HONG KONG, Jun 9, 2022 – (ACN Newswire) – On June 8th 2022, Legend Capital's portfolio company ANYCOLOR, a leading Virtual YouTuber (VTuber) management company in Japan, was listed on the Tokyo Stock Exchange. At the market close today, ANYCOLOR's share price rose more than 3 times compared to the issue price and its market capitalization exceeded 165.2 billion yen (about 1.239 billion US dollars).

|

Established in May 2017, ANYCOLOR was founded by Tazumi Riku who was at that time a student at Waseda University in Japan. The company officially announced the launch of a VTuber project "NIJISANJI" in January 2018 as one of the first major VTuber agencies in Japan. After years of continued success, ANYCOLOR as of today is managing around 200 VTubers with over 35.72 million fans, making it the largest VTuber operator in Japan.

According to ANYCOLOR's IPO Prospectus, in 2021 revenue reached 7.63 billion yen and operating income of 1.45 billion yen. This is over 100% growth from 3.5 billion yen revenue and 42.3 million yen operating income in 2020. Revenue in 2022 is expected to reach 13.2 billion yen while operating income is expected to grow to 3.7 billion yen.

With the introduction of Japan partner ITOCHU Corporation, Legend Capital led ANYCOLOR's Series B financing round in April 2020.

Joon Sung Park, Managing Director of Legend Capital, said: "Virtual YouTuber is a concept that Japan pioneered and this is a model that can scale outside of Japan because VTubers are not bound by physical limitations, and many of them engage in activities that are unconstrained by their real-world identity. ANYCOLOR is very unique because their focus on livestreams set its members apart from other early VTubers who primarily made pre-recorded videos. Based on Nijisanji's initial success in Japan, ANYCOLOR expanded its business to China, Korea, Indonesia, as well as English-language branches targeting a global audience. VTuber's popularity began to expand internationally through their appeal to the existing animation and cartoon fandom. Going forward, as 2D/3D technology will become more sophisticated, I firmly believe that ANYCOLOR's potential of becoming the internationally recognized leading platform for VTubers and animated influencers, who target worldwide audiences."

In China, ANYCOLOR has established a joint venture with Legend Capital's portfolio company Bilibili, a leading video and contents sharing platform in China and most of NIJISANJI's VTubers are active on the Bilibili platform. ANYCOLOR's VTubers started to broadcast livestreaming through Bilibili's platform and was able to successfully operate its Chinese VTuber group "VirtuaReal Project''.

Legend Capital also invested in HYBE in early 2016, the management agency of K-pop sensation BTS, and one of the world's "100 Most Influential Companies" as named by Time magazine. Korea's entertainment giant HYBE became the first in the K-pop industry to record 1 trillion won ($839.4 million) in sales in 2021. The unprecedented 100 times revenue growth from 2015 to 2021 was fueled by the agency's effort to build an internal distribution platform, various strategic initiatives for global IP expansion. It also acquired Ithaca Holdings, a well-known US based entertainment agency that manages popular artists like Justin Bieber, Ariana Grande and J Balvin, which helped HYBE to diversify its revenue stream.

As an active investor, Legend Capital shared HYBE's growth history and its monetization diversification efforts to ANYCOLOR management team. In addition, Legend Capital introduced the CEO of HYBE to the CEO of ANYCOLOR to share HYBE's experience, and discuss potential cooperation in the future.

"ANYCOLOR's successful listing under the current capital market situation is not only about fundraising but also about introducing ANYCOLOR to the public and showing a more interesting world of VTuber to the upcoming new generation. Legend Capital will continue to focus on cross-border investment opportunities in Japan, Korea, Southeast Asia and other countries, to explore more investment opportunities in emerging industries, especially in technology, consumption, and contents. We will also continue to utilize our comprehensive resources derived from our existing domestic and international portfolios, to provide value-added services for our portfolio companies." Joon Sung Park added.

Legend Capital is an independent and seasoned fund manager with deep roots in China and long coverage of local Chinese investment opportunities stemming from the strong innovation power in the country. With over two decades of expertise, Legend Capital has cultivated profound understanding of the technology and innovation drives of China, accumulated rich resources around industries, and built a powerful portfolio ecosystem. It is now recognized as a valuable partner for overseas investors and enterprises to access the market.

For overseas investors, Legend Capital can provide support on knowledge of China's technology innovation and access to technology investment opportunities for sustainable returns. For overseas enterprises, Legend Capital can help expand business on the Chinese market, and bridge key resources in China such as R&D and supply chain, for expedited value creation. Guided by such approach, Legend Capital has made a number of successful investments in Japan, Korea, Southeast Asia, and India.

On the other hand, by leveraging its "China Insights", Legend Capital also helps portfolio companies and entrepreneurs in China to "go global" and achieve strategic objectives across the border by integrating overseas resources and opportunities, helping portfolio companies to respond to complex changes in global industry landscape, and meanwhile generating new investment opportunities.

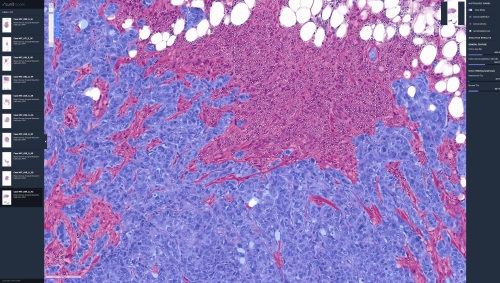

Legend Capital has invested numerous successful foreign companies: HYBE (KOSPI.A352820), world's leading entertainment company in Korea; Zinus (KOSPI.A013890), the largest mattress brand in Amazon; DEXTER (KOSDAQ.A206560), Korea's leading movie production and VFX company; NexImmune (NASDAQ: NEXI), the global next-generation immunomodulatory cell therapy company; Axonics (NASDAQ: AXNX), the global developer of new implantable neuromodulation technologies; Singular Genomics (NASDAQ: OMIC), the leading company in NGS testing; Lunit, the global leading AI medical diagnosis company; Mathpresso, the largest education technology company in Japan, Korea, and Southeast Asia; Vedantu, India's largest K12 Online tutoring company; and Akulaku, the leading fintech company in Southeast Asia.

Copyright 2022 ACN Newswire. All rights reserved. http://www.acnnewswire.com