SINGAPORE, Jun 1, 2021 – (ACN Newswire) – Xiaomi-backed online brokerage Tiger Brokers today announced their technology collaboration with Alibaba Cloud, the digital technology and intelligence backbone of Alibaba Group. Alibaba Cloud provides Tiger Brokers with end-to-end technology support to its trading platform, Tiger Trade, to meet the secure and low latency trading demands of its investors on the platform.

Tiger Brokers has been seeing a consistent increase in the number of investors onboarding the trading platform. Alibaba Cloud solution will help to ensure the speed of data flow on the app is not compromised. Its Big Data analytics will also provide relevant insights into Tiger Brokers' investors trading behaviour, allowing them the chance to offer better service offerings and trading opportunities to meet the demands of their investors.

Kelvin Liu, Vice President, Engineering of UP Fintech Holding Limited, known as "Tiger Brokers" in Asia, shared, "At Tiger Brokers, we are all about bringing superior user experience to our investors, from customer service, trading experience to up-to-date market insights. With Alibaba Cloud's service, we will be able to provide high performance and low latency trading experience on the platform, as well as foresight into our business planning and expansion within the region."

"With Alibaba Cloud's robust presence across the Asia Pacific region, Tiger Brokers will be able to scale up our online platform across markets with ease when the opportunity arises," added Kelvin.

UP Fintech's first quarter earnings showed positive momentum with total revenues at US$81.3 million, a 255.5% increase from the first quarter of 2020. Total trading volume also surged past US$123.8 billion dollars, nearly triple the same period in 2020. Total number of customers with deposits increased by 180.4% year-over-year to 376.0K. Tiger Brokers will continue to enhance the functionality of its platform, augmenting their comprehensive capability to serve corporate clients, as well as the execution of their global expansion strategy.

"Alibaba Cloud is committed to bringing the best technology solutions to the financial industry and support Tiger Brokers' digitalisation journey," said Dr Derek Wang, Singapore General Manager, Alibaba Cloud Intelligence. "We are confident that together with Tiger Brokers, we can bring better user experiences to the platform's investors, helping them to gain a stronger foothold in the competitive trading industry."

The technology collaboration with Alibaba Cloud is Tiger Brokers' latest effort when it comes to strengthening their online platform, allowing investors to gain better access to best-in-class and up-to-date financial information for seamless trading experience.

Eng Thiam Choon, CEO of Tiger Brokers Singapore also commented, "Singapore is known as the fintech hub of Asia and a mobile-savvy nation. Today, online trading has become part of the lifestyle of many people as we see 30% of Singapore investors being Gen Zs, also known as the internet generation. We hope to be the go-to trading platform for our investors to make the best, objective trading decisions when it comes to online investing – be it whether they are seasoned or new investors."

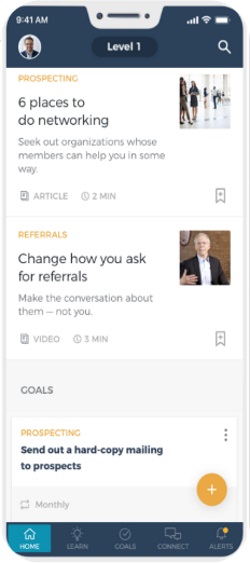

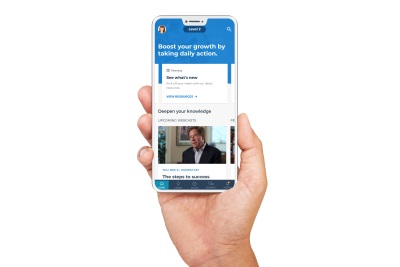

Tiger Trade officially launched in Singapore in February 2020, offering retail investors trading opportunities such as Equities, Exchange-Traded Funds (ETFs), Futures, Stock Options, Warrants, Callable Bull/Bear Contracts (CBBCs), Daily Leveraged Certificates (DLCs), US-listed over the counter (OTC) equities and Fund Mall. Investors also have the opportunity to trade on six different exchanges – New York Stock Exchange (NYSE), NASDAQ, Shanghai/Shenzhen-Hong Kong Stock Connect, the Hong Kong Stock Exchange (HKEX), the Singapore Exchange (SGX) and the Australian Securities Exchange (ASX).

The Tiger Trade mobile application is available for download on Apple App store and Google Play store.

– Apple App store: https://apps.apple.com/sg/app/id1023600494

– Google Play store: https://play.google.com/store/apps/details?id=com.tigerbrokers.stock

About Tiger Brokers (Singapore) Pte Ltd.

Tiger Brokers Singapore Pte Ltd (Tiger Brokers Singapore) is a brokerage firm operating with a Capital Markets Services (CMS) Licence from the Monetary Authority of Singapore (MAS). Its trading platform, Tiger Trade, offers complimentary real-time stock quotes, dedicated multilingual customer service during trading hours and 24/7 finance news updates. The company launched the mobile version of Tiger Trade in February 2020 – accessible on Google Play Store and the Apple App Store – offering mobile-savvy generation of retail investors similar trading opportunities as their online users, such as Equities, Exchange-Traded Funds (ETFs), Futures, Stock Options, Warrants, Callable Bull/Bear Contracts (CBBCs), Daily Leveraged Certificates (DLCs), US-listed over the counter (OTC) equities and Fund Mall on their mobile phones. Both online and mobile app allow users to invest across multiple asset classes traded on the US, China, Hong Kong, Singapore and Australian stock markets such as the New York Stock Exchange (NYSE), NASDAQ, Shanghai/Shenzhen-Hong Kong Stock Connect, the Hong Kong Stock Exchange (HKEX), the Singapore Exchange (SGX) and the Australian Securities Exchange (ASX).

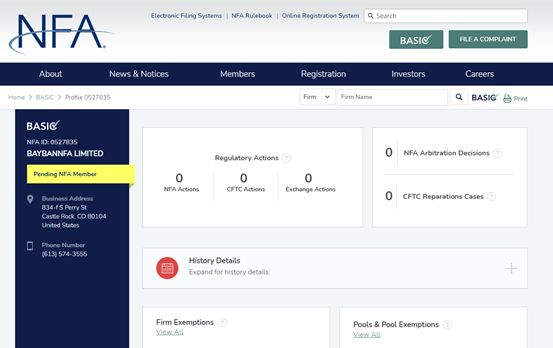

Tiger Brokers Singapore is the Singapore entity of UP Fintech Holding Limited, known as "Tiger Brokers" in Asia, a leading online brokerage firm focusing on global investors. Founded in 2014, Tiger Brokers became #1 in the U.S. equity trading by volume among trading platforms catered to Global Chinese investors in less than two years. Tiger Brokers was awarded "2017 Fintech 250" by CB Insights and shortlisted for "China Leading Fintech 50" for two years in a row by KPMG China. The company was listed on NASDAQ under "TIGR" in 2019 and has offices in China, United States, Australia, New Zealand and Singapore. Tiger Brokers has over 1.4 million customers worldwide currently, with a total trading volume exceeding USD123.8 billion in Q1 2021. The company is backed by well-known investors such as Xiaomi, as well as investment guru Jim Rogers. For more information, please visit https://www.tigerbrokers.com.sg

About UP Fintech Holding Limited

UP Fintech Holding Limited is a leading online brokerage firm focusing on global investors. The Company's proprietary mobile and online trading platform enables investors to trade in equities and other financial instruments on multiple exchanges around the world. The Company offers innovative products and services as well as a superior user experience to customers through its "mobile first" strategy, which enables it to better serve and retain current customers as well as attract new ones. The Company offers customers comprehensive brokerage and value-added services, including trade order placement and execution, margin financing, IPO subscription, ESOP management, investor education, community discussion and customer support. The Company's proprietary infrastructure and advanced technology are able to support trades across multiple currencies, multiple markets, multiple products, multiple execution venues and multiple clearing houses. For more information on the Company, please visit: https://ir.itiger.com.

For media enquiries, please contact:

PRecious Communications for Tiger Brokers (Singapore)

Email: Tiger@preciouscomms.com

This article has not been reviewed by the Monetary Authority of Singapore.

Any views shared with Prospective Clients ("Prospects") are suggestive in nature and on a sample basis only. This may also be predicated on assumptions that are made by Tiger Brokers (Singapore) Pte Ltd about the Prospects' investment objectives and risk profile. Our suggestive and sample views extended to Prospects are not to be considered as recommendations made by the Company. Suggestions provided are also based on information that may be shared by the Prospects, the accuracy and comprehensiveness of which Tiger Brokers in not in a position to verify.

Tiger Brokers (Singapore) Pte Ltd (herein "Tiger Brokers") may, to the extent permitted by law, participate or invest in other transactions with the issuer of the products referred to herein, perform services or solicit business from such issuers, and/or have a position or effect transactions in the securities or options thereof. The information herein is for recipient's information only and not an offer to sell or a solicitation to buy. Any date or price information is indicative only and may be changed without prior notice. All opinions expressed and facts referred to herein are subject to change without notice. The information herein was obtained and derived from sources that we believe are reliable, but while reasonable care has been taken to ensure that stated facts are accurate and opinions are fair and reasonable, Tiger Brokers does not represent that it is accurate or complete and it should not be relied upon as such. The information expressed herein is current and does not constitute an offer, recommendation or solicitation, nor does it constitute any prediction of likely future stock performance. Investment involves risk. The price of investment instruments can and do fluctuate, and any individual instrument may experience upward or downward movements, and under certain circumstances may even become valueless. Past performance is not a guarantee of future results. In preparing this information, we did not take into account the investment objectives, financial situation or particular needs of any person or affiliated companies. Before making an investment decision, you should speak to a financial adviser to consider whether this information is appropriate to your needs, objectives and circumstances. Tiger Brokers assumes no fiduciary responsibility or liability for any consequences financial or otherwise arising from trading in securities if opinions and information in this document may be relied upon.

Copyright 2021 ACN Newswire. All rights reserved. http://www.acnnewswire.com