment in the lithium battery industry, on the other hand, reflects the industry chain investment theme that is rooted in the industry background of the Legend Capital team. Benefiting from the long-term in-depth layout in the industrial mapping and the precise control of investment timing, Legend Capital has realized a number of landmark investments in the new energy field. Among them, projects such as Lead Intelligent, CATL, PUTAILAI, CNGR, Hymson have created huge returns for Legend Capital.

Based on the prediction of the scale and trend of the downstream industry, Legend Capital has also systematically invested in assisted and autonomous driving along the direction of intelligent and unmanned new energy vehicles, as well as related sensor, radar, chip, and other projects in similar niches. Typical cases include Pony.ai, Zongmu Technology, MUNIU Tech, Black Sesame Technologies, etc.

Richard Li said frankly: "Distinct from the internet sector, hard technology companies have a relatively long incubation period. Technology verification and productization need to be completed in the early stage, then put into the market, and then gradually scale up. The industry has large development potential and the enterprises have strong profitability. However, the market environment is complex, so it is hard for 'one winner to take all', and it is unrealistic to rely on first-mover advantage to achieve home runs. Therefore, investment institutions need to grasp the inflection point of the industry, such as when the effectiveness of the technology could be verified and when the product develops rapidly, which tests investors' judgment on timing.

Richard Li summed it up in this way: To invest in science and technology, it is necessary to have an industrial mindset, sort out the industrial map, and then invest according to the timing of different stages and nodes of the industry. After that, we need to wait, and time will show us the answer. Investment institutions should have the patience and determination to accompany enterprises for a long time.

The Logic of Technology Investment Has Changed

Looking back on 20 years of experience in China's Venture Capital, Richard Li exclaimed that the industry is undergoing great changes today. "It's a systemic change including funding sources, investment directions and exit channels." He believes that these years are a critical turning point for the industry. Investment institutions need to make targeted adjustments to accommodate the new environment.

In the past, the fundraising and exit of USD funds were both structured abroad, which led to most of the funds not actually investing in China. "To some extent, it is equivalent to going public in the United States with financial statements submitted from companies in China, and then selling shares in the United States market to exit." US dollar investors must now face up to the fact that the old game is over.

Richard Li bluntly remarked that when USD funds began to shift investment focus from business model innovation to hard technology, in addition to the changes in target investment fields, the fundamental difference between the historic "two-end abroad" to invest in Chinese Concept Stocks and the new reality of China-rooted model of "investing onshore in China" put forth significant requirements for the localization of investment institutions, which requires long-term accumulation of resource networks and support from mid to back office.

Besides, to be successful in using USD funds to invest in hard technologies in China with a focus on local listings and exits, it is very important to manage a complementary large-scale RMB fund as the cooperation between the two derives unique differentiation. Otherwise, we can only invest in individual "Cusp" projects opportunistically, rather than systematically investing in a long-term sustainable manner.

This is also the challenge and opportunity that Legend Capital has always emphasized. Our latest plan focuses on technology investment, while paying attention to domestic A-share exit channels, we also take into account the exit channels for overseas investment projects in overseas capital markets, including Hong Kong stocks, US stocks, and capital markets such as South Korea and Japan. "Actually, these plans are things that we started doing a few years ago. If you just start to do these things today, I think it's too late." Said Richard Li.

About Legend Capital

Founded in 2001, Legend Capital is a leading VC&PE investor focusing on early-stage and growth-stage opportunities in China, with offices across Beijing, Shanghai, Shenzhen, Hong Kong, and Seoul, Korea.

It currently manages USD and RMB funds of over US$10 billion in commitments and has invested in around 600 companies, covering technology, healthcare, consumer, enterprise service and intelligent manufacturing sectors. Rooted in China, Legend Capital participated in the rise of many world-leading companies through solid investment coverage and systematic post-investment value-add. Over the years, Legend Capital has also become a widely recognized name in bridging key resources in China and overseas through cross-border activities, and a valuable partner to Chinese and overseas investors.

Legend Capital values long-term sustainable investment and incorporates ESG into its long-term development strategy. As a UNPRI signatory since November 2019, Legend Capital is among the first group of top VC/PE firms in China to join the initiative.

For more information, please visit www.legendcapital.com.cn/index_en.aspx and follow us on LinkedIn @Legend Capital (https://www.linkedin.com/company/legend-capital).

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com